Mobile Virtual Network Operator Market Size, Share & Trends Analysis Report By Type (Branded Reseller MVNO, Light MVNO, Service Provider MVNO, Full MVNO), By Technology (4G LTE, 5G, NB-IoT, eSIM), By Service Offering (Voice Services, Data Services, Messaging Services, Value-Added Services (VAS), IoT Connectivity Services), By Application (Consumer, Enterprise, IoT, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Mobile Virtual Network Operator Market Overview

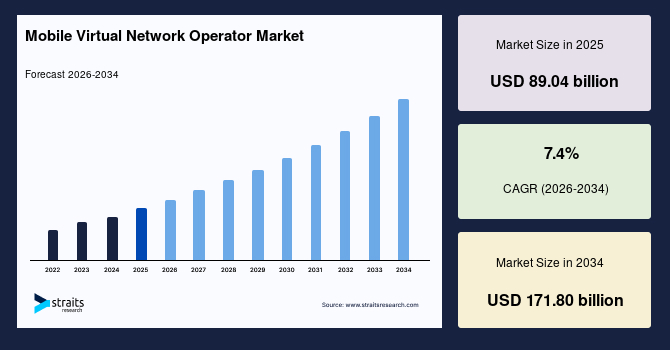

The global mobile virtual network operator (MVNO) market size is valued at USD 89.04 billion in 2025 and is estimated to reach USD 171.80 billion by 2034, growing at a CAGR of 7.4% during the forecast period. Consistent growth of the market is supported by the expanding adoption of eSIM technology, 5G-enabled service models, and IoT connectivity solutions, which enhance network flexibility, reduce dependence on physical SIM infrastructure, and enable seamless multi-device connectivity. These advancements are driving enterprises and consumers to increasingly adopt MVNO-based offerings for cost-effective, scalable, and digitally optimized mobile communication services.

Key Market Trends & Insights

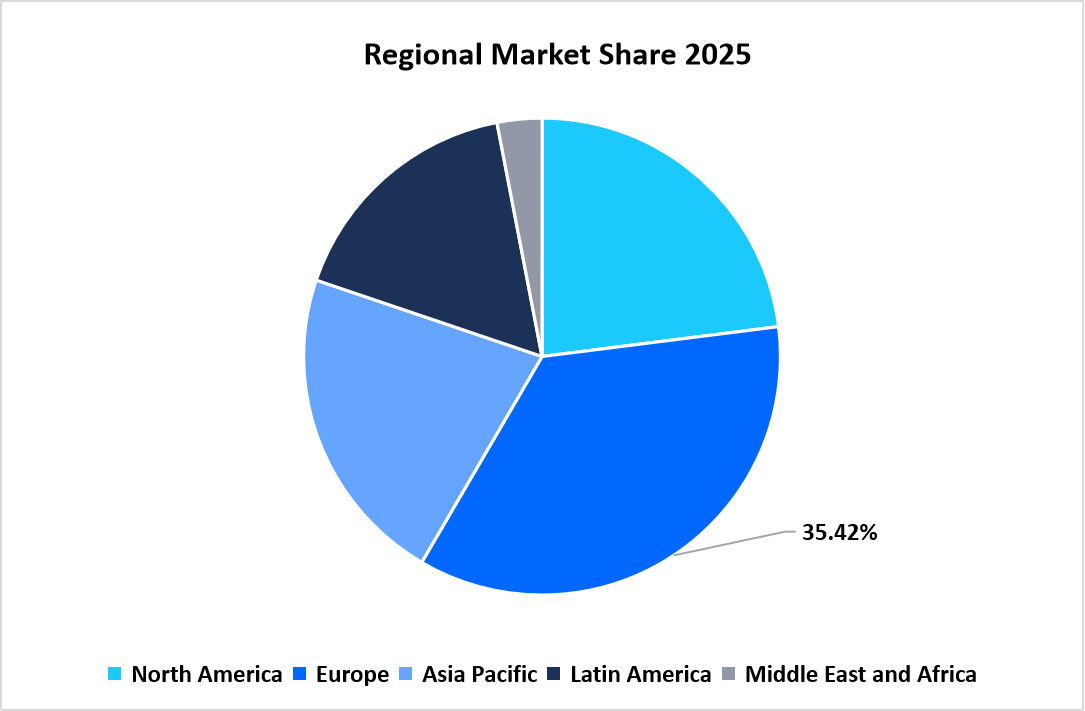

- Europe dominated the market with a revenue share of 35.42% in 2025.

- North America is anticipated to grow at the fastest CAGR of 10.12% during the forecast period.

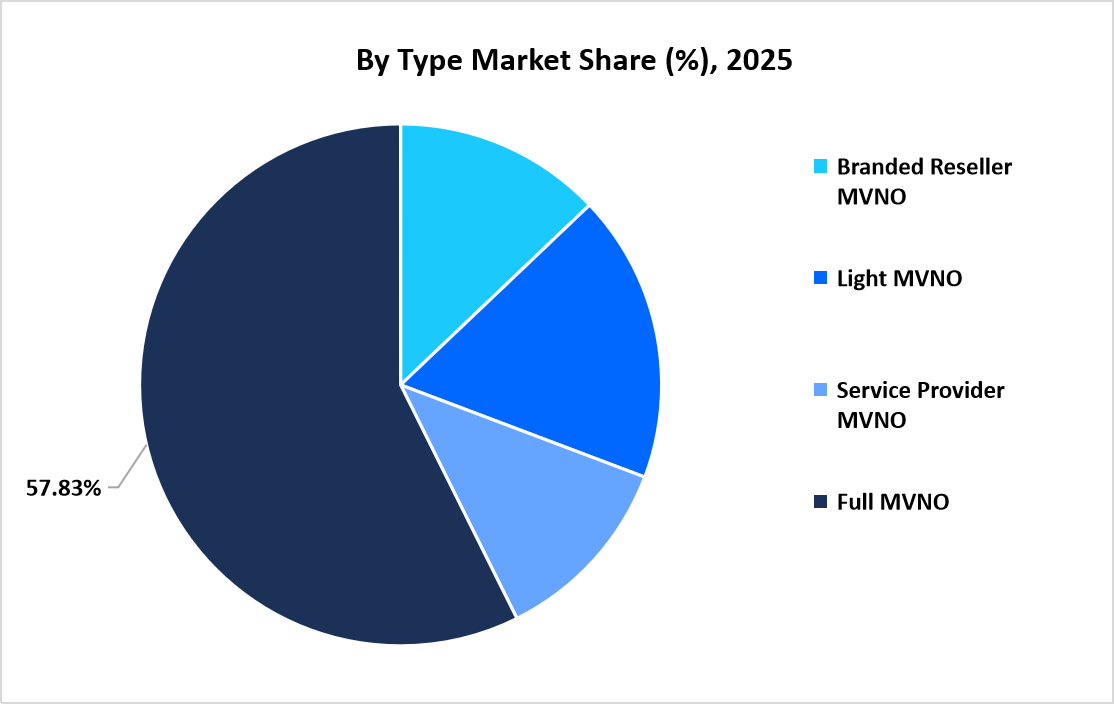

- Based on type, the Full MVNO segment held the highest market share of 57.83% in 2025

- By technology, the 5G segment is estimated to register the fastest CAGR growth of 9.85%.

- Based on service offering, the Data Services segment dominated the market in 2025, accounting for a market share of 41.26%.

- Based on application, the Consumer segment is projected to grow at a CAGR of 8.14% during the forecast period.

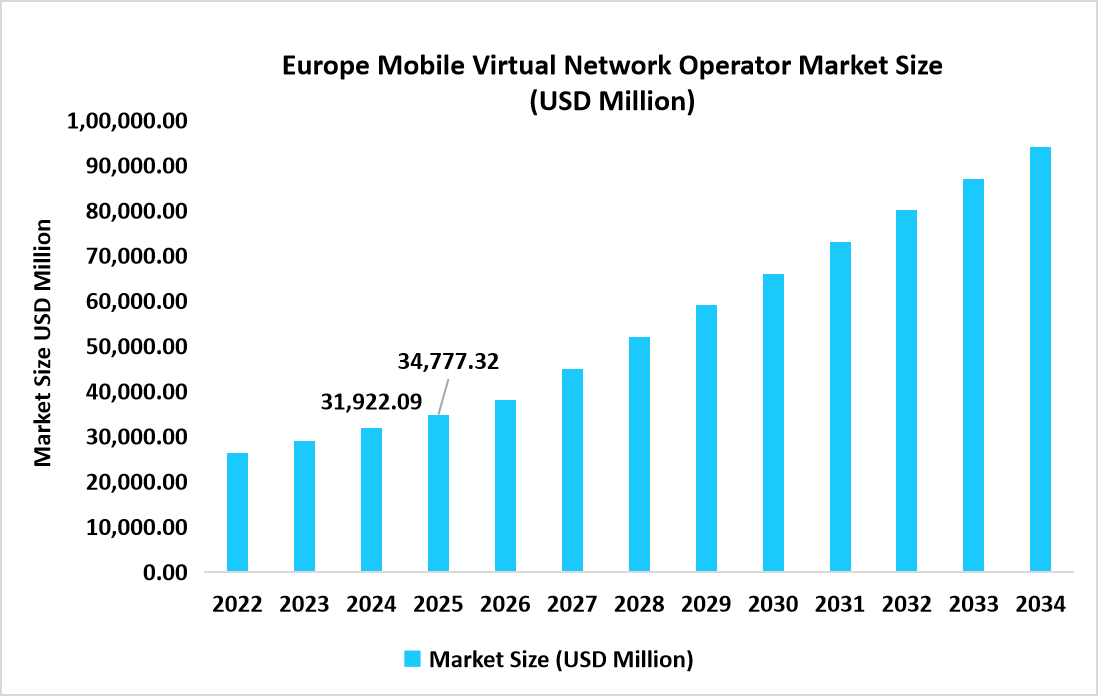

- Europe leads the MVNO market, valued at USD 31.92 billion in 2024 and reaching USD 34.77 billion in 2025.

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 89.04 billion

- 2034 Projected Market Size: USD 171.80 billion

- CAGR (2026-2034): 7.4%

- Dominating Region: Europe

- Fastest Growing Region: North America

The global MVNO market represents a broad range of services for mobile communication, not based on owned physical infrastructure but on wholesale agreements with a host mobile network operator. MVNOs have different operation models, including Branded Reseller MVNOs, Light MVNOs, Service Provider MVNOs, and Full MVNOs, each offering various control levels for network elements, billing systems, and customer management.

Services will be delivered in critical connectivity areas: voice, data, messaging, VAS, and IoT connectivity solutions catering to individual consumers and enterprise users. Supported by key technologies such as 4G-LTE, 5G, NB-IoT, and eSIM, MVNOs can offer flexible, cost-effective, digitally driven mobile services targeting different application segments, namely consumer mobility, enterprise communication, and IoT device networks, amongst others. This, therefore, involves technology enablers, host operators, and digital platforms that together provide scalable multi-segment solutions for connectivity across all global telecommunications markets.

Market Trends

Transition from SIM-bound Services Into Fully Digital, Infrastructure-Light Mobile Ecosystems

The MVNO landscape is in rapid evolution from traditional, basically SIM-based service delivery to models of fully digital connectivity, supported by eSIM activation, cloud-native provisioning, and automated onboarding flows. Historically, much of the operations of MVNOs relied on physical SIM distributions, in-store activations, and manual verification of customers, entailing longer activation cycles and higher operational overhead. Digital-first MVNOs deploy self-serve mobile apps, instant eKYC, remote SIM provisioning, and real-time plan customization, none of which requires any kind of physical infrastructure, thus getting services activated in a matter of a few minutes. Platforms based on cloud-native BSS/OSS architectures illustrate how digital onboarding, automated billing, and AI-powered customer support dramatically improve customer experience, bring down the acquisition price, and improve retention. New-age MVNO deployments have proven that digital onboarding can cut down the activation time by more than 80% and increase customer lifetime value manifold, which happened to be a radical shift toward frictionless, app-driven connectivity services.

Accelerating IoT and Enterprise Connectivity With Lightweight, Scalable MVNO Models

The expansion of IoT ecosystems, ranging from asset tracking, telematics, smart utilities, logistics, and industrial automation, positioned MVNOs as critical enablers of low-cost, scalable connectivity solutions. Early enterprise models were constrained by limited network control, fragmented device management, and dependence on MNO processes. The emergence of NB-IoT, eSIM, and cloud-based connectivity management platforms now empowers specialized IoT MVNOs to manage device lifecycles, monitor SIM fleets, and optimize data usage autonomously. Adoption of these models has grown exponentially as enterprises prioritize predictable pricing, flexible scaling, and cross-border connectivity. This evolution marks a shift from consumer-centric MVNO operations to a diversified market where IoT MVNOs represent one of the most strategically significant growth pillars for global connectivity providers.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 89.04 billion |

| Estimated 2026 Value | USD 95.63 billion |

| Projected 2034 Value | USD 171.80 billion |

| CAGR (2026-2034) | 7.4% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | TracFone, Lycamobile, Tesco Mobile, Lebara, Giffgaff |

to learn more about this report Download Free Sample Report

Market Driver

Government-led Reforms That Expand Wholesale Access Opportunities

The regulatory authorities of many regions are reworking the mobile spectrum and wholesale access regimes to better suit the case of MVNOs. Many governments around Europe and parts of Asia have imposed obligations on mobile network operators to provide equitable, nondiscriminatory wholesale access to virtual operators, thus allowing further competition and service differentiation. For example, revised wholesale pricing guidelines and updated access regulations have lowered the barriers to entry for new MVNOs, which can negotiate more competitive data and voice prices. Such policies have accelerated market participation from digital-native brands, enterprises, and IoT service providers, driven by remarkable growth in subscriber acquisition and service innovation. The regulatory momentum toward open and competitive mobile markets is strengthening the scalability of MVNOs and helping extend their contribution to national digital connectivity goals.

Market Restraint

Regulatory Bottlenecks And Compliance Requirements Are Acting as a Drag on MVNO Expansion

A major restraint in the Mobile Virtual Network Operator market is the progressively complex regulatory regime governing mobile service authorization, SIM registration, data residency, and the assurance of compliance regarding lawful interception. Different national regulators of telecom companies have tightened verification rules and obligatory security standards, requiring MVNOs to implement advanced identity validation systems, interoperable monitoring frameworks, and country-specific data storage protocols before commercial launch. Government directives in multiple regions now prescribe more stringent Know-Your-Customer (KYC) compliance, real-time user verifications, and enhanced audit transparency factors that extend the timelines of approvals against new MVNO entrants.

Market Opportunity

Expansion of Sector-Specific MVNO Models That Unlock New Commercial Segments

The increasing trend toward sector-based connectivity solutions is presenting massive opportunities for MVNOs to participate in high-value, underserved market niches. Retail, banking, education, transportation, and hospitality industries have increasing needs for customized mobile service bundles that support their loyalty engagement, digital payment, customer analytics, and workforce communication needs. MVNOs that have designed vertical, tailored offerings such as prepaid financial-service bundles for the fintech industry, managed mobility plans for transport fleets, or student-centric data packages for educational institutions are seeing rapid adoption, as the enhanced relevance and lower barriers to switching converge. This targeted approach allows MVNOs to differentiate beyond price-driven competition and build long-term institutional contracts, thereby massively expanding their addressable market. As demand increases for integrated, sector-aligned connectivity, this appears to be a powerful opportunity for MVNOs to consolidate their market footprint and diversify revenue streams faster across global regions.

Regional Analysis

Europe was the leading market in 2025, with a share of 35.42% of the market. This is buoyed by the region's heavy emphasis on open telecommunications competition, which has, over time, welcomed various MVNO brands into the retail, utility, entertainment, and digital service categories. Well-established wholesale frameworks and complete transparency in the reporting of connectivity performance allow virtual operators to drive down access costs without compromise to service quality. Furthermore, consumer mobility initiatives, SIM portability across borders, and multi-network roaming have also accelerated the adoption of MVNOs for prepaid and digital-only user segments, fortifying the position of Europe as the global MVNO expansion hub.

Germany’s advanced telecommunications infrastructure is accelerating the growth of the mobile virtual network operator market, as virtual operators benefit from extensive nationwide network reliability, structured wholesale frameworks, and a competitive environment shaped by multiple major host networks. The country’s strong preference for transparent pricing, customizable prepaid plans, and privacy-focused digital services has increased consumer confidence in MVNO offerings. In recent years, Germany has also experienced a sharp rise in digital onboarding, with a growing share of subscribers activating mobile services through automated self-service platforms. This shift, combined with the high willingness of German consumers to compare providers and switch for better value, continues to strengthen MVNO penetration and expand the country’s position as a key European market for virtual mobile services.

North America Market Insights

North America is going to emerge as the fastest-growing region, estimated to represent a CAGR of 10.12% from 2026 to 2034. This rapid growth is due to rising demand for digital-native MVNOs that focus on unlimited data plans, bundled entertainment services, and flexible mobile subscriptions positioned specifically for hybrid work lifestyles. Strong momentum is also emanating from connectivity-driven business models in the retail, cable, and internet sectors, where companies launch their own MVNO brands to extend customer value and reduce churn. Growing demand for simplified multi-device connectivity across smartphones, wearables, and connected home devices is further propelling MVNO adoption across North America.

The U.S. mobile virtual network operator market is growing rapidly, with many large retail chains, online service platforms, and broadband providers introducing branded mobile services to increase customer stickiness and tap into recurring subscription revenue. Digital self-activation, coupled with competitively priced data-centric plans, has made the services very attractive for consumers looking to save money on traditional carrier contracts. Moreover, innovation in multi-network access solutions that enable devices to switch between partner networks for better coverage is improving service reliability and fueling rapid subscriber growth across the country.

Source: Straits Research

Asia Pacific Market Insights

The Asia Pacific is experiencing rapid growth in MVNO adoption due to the surge in digital-only mobile subscriptions, increases in wholesale partnerships, and demand for flexible application-based connectivity plans. Different countries in the region are quickly adopting multi-network access models that enable MVNOs to have comparable coverage and attractive pricing for millions of consumers. Furthermore, regional growth is being fueled by a rise in online service platforms that launch their own-branded mobile plans. MVNO penetration will thus intensify across not only metro but also emerging markets.

China's market for mobile virtual network operator is growing, with large retail groups, digital service platforms, and logistics companies launching private-label mobile offers to enable customer loyalty, last-mile workforce mobility, and enterprise communication. As virtual onboarding, QR-based activation flows, and digital identity verification increase, the user journey has become smoother, and MVNO plans are therefore gaining traction in younger, digitally engaged demographics. This evolution toward ecosystem-driven connectivity is making China a fast-advancing market within the Asia Pacific MVNO landscape.

Latin America Market Insights

This growth is supported in Latin America's mobile virtual network operator market by increasing demand for low-cost mobile data services and an expansion of digital commerce platforms that use the MVNO model to further enhance customer engagement. Brazil, Mexico, and Colombia have especially witnessed rapid uptake of MVNO offerings since these services have flexible prepaid plans, localized content bundled offers, and strong interest in no-contract mobile services. The emergence of digital wallets and ecosystems for e-commerce that integrate mobile connectivity further elevates this market momentum.

Brazil's mobile virtual network operator market is growing, with the introduction of co-branded mobile services by retail chains, fintech companies, and digital entertainment platforms aimed at improving customer retention and driving recurring revenue. Simplified digital activation tools and multi-channel recharge options have made MVNO offers especially popular among prepaid-dominant user bases. Such new business models are allowing MVNOs to capture a more significant consumer base and consolidate their position within Brazil's dynamic mobile services market.

Middle East and Africa Market Insights

In the Middle East and Africa region, MVNOs are gaining more traction as various mobile service providers offer specialized connectivity plans that align with regional communication preferences and diverse customer needs. The rise of youth-centric digital brands, flexible prepaid bundles, and data-heavy mobile offerings will spur wider acceptance of MVNO services. Furthermore, growing virtual operator-large retail group partnerships is expected to enhance the accessibility of MVNOs throughout underserved and remote communities.

In Saudi Arabia, the mobile virtual network operator industry is on the grow, driven by consumer demand for easy, seamless mobile subscriptions and clear pricing, along with improved digital onboarding experiences. This is good news for virtual operators offering customer support in multiple languages, app-based account management, and youth-oriented data packages. These emerging models for services are driving wider user adoption, further solidifying Saudi Arabia's position as a key growth market within the regional MVNO ecosystem.

Type Insights

The Full MVNO segment dominated the market, as it accounted for 57.83% of the revenue share in 2025, driven by growing preferences among operators for having their own core network elements in order to have flexibility in service design, pricing, and customer experience. In a world where global users are moving toward digital-first connectivity models, Full MVNOs are better positioned to launch differentiated service bundles, manage their own IMS and billing platforms, and negotiate competitive wholesale agreements.

The Light MVNO segment is expected to grow at the highest rate during the forecast period, at a projected CAGR of about 8.14%. It is also fast-moving due to the fact that there is an increased influx of digital brands, retail chains, and enterprises into the ecosystem on low-infrastructure, asset-light models. Lower set-up costs, faster time-to-market, and less integration complexity-enabling host MNOs and MVNE platforms, help scalability in non-core consumer and enterprise segments, thus making them one of the strongest growth drivers in the MVNO landscape due to their capabilities for minimal technical overhead and offering plans at best prices.

Source: Straits Research

Technology Insights

Dominating the market with a revenue share of 52.37%, the segment of 4G LTE led the forefront in 2025. The reasons for such leadership include ubiquitous coverage, mature wholesale pricing models, and the installed base of 4G devices, each of which enables MVNOs to deliver stable, cost-competitive voice and data plans across both developed and emerging markets. The 4G ecosystem continues to underpin the majority of MVNO subscriber consumption and revenue today.

The 5G segment is expected to show the fastest growth at a CAGR of 9.85% during the forecast period, while it would hold 18.24% of the revenue share in the market in 2025. This exponential growth is driven by an increasing availability of 5G wholesale access, expanding the traction of 5G-capable devices, and a growing demand for latency-sensitive and high-bandwidth services, thus allowing MVNOs to offer premium and differentiated services and enterprise-grade connectivity.

Service Offering Insights

The Data Services segment dominated the market share in 2025, accounting for 41.26% of revenue. This leadership is well undergirded by the rapid increase in demand for high-speed mobile internet, streaming services, and app-based digital experiences across worldwide consumer bases. MVNOs have competitively priced data bundles, unlimited data plans, and hybrid prepaid–postpaid offerings as the centerpiece of their value proposition.

The segment of IoT Connectivity Services is expected to witness the fastest growth during the forecast period. Fast growth will be witnessed with rapid industry-wide adoptions of connected devices in verticals like logistics, automotive, utilities, and smart infrastructure. IoT-focused MVNOs are running on increasing demand for low-power wide-area networks, fleet-scale SIM management, and cost-efficient global device provisioning.

Application Insights

It is expected that the Consumer segment will grow at a CAGR of 8.14%, owing to increasing adoption of flexible, contract-free mobile plans and rapid movement toward digital-first communication services. As users increasingly focus on affordable data packages, seamless eSIM activation, and app-based account management, they are progressively choosing MVNO offers that resonate with their cost, convenience, and customization needs. This growing interest in seamless, user-centered mobile experiences greatly enhances demand for consumer-oriented MVNO services across different global markets.

Competitive Landscape

Globally, the mobile virtual network operator market is considered to be moderately fragmented with established virtual operators, digital-first brands, and specialist connectivity players. A few players may grab the majority market share since they have sizeable subscriber bases, healthy retail footprints, and diversified service portfolios in consumer, enterprise, and IoT connectivity solutions. These operators employ flexible wholesale agreements, comprehensive digital onboarding platforms, and competitive pricing models that surely give a strong push toward improvement in customer loyalty and expansion of the market base.

The key market players include TracFone Wireless, Lycamobile, and Tesco Mobile, among others. In fact, these key players are very active in the competition, through new launches of strategic service bundles, expanding digital self-service channels, undertaking strategic wholesale partnerships, and pursuing scale through M&A deals. Paying attention to customer-centric plans, cross-border services, and digital transformation initiatives helps them reinforce their positions to capture growth opportunities in various MVNO markets around the world.

N26 SIM: An emerging market player

Headquartered in Germany, N26 SE's recent foray into the digital MVNO space, N26 SIM, introduced mobile connectivity directly into the digital banking ecosystem of the company. The service does differ in offering seamless eSIM activation, managing subscriptions via an app, and wide-area roaming benefits, allowing customers to access financial and mobile services from one unified digital platform.

- In May 2025, N26 SE officially launched N26 SIM with multiple mobile plans available via eSIM, reflecting its expansion beyond core financial services into telecom offerings that bundle connectivity with digital banking features.

Thus, N26 SIM became an important player in the global MVNO market. Its strong presence of digital brands and integrated service strategy propelled the company in subscriber acquisition and expanded its footprint within the virtual mobile services ecosystem.

List of Key and Emerging Players in Mobile Virtual Network Operator Market

- TracFone

- Lycamobile

- Tesco Mobile

- Lebara

- Giffgaff

- Boost Mobile

- Mint Mobile

- Consumer Cellular

- Google Fi

- Xfinity Mobile

- Cricket Wireless

- Virgin Mobile

- Ting Mobile

- Red Pocket Mobile

- FreedomPop

- Truphone

- Hologram

- 1NCE

- Soracom

- PosteMobile

- Others

Strategic Initiatives

- November 2025: Vitel Wireless Partners With PortaOne to Launch Nigeria’s Tier-3 MVNO. Vitel Wireless completed its MVNO launch in the Nigerian market using PortaOne’s real-time billing and charging platform, representing one of West Africa’s first-tier tier-3 MVNO deployments and enabling localized mobile service growth with advanced operational support.

- September 2025: Visible Expands Retail Availability Through Best Buy Partnership. Visible by Verizon expanded its distribution by making its wireless service available through Best Buy retail locations across the U.S., enabling customers to activate plans in-store as well as online, broadening its reach beyond digital channels and increasing accessibility for less digitally engaged consumers.

- September 2025: Netquori Expands MVNO Footprint Into South America. MVNO enabler Netquori officially announced its strategic expansion into the South American market, driven by rising enterprise and IoT connectivity demand, positioning the company to support new virtual operator launches in the region.

- April 2025: MobileX Unveils New Brand Campaign “Mobile. Done Different.” MobileX, an emerging U.S. MVNO player, launched its new brand positioning focused on transparency and customer-centric mobile pricing with AI-driven customizable plans starting as low as USD 24.88/month, challenging traditional carrier pricing norms. This initiative strengthens MobileX’s market differentiation and visibility among value-seeking subscribers.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 89.04 billion |

| Market Size in 2026 | USD 95.63 billion |

| Market Size in 2034 | USD 171.80 billion |

| CAGR | 7.4% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Technology, By Service Offering, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Mobile Virtual Network Operator Market Segments

By Type

- Branded Reseller MVNO

- Light MVNO

- Service Provider MVNO

- Full MVNO

By Technology

- 4G LTE

- 5G

- NB-IoT

- eSIM

By Service Offering

- Voice Services

- Data Services

- Messaging Services

- Value-Added Services (VAS)

- IoT Connectivity Services

By Application

- Consumer

- Enterprise

- IoT

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.