Pancreatin Market Size, Share & Trends Analysis Report By Source(Porcine , Bovine, Others), By Form (Powder, Granules, Tablets, Capsules), By Application (Pharmaceuticals, Food & Beverages, Animal Feed), By Distribution Channel (Online Stores , Pharmacies, Specialty Stores) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Pancreatin Market Overview

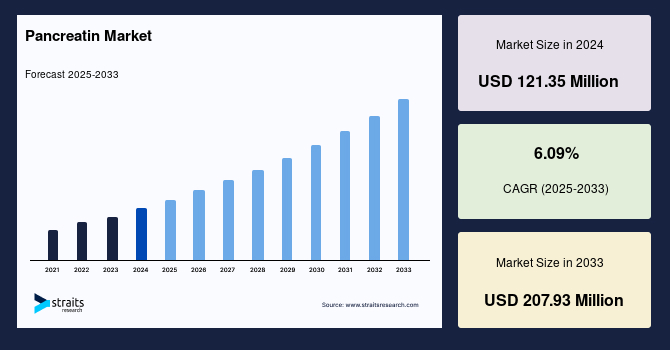

The global pancreatin market size was valued at USD 121.35 million in 2024 and is estimated to grow from USD 128.46 million in 2025 to reach USD 207.93 million by 2033, growing at a CAGR of 6.09% during the forecast period (2025–2033). Growth of the market is driven by the rising prevalence of pancreatic disorders, increasing demand for digestive enzyme supplements, advancements in enzyme extraction technologies, and heightened awareness about gastrointestinal health and enzyme-based therapies worldwide.

Key Market Insights

- North America held the largest market share, over 35% of the global market.

- Based on source, the porcine segment held the highest market share of over 55%.

- Based on form, the powder segment is expected to witness the fastest CAGR of 6.45%.

- Based on application, the pharmaceutical segment held the highest market share of over 45%.

- Based on distribution channel, the online store segment is expected to witness the fastest CAGR of 5.97%.

Market Size & Forecast

- 2024 Market Size: USD 121.35 million

- 2033 Projected Market Size: USD 207.93 million

- CAGR (2025-2033): 6.09%

- North America: Largest market in 2024

- Asia-Pacific : Fastest-growing region

Pancreatin is a mixture of digestive enzymes, including amylase, lipase, and protease, derived from animal pancreas. It plays a vital role in breaking down carbohydrates, fats, and proteins, thereby supporting proper digestion and nutrient absorption. Pancreatin is widely used in treating conditions such as pancreatic insufficiency, cystic fibrosis, and chronic pancreatitis, where natural enzyme production is insufficient. Beyond pharmaceuticals, it is also utilized in the food industry for improving digestion and in dietary supplements to enhance gastrointestinal health.

The pancreatin market is driven by increasing research into enzyme-based drug formulations and innovations in enzyme stabilization for improved efficacy. Opportunities lie in expanding applications across veterinary medicine, where enzyme supplements improve animal health and nutrition, and in biopharmaceutical manufacturing, where pancreatin supports protein processing. Additionally, growing healthcare expenditure in emerging economies, coupled with supportive regulatory frameworks for enzyme therapies, presents new avenues for market penetration and long-term growth.

Market Trend

Rising Awareness of Enzyme Replacement Therapies

The global pancreatin market is witnessing steady growth, driven by rising awareness of enzyme replacement therapies. Pancreatin, a blend of digestive enzymes, is increasingly recognized for its role in managing conditions such as pancreatic insufficiency, cystic fibrosis, and chronic pancreatitis. Growing patient education and physician recommendations are boosting adoption, particularly in developed healthcare markets.

Moreover, advancements in drug formulations, improved delivery systems, and expanding clinical research are enhancing treatment effectiveness and compliance. With an increasing prevalence of digestive disorders worldwide, the emphasis on early diagnosis and effective therapeutic options is pushing demand for pancreatin-based enzyme replacement solutions.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 121.35 Million |

| Estimated 2025 Value | USD 128.46 Million |

| Projected 2033 Value | USD 207.93 Million |

| CAGR (2025-2033) | 6.09% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Nordmark Arzneimittel GmbH & Co. KG , Biozyme Laboratories , Amano Enzyme Inc. , Allergan plc , Abbott Laboratories |

to learn more about this report Download Free Sample Report

Pancreatin Market Growth Factor

Rising Prevalence of Digestive Disorders

One of the key drivers of the global pancreatin market is the rising prevalence of digestive disorders. Increasing cases of gastrointestinal problems, including enzyme insufficiency, malabsorption, and chronic pancreatitis, are creating strong demand for enzyme replacement therapies such as pancreatin.

- In 2025, digestive disorders remain extremely common worldwide: recent analyses estimate roughly 2.28 billion people living with one or more digestive conditions. For specific conditions, large meta-analyses place irritable bowel syndrome (IBS) prevalence at about 14% of adults globally, with notable regional variations.

This growing patient pool underscores the critical need for effective enzyme supplements, fueling market expansion as healthcare systems prioritize better management of digestive health worldwide.

Market Restraint

Variability in the Source and Supply of Raw Materials

Pancreatin is primarily derived from porcine or bovine sources, making its production highly dependent on the livestock industry. Fluctuations in animal health, disease outbreaks, and regulatory restrictions on animal-derived products can disrupt supply chains and create inconsistencies in availability.

Moreover, ethical concerns and dietary restrictions limit its acceptance in certain regions. These factors often lead to cost volatility, quality variations, and supply shortages, posing challenges for manufacturers in ensuring consistent production and meeting the growing demand for enzyme replacement therapies.

Market Opportunity

Expansion Into Functional Foods and Nutraceuticals

The global pancreatin market is poised for strong growth through its integration into functional foods and nutraceuticals. Increasing consumer awareness about digestive health and the shift toward preventive healthcare are driving demand for enzyme-enriched products.

- A notable example is Enzymedica, which offers pancreatin-based digestive supplements widely used for supporting nutrient absorption and improving gut health. Similarly, NOW Foods markets enzyme formulations incorporating pancreatin for fitness enthusiasts and individuals with mild digestive concerns.

As the functional food and nutraceutical industries expand worldwide, the inclusion of pancreatin in innovative dietary solutions presents manufacturers with a significant opportunity to diversify portfolios and meet evolving consumer preferences.

Regional Analysis

The pancreatin industry in North America held 35% of the global revenue in 2024. Growth is driven by advanced healthcare infrastructure, high awareness, and rising incidences of digestive disorders. Strong pharmaceutical R&D and the presence of major industry players further strengthen growth in this region. For example, the increasing use of pancreatin in enzyme replacement therapies in the US highlights its expanding role in treating pancreatic insufficiency. Moreover, supportive regulations and high investments in biotechnology ensure North America maintains its leadership position, making it a critical hub for pancreatin development and commercialization.

The United States pancreatin market is expanding due to rising cases of pancreatic disorders and strong demand for effective enzyme replacement therapy. Pharmaceutical companies in the U.S. are heavily investing in research to develop improved pancreatin-based formulations. For example, the FDA approval of advanced enzyme therapies has significantly boosted patient accessibility.

Canada’s market benefits from strong imports of pancreatin-based drugs and growing collaborations with global pharmaceutical companies. For example, the rising prescription of enzyme replacement therapies for patients with cystic fibrosis is boosting market growth. Moreover, government healthcare support and favorable reimbursement policies make Canada a promising contributor.

Asia-Pacific Pancreatin Market Trends

Asia-Pacific is a significantly growing region in the global pancreatin market, fueled by a rising patient population, increasing healthcare expenditure, and expanding pharmaceutical manufacturing capacity. Countries such as China and India are leading this growth due to their large populations and rising prevalence of digestive disorders. For example, growing investments in local drug production and clinical trials highlight the region’s potential. Moreover, improved healthcare access, government initiatives, and partnerships with multinational companies are driving rapid expansion.

China’s pancreatin market is witnessing rapid growth due to rising incidences of pancreatic insufficiency and increasing demand for affordable therapies. Domestic pharmaceutical manufacturers are boosting production capacity to meet local needs and expand exports. For example, government incentives supporting generic drug manufacturing are driving wider availability of pancreatin-based medicines.

India’s market benefits from its cost-effective drug production capabilities and strong pharmaceutical export market. For example, Indian companies are manufacturing affordable pancreatin formulations that serve both domestic patients and international markets. Supportive government policies, rising healthcare expenditure, and growing medical tourism are further boosting the market.

Source Insights

Porcine-derived pancreatin continues to dominate the global market in 2025 due to its high enzymatic activity, cost-effectiveness, and wide availability compared to other sources. Pharmaceutical manufacturers prefer porcine pancreatin for enzyme replacement therapies, especially in treating exocrine pancreatic insufficiency. Its biochemical similarity to human enzymes makes it a reliable choice for consistent therapeutic outcomes. Growing demand in emerging markets and strong supply chains further reinforce porcine pancreatin’s leading position over bovine or alternative sources.

Form Insights

Powdered segment remains the leading form in the market, owing to its versatility and ease of incorporation into pharmaceutical formulations, nutraceutical blends, and food supplements. Manufacturers favor powder for its longer shelf life, better dosage flexibility, and ease of mixing with carriers. It is also widely used in laboratory and industrial applications for protein hydrolysis and digestion studies. The cost-effectiveness and adaptability of powder form make it the preferred choice across healthcare and industrial sectors.

Application Insights

Pharmaceuticals represent the largest application segment for pancreatin, driven by rising cases of digestive disorders such as pancreatitis, cystic fibrosis, and enzyme insufficiency. Pancreatin-based drugs are essential in enzyme replacement therapies, ensuring proper digestion and nutrient absorption. Increasing awareness of gastrointestinal health, coupled with healthcare initiatives promoting better access to treatments, boosts demand. Pharmaceutical companies are also investing in advanced formulations like enteric-coated tablets and capsules, further solidifying this segment’s dominance.

Distribution Channel Insights

Online stores have emerged as the dominant distribution channel, fueled by the global shift toward digital health solutions and e-commerce convenience. Consumers and healthcare providers increasingly prefer online platforms for their wide product variety, transparent pricing, and home delivery benefits. The growing penetration of digital pharmacies and specialized nutraceutical e-retailers has expanded access to pancreatin supplements. Moreover, discounts, subscription models, and global reach offered by ecommerce platforms make online sales more attractive compared to traditional pharmacies.

Company Market Share

In the global pancreatin market, company market share is influenced by strategic focus on product innovation, distribution networks, and expansion into new application areas. Leading players are working on developing advanced pancreatin formulations with improved stability and bioavailability to enhance therapeutic effectiveness. Many companies are also investing in nutraceutical and functional food applications to diversify beyond traditional pharmaceuticals.

Nordmark Arzneimittel GmbH & Co. KG has a long-standing history in the development and manufacturing of enzyme-based products, including pancreatin. The company is recognized for its expertise in producing high-quality pharmaceutical-grade enzymes used in treatments for pancreatic insufficiency and related digestive disorders. With a strong focus on research and innovation, it has consistently worked on enhancing the safety, purity, and effectiveness of its pancreatin formulations.

List of Key and Emerging Players in Pancreatin Market

- Nordmark Arzneimittel GmbH & Co. KG

- Biozyme Laboratories

- Amano Enzyme Inc.

- Allergan plc

- Abbott Laboratories

- Nordic Pharma

- Mylan N.V.

- Digestive Care, Inc.

- Advanced Enzyme Technologies Ltd.

- Biovet JSC

- Biosynth AG

- Spectrum Chemical Manufacturing Corp.

- Zytex Biotech Pvt. Ltd.

- Enzyme Bioscience Pvt. Ltd.

- Shenzhen Hepalink Pharmaceutical Group Co., Ltd.

- Sichuan Deebio Pharmaceutical Co., Ltd.

- Jiangxi Tianxin Pharmaceutical Co., Ltd.

- Chongqing Aoli Biopharmaceutical Co., Ltd.

- Shanghai Yaxin Biotechnology Co., Ltd.

- Shandong Zhongke Taidou Biological Technology Co., Ltd.

Recent Developments

- August 2025: Advanced Enzyme Technologies reported a 16.93% rise in consolidated net profit for the June 2025 quarter, reaching ₹39.93 crore. This significant financial growth, which also included a 20.31% increase in sales, indicates a strong performance across its various segments, which include its human and animal nutrition enzyme products.

- March 2025: Nordmark continues to be a key player in the pancreatin market, focusing on production and supply chain security. The company highlighted its commitment to cGMP standards and its ability to produce various pancreatin formulations, including micro-tablets and pellets, to meet diverse customer needs.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 121.35 Million |

| Market Size in 2025 | USD 128.46 Million |

| Market Size in 2033 | USD 207.93 Million |

| CAGR | 6.09% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Source , By Form , By Application , By Distribution Channel , By Regions |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pancreatin Market Segments

By Source

- Porcine

- Bovine

- Others

By Form

- Powder

- Granules

- Tablets

- Capsules

By Application

- Pharmaceuticals

- Food & Beverages

- Animal Feed

- Others

By Distribution Channel

- Online Stores

- Pharmacies

- Specialty Stores

- Others

By Regions

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.