Personal Training Software Market Size, Share & Trends Analysis Report By Type ( Web-Based Personal Training Software, Mobile App-Based Personal Training Software), By End-User ( Individual Trainers, Fitness Enthusiasts, Health and Fitness Organizations, Others, By Application ( Fitness Centers & Gymnasiums, Personal Trainers, Corporate Wellness Programs, Health & Wellness Clubs, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Personal Training Software Market Size

The global personal training software market size was worth USD 1.8 billion in 2024 and is estimated to reach from USD 1.86 billion in 2025 to USD 2.45 billion by 2033, growing at a CAGR of 3.5% during the forecast period (2025-2033).

Personal Training Software is a digital tool or platform designed to help personal trainers, fitness professionals, and gyms manage their business, interact with clients, and deliver personalized fitness programs. It typically streamlines scheduling, client progress tracking, workout planning, and communication, enabling trainers to provide efficient, high-quality in-person and online services. It stores and organizes client profiles, health history, and fitness goals and tracks client progress through weight, strength gains, body measurements, and performance benchmarks.

The global personal training software market is emerging fast as people become more interested in being healthier and fit. The shift toward online fitness solutions has significantly increased this growth, especially after the pandemic. Many more people and businesses realize how beneficial it is to use personal training software to access highly customized fitness plans and track their progress. Raising awareness about health and wellness has been one trend that has led to an increase in demand for remote personal training solutions.

Furthermore, many gyms and fitness trainers are looking for new ways to engage clients; these software tools provide flexibility in training schedules and accessibility. Technology is changing rapidly, and many solutions now come with virtual sessions, nutrition tracking, and AI-based coaching. According to experts, the market will grow more as the shift of people toward online training solutions for better health and well-being is increasing, and due to the increasing number of fitness enthusiasts worldwide, the demand for this type of software is expected to increase in the coming years.

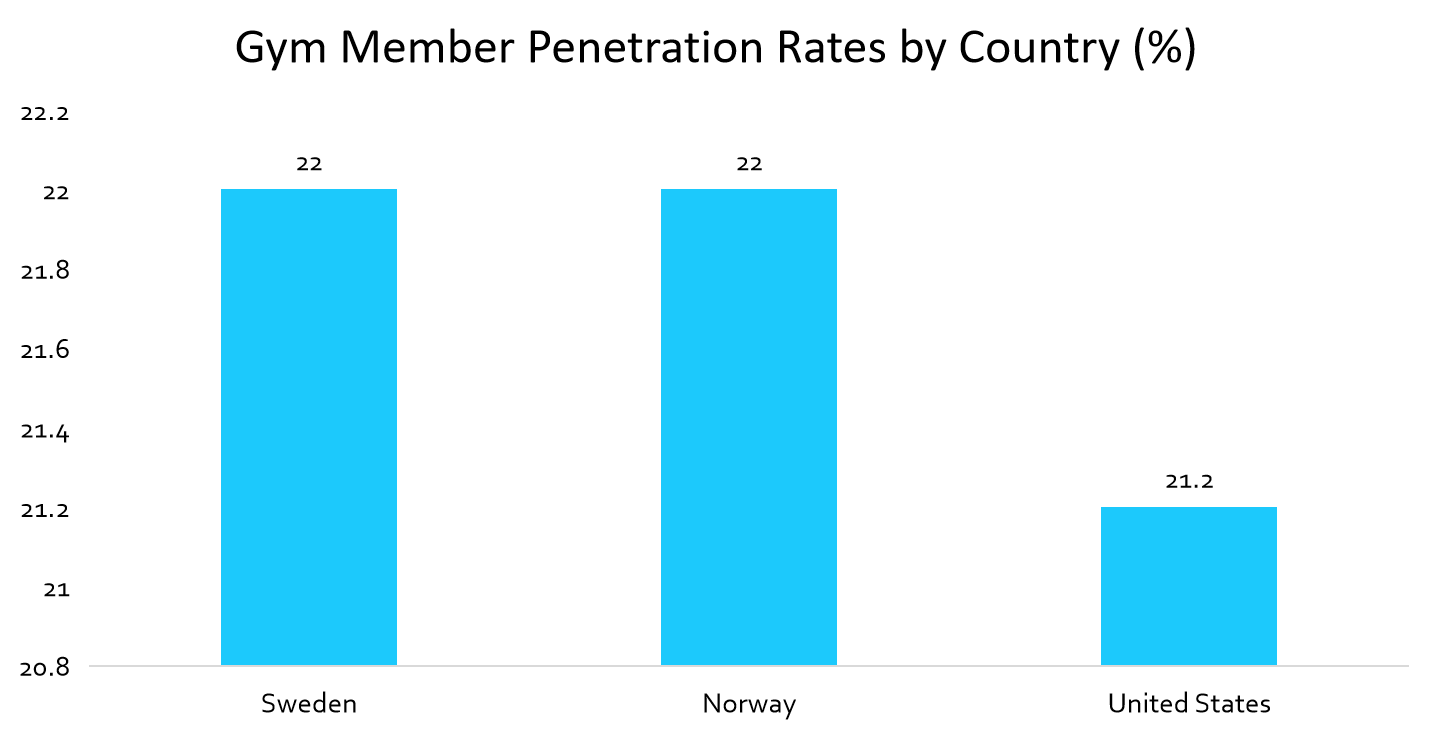

The graph below shows the high gym membership penetration rates in Sweden, Norway, and the U.S., indicating a strong fitness culture and driving demand for digital personal training solutions. This trend fuels market growth as software providers innovate to meet evolving consumer needs.

Source: Straits Research

Latest Market Trends

Rising Popularity of Ai-Powered Personal Training Solutions

The rapid growth of AI-driven personal training solutions is reshaping the fitness industry by offering personalized, adaptive workout experiences. AI systems analyze large datasets, such as data from fitness trackers and wearable devices, to provide real-time feedback and adjust training plans based on individual progress and goals. This enhances user engagement and improves outcomes. With the growing demand for hyper-personalized fitness services, AI-powered software is increasingly being adopted across the industry.

- For example, Peloton recently introduced an AI-driven strength training feature called Peloton Guide, which tracks user movement and provides real-time form corrections to prevent injuries and optimize performance.

AI solutions can also monitor heart rate variability, sleep quality, and recovery times, helping users maintain balance in their fitness and health journey.

Increasing Adoption of Virtual and on-Demand Training

Demand for virtual and on-demand fitness solutions surged during the COVID-19 pandemic and remains high due to the ongoing desire for flexibility and convenience. These solutions allow users to train from anywhere, blending fitness into their daily lives more seamlessly. Many trainers and clients now prefer online platforms over traditional gym settings, enabling access to a broader audience and reducing overhead costs for fitness businesses.

- Pure Gym Limited reported that 48% of individuals now exercise regularly, a 3% increase compared to previous years. The availability of virtual training options is cited as a major contributor to this growth.

Integrating live-streamed workouts and pre-recorded sessions makes fitness accessible to people with busy schedules. Companies like FitOn and My PT Hub have capitalized on this trend by offering comprehensive virtual training platforms with flexible pricing models.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.8 Billion |

| Estimated 2025 Value | USD 1.86 Billion |

| Projected 2033 Value | USD 2.45 Billion |

| CAGR (2025-2033) | 3.5% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Trainerize, Mindbody, PTminder, Virtuagym, My PT Hub |

to learn more about this report Download Free Sample Report

Personal Training Software Market Growth Factors

Growing Global Health and Fitness Awareness

Heightened global awareness around physical fitness and mental well-being has led to a substantial increase in demand for personal training solutions. Fitness enthusiasts and professionals use personal training software to manage and optimize their workout regimens. This trend is especially pronounced among older populations who seek structured exercise programs to maintain health and mobility.

- According to the International Health, Racquet & Sportsclub Association (IHRSA), gym memberships in the U.S. reached approximately 9 millionin 2024, reflecting a 3.7% year-over-year growth.

Additionally, health campaigns promoting fitness and healthy lifestyles and an increased focus on mental health have driven demand for holistic fitness solutions that integrate exercise, nutrition, and wellness tracking.

Shift toward Remote Fitness Solutions Due to Work-from-Home Culture

The rise of remote work has permanently altered fitness habits, prompting users to seek convenient fitness solutions they can access from home. Personal training software is critical in providing these solutions by offering flexibility and personalized support without requiring gym visits.

- For instance, according to the 2021 ACS one-year estimate, 27.6 million people, or 17.9% of employees in the U.S., were primarily working from home, creating a greater demand for remote fitness solutions to complement the new work-from-home lifestyle.

Companies like Future Fitness have leveraged this shift by offering remote coaching with wearable integrations, providing users with a tailored workout plan and real-time feedback from a personal trainer.

Market Restraint

High Initial Setup Costs for Digital Platforms

One of the significant challenges in adopting personal training software is the high initial investment required. Transitioning from traditional in-person training to digital platforms involves substantial costs related to software development, staff training, and acquiring necessary hardware. For independent trainers and small gyms, these expenses can be prohibitive.

- According to a Club Industry survey (2022) reported that 40% of gym owners identified high costs associated with digital platform adoption as a key barrier to business growth.

Additionally, maintaining and updating these platforms can be costly, particularly for businesses without in-house IT teams. This can limit advanced personal training software adoption among smaller fitness operations.

Market Opportunity

Expanding Market for Fitness Apps with Integrated Wellness Features

The growing interest in holistic health presents significant opportunities for personal training software providers. Modern fitness apps now go beyond exercise to offer integrated wellness features, such as nutrition tracking, sleep monitoring, and mindfulness exercises. This comprehensive approach appeals to users looking for tools that address physical, mental, and emotional well-being in one place.

- For example, Apple Fitness+ introduced sleep-tracking and meditation features in its latest update to create a more holistic fitness experience. This aligns with broader consumer demand for lifestyle improvement rather than just physical transformation.

Moreover, several startups have successfully merged fitness and wellness to create unique value propositions.

- For instance, Cure.fit in India integrates fitness classes, meditation, and nutrition tracking under one app, reaching millions of users.

- Noom, which focuses on behavior change, combines fitness tracking with cognitive behavioral therapy (CBT) principles to help users build long-term healthy habits.

Regional Insights

North America dominates the global personal training software market, driven by a tech-savvy population, a high level of fitness awareness, and strong adoption of digital fitness solutions. The widespread use of smartphones and wearable devices further boosts the demand for fitness apps offering personalized training and real-time progress tracking.

Additionally, the United States leads the region due to its large population of fitness enthusiasts seeking flexible, on-demand fitness programs. The growing popularity of the work-from-home model has fueled demand for mobile and web-based personal training solutions, enabling users to integrate fitness into their daily routines without needing to visit a gym. According to IHRSA, the U.S. had 64.19 million gym members in 2024, which continues to grow as hybrid fitness models become more mainstream.

- For instance, companies like Future Fitness and TrainHeroic have successfully capitalized on this trend by offering remote coaching and personalized training plans that integrate with wearables like Apple Watch and Fitbit.

United States Market Growth Factors

With 19 million gym members, the U.S. leads the global personal training software market. The rise of home-based fitness and the demand for personalized training plans continue to drive digital platform growth. Leading brands such as Peloton and Futureare capitalizing on this trend by offering AI-powered virtual coaching and integration with popular wearables.

Canadian Market Growth Factors

Canada’s 18 million gym members are increasingly adopting digital fitness solutions. Personal training apps that offer tailored workout plans and virtual coaching are particularly popular among remote workers and fitness enthusiasts.

European Market Trends

Europe is another significant contributor to the global personal training software market, with a strong fitness culture and high digital integration into daily life. Countries like Germany, the UK, and France are at the forefront, driven by growing consumer interest in health and wellness, personalized fitness solutions, and the increasing availability of mobile and web-based training platforms.

Germany leads with 11.66 million gym members, where digital transformation in fitness centers accelerates the adoption of software solutions for personalized training and progress tracking. The UK, with 10.39 million gym members, is experiencing steady growth in virtual fitness programs and AI-powered coaching.

Moreover, the mature digital infrastructure across Europe ensures seamless access to cloud-based fitness solutions, helping individual trainers and large fitness chains provide tailored services to their clients. Fitness companies such as Virtuagym and Freeletics have expanded their offerings with holistic wellness features, combining fitness, nutrition, and mental well-being.

Germany Market Trends

With 66 million gym members, Germany is a key player in the European market. Fitness centers and personal trainers increasingly adopt mobile and web-based solutions to offer customized programs and real-time progress tracking.

United Kingdom Industry Insights

The UK, with 39 million gym members, sees significant growth in virtual fitness programs. Personalized training apps and hybrid fitness models are becoming more popular, driven by a shift in consumer preferences toward flexible fitness solutions.

Indian Market Trends

The rapid urbanization and widespread use of affordable smartphones drive India’s growing fitness market. Apps like fit and Fittr are leading the way in providing cost-effective fitness solutions that combine training, nutrition, and mental wellness features.

Australian Market Trends

With a strong fitness culture, Australia’s personal training software market is expanding as consumers increasingly turn to mobile fitness apps for flexible, on-demand solutions. For example, apps such as My PT Hub have grown significantly in recent years.

Japanese Market Trends

Known for its tech-savvy population, Japan is embracing mobile fitness apps with features like real-time feedback, personalized training, and virtual coaching, helping users meet their fitness goals conveniently.

South Korean Market Trends

High smartphone penetration and a growing focus on fitness fuel the demand for personal training software. Apps that offer holistic wellness features, including fitness tracking and nutrition management, are gaining traction in this market.

Type Analysis

Mobile app-based personal training software segment dominates the global personal training software market.The on-the-go preference and the need for an increasingly mobile and agile solution for users have helped to increase the usage of mobile application-based personal training software, accounting for most of the market share. The increasing dependence on mobile phones can work out anytime, anywhere. This can be done based on real-time tracking, virtual coaching, or wearables in a customized fitness experience offered by these applications, making them more user-preferred.

End-User Analysis

Fitness enthusiasts lead the end-user segment, making up a considerable proportion of the global personal training software market. They are highly involved with fitness and health and look for customized solutions to optimize workout plans and monitor performance. The main driver for the growth of personal training software in the market among fitness enthusiasts is the desire for better performance and results. Their commitment to achieving specific fitness goals fosters continuous usage and boosts market adoption.

Application Analysis

Fitness centers & gymnasiums dominated with the largest market revenue. Fitness centers and gyms are significant applications because they need effective management systems to deal with numerous customers, keep track of their progress, and provide scalable training services. Such centers and gyms are increasingly turning towards digital platforms to simplify operations, improve customer interaction, and customize training according to personal needs. Offering remote or hybrid training options makes the software even more appealing for usage in gyms, further emphasizing its market leadership.

Company Market Share

Key market players are investing in advanced Personal Training Software technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Virtuagym: An Emerging Player in the Personal Training Software Market

Virtuagym strengthens its position as an emerging player in the Personal Training Software Market with the launch of its AI-powered Fitness Coach, enhancing personalized training for consumers and fitness businesses worldwide.

Recent Developments:

- In January 2025, Virtuagym launched its AI-powered Fitness Coach, offering personalized workouts and support. This tool, available through its app, serves 20M consumers and expands to 9K fitness businesses and 45K trainers globally, marking a significant development in AI-driven fitness training.

List of Key and Emerging Players in Personal Training Software Market

- Trainerize

- Mindbody

- PTminder

- Virtuagym

- My PT Hub

- TrueCoach

- Wodify

- Fitli

- Gymcatch

- TeamUp

Recent Developments

- January 2025- Mindbody launched three new AI-powered features Clients At Risk, Big Spenders, and an AI Assistant to improve member retention and enhance business efficiency for wellness and fitness businesses.

Analyst Opinion

As per our analyst, the global personal training software market is rapidly transforming, driven by increasing digitalization, AI integration, and consumer demand for personalized fitness solutions. AI-powered coaching is expected to be a game-changer in the market, offering users tailored recommendations and real-time feedback. With health awareness at an all-time high and the number of gym memberships steadily increasing worldwide, fitness professionals are adopting advanced software for personalized training, client engagement, and performance tracking.

Mobile and web-based solutions are becoming essential tools for personal trainers, gyms, and corporate wellness programs, helping improve operational efficiency and user experience. As technology advances, emerging players introduce innovative solutions catering to evolving consumer preferences. Companies like Virtuagym, Peloton, and My PT Hub continuously expand their offerings with integrated wellness features and AI-powered coaching, ensuring the market’s steady growth in the coming years.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.8 Billion |

| Market Size in 2025 | USD 1.86 Billion |

| Market Size in 2033 | USD 2.45 Billion |

| CAGR | 3.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By End-User, By Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Personal Training Software Market Segments

By Type

- Web-Based Personal Training Software

- Mobile App-Based Personal Training Software

By End-User

- Individual Trainers

- Fitness Enthusiasts

- Health and Fitness Organizations

- Others

By Application

- Fitness Centers & Gymnasiums

- Personal Trainers

- Corporate Wellness Programs

- Health & Wellness Clubs

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.