Polyvinyl Alcohol Market Size, Share & Trends Analysis Report By End-use (Paper, Food Packaging, Construction, Electronics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Polyvinyl Alcohol Market Overview

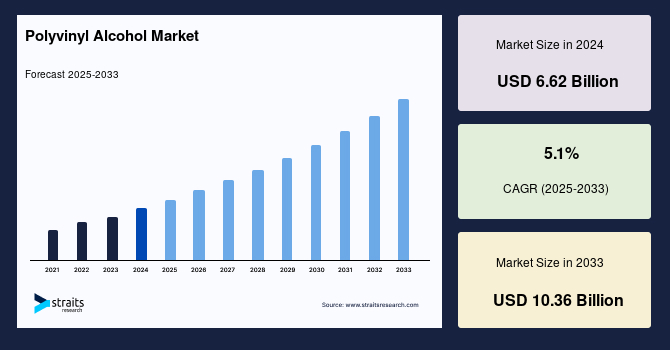

The global polyvinyl alcohol market size was valued at USD 6.62 billion in 2024 and is projected to grow from USD 6.96 billion in 2025 to USD 10.36 billion by 2033, exhibiting a CAGR of 5.1% during the forecast period (2025-2033). The growth of the market is attributed to stringent environmental regulations.

Key Market Insights

- Asia-Pacific dominated the polyvinyl alcohol industry in 2024 with a 55% market share

- Based on end-use, the food packaging segment led the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.62 Billion

- 2033 Projected Market Size: USD 10.36 Billion

- CAGR (2025–2033): 5.1%

- Asia-Pacific: Largest market in 2024

- North America: Fastest-growing region

PVA is a synthetic water-soluble polymer that is a basic element in various end-use industries such as food packaging, construction, electronics, coatings, printing, textiles, cosmetics, and paper. The global polyvinyl alcohol (PVA) market involves the production and commercialization of a water-soluble synthetic polymer used in various industrial and consumer applications. PVA is known for its excellent film-forming, adhesive, and emulsifying properties. It is widely used in textile sizing, paper coatings, adhesives, construction, packaging films, and water-soluble personal care products. Additionally, it plays a critical role in eco-friendly packaging and biodegradable plastics.

The global polyvinyl alcohol (PVA) market growth is driven by environmental, industrial, and technological factors. Increasing global awareness of environmental degradation and the urgent need to reduce plastic pollution have significantly boosted demand for sustainable alternatives to conventional petroleum-based plastics. As a water-soluble, biodegradable, and non-toxic polymer, PVA is increasingly a promising solution across multiple applications.

Moreover, the construction and textile industries are increasingly adopting PVA due to its strong adhesion, emulsifying properties, and resistance to grease and oil. In construction, PVA is used in mortar and cement formulations to enhance durability and bonding strength. At the same time, in textiles, it serves as a sizing agent and coating material for high-performance fabrics.

Emerging Market Trends

Consumer Preference for Eco-Friendly Products

Amid growing global concerns about plastic pollution and climate change, there has been a significant shift in consumer behavior towards environmentally sustainable alternatives, such as bio-based polyvinyl alcohol (PVA). Consumers increasingly prioritize biodegradable, recyclable, and compostable packaging, pushing manufacturers to innovate and adopt greener materials. Bio-based PVA, derived from renewable resources, offers water solubility, low toxicity, and biodegradability, making it a desirable substitute for conventional plastics.

- For instance, Anhui Wanwei Group Co., Ltd. introduced high-performance PVA products in November 2024, enhancing water resistance and film-forming properties. These innovations cater to industries like textiles and packaging, aligning with the growing demand for sustainable materials.

Moreover, product labeling highlighting sustainability credentials further influences purchasing decisions. As awareness spreads through social media, policy advocacy, and environmental education, the trend toward sustainable materials such as bio-based PVA is expected to continue growing. Companies investing in sustainable packaging and R&D for advanced PVA-based materials are well-positioned to capitalize on this consumer-driven trend, which supports long-term market growth and regulatory compliance.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 6.62 Billion |

| Estimated 2025 Value | USD 6.96 Billion |

| Projected 2033 Value | USD 10.36 Billion |

| CAGR (2025-2033) | 5.1% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | du Pont de Nemours and Company, Nippon Synthetic Chemical Industry Co., Eastman Chemical Company, Sekisui Chemical Co. Ltd., Kuraray Co. Ltd. |

to learn more about this report Download Free Sample Report

Polyvinyl Alcohol Market Growth Factor

Stringent Environmental Regulations

Environmental legislation across the globe is increasingly targeting the reduction of single-use plastics and non-biodegradable materials, accelerating the adoption of alternative materials like bio-based polyvinyl alcohol (PVA). Governments and international bodies are imposing tighter restrictions and introducing new regulations to curb the environmental impact of synthetic polymers.

- For instance, the European Union's Packaging Directive mandates that packaging contain no more than 50% voids by 2030, encouraging sustainable materials like PVA. Similarly, countries like China, Australia, and South Korea have set targets for reducing plastic waste and promoting recyclable or compostable packaging by 2025.

These legal frameworks discourage the use of petroleum-based plastics and actively incentivize the research, development, and commercialization of biodegradable substitutes. Bio-based PVA aligns well with these initiatives, as it meets the criteria for compostability, minimal environmental impact, and safe degradation.

Market Restraining Factor

Environmental Concerns in Synthetic Pva

Despite being water-soluble and partially biodegradable under specific conditions, synthetic polyvinyl alcohol (PVA) presents significant environmental challenges that hinder its widespread acceptance, especially in regions with strict environmental regulations. Derived primarily from petrochemical sources like ethylene, synthetic PVA raises sustainability concerns due to its reliance on fossil fuels and the environmental cost of its production processes.

Furthermore, its biodegradability is conditional it requires specific microbial environments, humidity, and temperature levels to decompose fully, which are not consistently present in natural environments or landfills. This partial biodegradation can result in microplastic pollution, contradicting the very goals of green innovation. Countries like those in the European Union, with stringent environmental policies, often do not classify synthetic PVA as fully biodegradable, limiting its use in certified compostable packaging.

Market Opportunity

Expansion in Food Packaging Applications

The food packaging sector is emerging as a key growth driver in the global polyvinyl alcohol (PVA) market, thanks to increasing demand for sustainable and high-performance materials. PVA’s unique properties, including water solubility, biodegradability, non-toxicity, and excellent film-forming ability, make it a highly suitable material for environmentally friendly packaging solutions. With growing awareness of conventional plastics' health and environmental impacts, food brands are turning to materials like PVA for packaging perishables, ready-to-eat meals, and single-serve products.

- For instance, Unilever Group expanded production facilities across countries like India and the Philippines, responding to the rising demand for PVA films in the packaging of personal care products, driven by consumer preferences for sustainable packaging in October 2024.

Additionally, PVA’s ability to create strong, oxygen-resistant films supports longer shelf life, essential in reducing food waste. The surge in e-commerce grocery delivery and on-the-go consumption patterns further fuels this trend.

Regional Analysis

Asia-Pacific continues to lead the global polyvinyl alcohol market, accounting for 55% of total demand. It is projected to maintain its dominance due to the strong presence of end-use industries and favorable economic conditions. China, as the largest producer and consumer of PVA, benefits from a well-established chemical manufacturing base, which supports large-scale production at competitive costs. India is witnessing a surge in infrastructure development, urbanization, and packaging demand, further propelling the PVA market.

Meanwhile, in Japan and South Korea, adopting sustainable food and industrial packaging materials is accelerating, and stringent government regulations and corporate sustainability goals are behind it. Technological advancements in biodegradable packaging solutions and increased focus on reducing carbon footprints foster regional market expansion.

China Polyvinyl Alcohol Market Trends

- As the world’s largest producer and consumer of PVA, China plays a dominant role in the Asia-Pacific market. Rapid urbanization, infrastructure development, and an expanding textile industry are major drivers. The country’s push for circular economy initiatives and biodegradable packaging solutions has encouraged innovation in bio-based PVA production.

- India’s market is growing swiftly due to its booming construction and textile sectors. PVA demand is further amplified by government-backed sustainability initiatives promoting biodegradable packaging and agricultural films. India's substantial textile manufacturing base heavily relies on PVA for yarn sizing and finishing.

North America Polyvinyl Alcohol Market Trends

North America is emerging as the fastest-growing region in the global polyvinyl alcohol market, driven by a robust shift towards sustainability, particularly in packaging and healthcare applications. The region’s rising commitment to eco-conscious practices prompts industries to replace conventional plastics with biodegradable alternatives like PVA. Legislative movements such as bans on single-use plastics and increasing consumer demand for green products are significantly influencing material choices across sectors.

Additionally, the region’s well-established R&D infrastructure fosters the development of advanced PVA-based solutions tailored to high-performance and eco-friendly applications. North America’s market CAGR is further propelled by ongoing collaboration between private firms and regulatory bodies to meet environmental targets, positioning the region as a key growth hub in the global PVA landscape.

- The U.S. market is mature but growing, driven by the shift toward biodegradable materials in packaging, pharmaceuticals, and personal care. Regulatory pressure and rising consumer preference for green products make the U.S. a hub for sustainable innovation in PVA applications.

Country Insights

The global polyvinyl alcohol (PVA) market is witnessing accelerated demand across key regions due to rising environmental awareness and shifting regulatory landscapes promoting sustainable material usage.

- Germany: Germany leads Europe in sustainable packaging and regulatory enforcement. PVA demand in food packaging, automotive coatings, and medical products is rising. EU-wide bans on single-use plastics are accelerating the transition to eco-friendly materials like PVA.

- Brazil: As South America's largest economy, Brazil is emerging as a promising market for PVA, particularly in textiles and packaging. Government efforts to reduce plastic waste and promote biodegradable alternatives foster interest in PVA-based solutions, especially within urban centers and export-driven industries.

Market Segmentation

End-Use Insights

The food packaging segment commands the largest share of the global polyvinyl alcohol market, driven by the surging demand for sustainable and non-toxic materials in the food and beverage industry. With rising consumer awareness regarding plastic pollution and health risks associated with traditional packaging materials, food manufacturers are increasingly turning to environmentally friendly options such as PVA. Polyvinyl alcohol’s exceptional biodegradability, non-toxic composition, and water solubility make it highly attractive for food-grade packaging applications.

Additionally, regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) have approved certain grades of PVA for direct contact with food, further encouraging adoption. With rising demand for compostable and high-performance packaging solutions, the food packaging segment is expected to remain dominant over the forecast period.

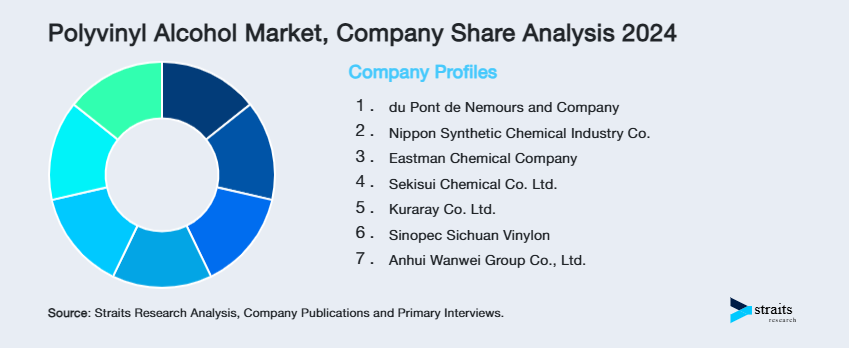

Company Market Share

The market for polyvinyl alcohol is competitive. Companies nowadays focus on new product developments and sustainability improvements to become winners through these new bio-based and biodegradable PVA products. Further growth would be assured with innovations in sustainable solutions and biodegradable materials, even when the PVA market share becomes competitive.

Nippon Synthetic Chemical Industry Co. (NSC): An Emerging Player in the Polyvinyl Alcohol Market

Market Share: Nippon Synthetic Chemical Industry Co. is one of the leaders in the Japanese PVA market and has a very strong position in Asia-Pacific. The company has a whole gamut of PVA products used in applications such as adhesives, textiles, and coatings. NSC is very prominent in the PVA market share in Japan and other Asian markets; its thrust on high-performance products has given it an important share of this region.

Recent Developments at Nippon Synthetic Chemical Industry Co. (NSC) Include:

- In April 2020, Mitsubishi Chemical Corporation's Performance Polymers business unit (MCPP) now comprises Nippon Gohsei Europe. Nippon Gohsei Europe GmbH was renamed MCPP Europe GmbH, and the following business areas would be incorporated into Mitsubishi Chemical's European business organization.

List of Key and Emerging Players in Polyvinyl Alcohol Market

- du Pont de Nemours and Company

- Nippon Synthetic Chemical Industry Co.

- Eastman Chemical Company

- Sekisui Chemical Co. Ltd.

- Kuraray Co. Ltd.

- Sinopec Sichuan Vinylon

- Anhui Wanwei Group Co., Ltd.

to learn more about this report Download Market Share

Recent Development

- October 2024- Sekisui Chemical Co., Ltd. invested in a new PVA production facility in Thailand, focusing on technological advancements to produce bio-based PVA suitable for various applications, including packaging and textiles.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 6.62 Billion |

| Market Size in 2025 | USD 6.96 Billion |

| Market Size in 2033 | USD 10.36 Billion |

| CAGR | 5.1% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By End-use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Polyvinyl Alcohol Market Segments

By End-use

- Paper

- Food Packaging

- Construction

- Electronics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.