Recombinant Cell Culture Insulin Market Size, Share & Trends Analysis Report By Type (Stand-alone Powder, Combined kits & Cocktails, Liquid Insulin), By End use (Therapeutic Protein Originators, Therapeutic Proteins Biosimilars, Vaccine Manufacturers, Regenerative Medicine, Academic Research Institutes, Cell Culture Media Manufacturers, CMOs & CROs, CDMO) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Recombinant Cell Culture Insulin Market Overview

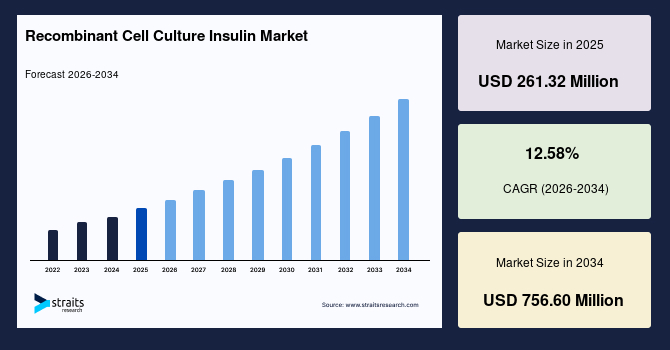

The global recombinant cell culture insulin market size is valued at USD 261.32 million in 2025 and is estimated to reach USD 756.60 million by 2034, growing at a CAGR of 12.58% during the forecast period. The observed market growth is stimulated by the rising adoption of insulin-supplemented media systems to support higher productivity in advanced biomanufacturing workflows.

Key Market Trends & Insights

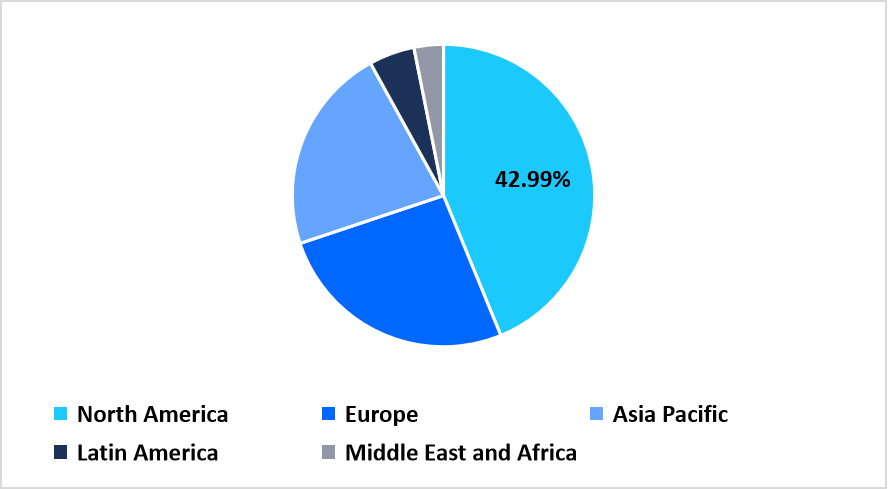

- North America held a dominant share of the global market, accounting for 42.99% in 2025.

- The Asia Pacific region is expected to grow at the fastest pace, with a CAGR of 14.58%.

- By type, the stand-alone powder segment dominated the recombinant cell culture insulin market with the highest share of 75.12% in 2025.

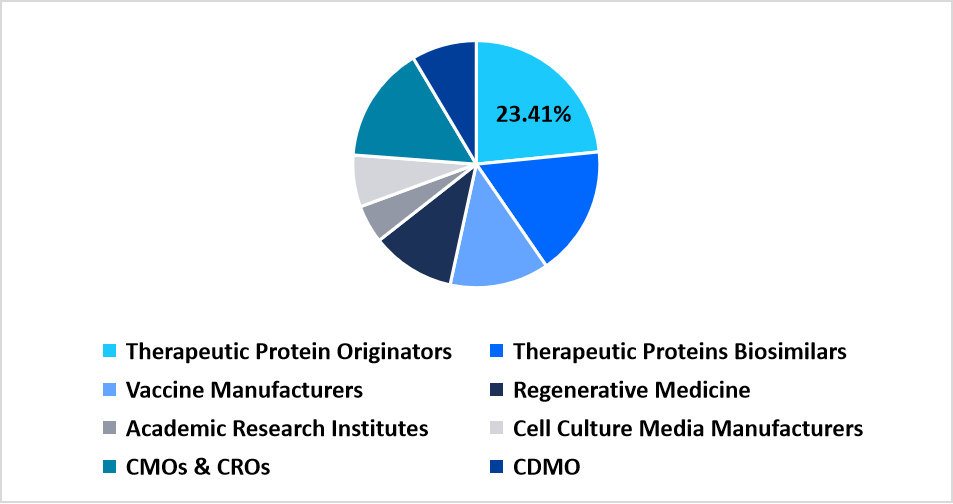

- By end use, the therapeutic protein originators segment dominated the recombinant cell culture insulin market with the highest share of 23.41% in 2025.

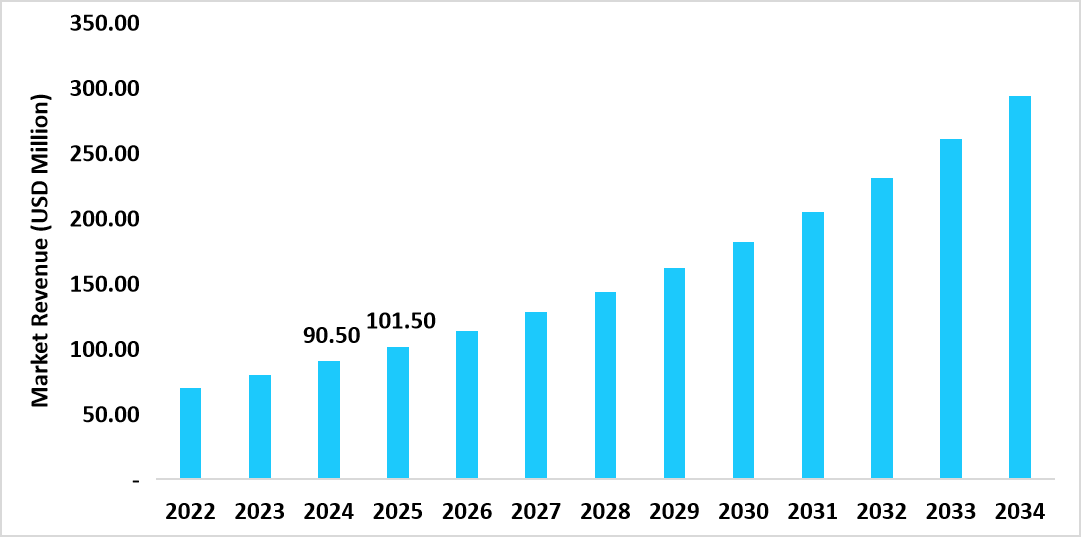

- The U.S. dominates the recombinant cell culture insulin market, valued at USD 90.50 million in 2024 and reaching USD 101.50 million in 2025.

Table: U.S. Recombinant Cell Culture Insulin Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 261.32 million

- 2034 Projected Market Size: USD 756.60 million

- CAGR (2026-2034): 12.58%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The recombinant cell culture insulin market encompasses the production and commercialization of insulin formulated specifically as a nutrient component for cell-based bioprocesses, where it functions as a key metabolic regulator that supports cellular growth, viability, and protein expression across diverse biomanufacturing environments. This market includes multiple formulation types such as standalone powder, combined kits and cocktails, and liquid insulin that serve a wide range of upstream processing requirements. Demand originates from therapeutic protein originators, biosimilar developers, vaccine producers, regenerative medicine platforms, academic research institutes, cell culture media manufacturers, CMOs and CROs, and CDMOs that rely on consistent insulin supplementation to optimize culture performance for research-scale and commercial-scale applications.

Latest Market Trends

Shift from Empirical Feeding Strategies to Data-Guided Nutrient Optimization

A major trend in the recombinant cell culture insulin market is the shift from empirical feeding strategies to data-guided nutrient optimization. Producers are adopting computational tools that simulate nutrient uptake patterns for different cell lines, which allows more precise insulin feeding schedules during upstream processing. This shift enhances control over metabolic states during culture expansion and supports smoother adaptation of cells during scale transfers.

Shift from Single Component Supplementation to Modular Insulin Blended Systems

The major trend reshaping the market is the shift from single-component supplementation to modular insulin blended systems that allow laboratories and manufacturers to customize nutrient matrices for distinct production campaigns. The emergence of modular blends gives users greater flexibility in matching insulin concentrations with amino acid profiles and trace components, which improves consistency across varied expression systems without altering core media formulations.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 261.32 Million |

| Estimated 2026 Value | USD 293.25 Million |

| Projected 2034 Value | USD 756.60 Million |

| CAGR (2026-2034) | 12.58% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | Thermo Fisher Scientific Inc., Corning Incorporated, Lonza, GeminiBio LLC., Capricorn Scientific |

to learn more about this report Download Free Sample Report

Market Driver

Growing Transition toward Intensified Upstream Bioprocessing

A major driver for the market is the growing transition toward intensified upstream bioprocessing, where producers seek higher cell densities and extended culture durations. These approaches require controlled insulin supplementation to maintain stable metabolic activity during prolonged production window,s which increases demand for recombinant insulin in research facilities and commercial manufacturing environments seeking greater output from existing infrastructure.

Market Restraint

Procurement Constraints Among Smaller-Scale Producers

A major restraint is the procurement constraint faced by smaller-scale producers that operate with restricted operational budgets and limited storage capacity. Fluctuations in global reagent supply chains can elevate delivery times and restrict access to preferred recombinant insulin grades which creates planning challenges for laboratories that rely on predictable batch scheduling. This constraint can delay experimental progress and disrupt continuous production cycles.

Market Opportunity

Growth of Cell Line Engineering Programs Across Global Research Centers

A major opportunity arises from the rapid expansion of cell line engineering programs across research institutions and biomanufacturing clusters. As laboratories develop expression systems with higher productivity, they require tailored insulin supplementation strategies that match the metabolic traits of engineered cells. This creates growing demand for specialized recombinant insulin variants that support advanced screening platforms and high-yield bioproduction templates.

Regional Analysis

North America leads the recombinant cell culture insulin market in 2025 with a market share of 42.99% driven by advanced bioprocessing capabilities across major biologics production hubs. State-of-the-art manufacturing centers across the region support a large-scale supply of cell culture-grade insulin for upstream processing, which increases consistency in biomanufacturing and strengthens the regional ecosystem for biologics development.

The U.S. market expands due to large federal allocations directed toward biomanufacturing science. In 2023, federal agencies committed around USD 4.1 billion to programs that support upstream reagent development for biologics, which fuels demand for cell culture insulin across research institutes, biopharma companies, and contract development facilities, and reinforces the position of the United States as a leading center for bioprocess advancement.

Asia Pacific Market Insights

Asia Pacific is emerging as the fastest-growing region with a compound annual growth rate of 14.58% during the forecast period, supported by the rapid expansion of bioproduction capacity across China, India, and South Korea. Contract development organizations across the region are scaling operations and executing high-volume production campaigns, which expand access to upstream reagents, including recombinant cell culture insulin, and elevate regional market growth.

China's market growth is driven by a swift increase in domestic production infrastructure supported by a national bioeconomy investment program valued at RMB 190 billion, which expands local availability of culture-grade raw materials and accelerates adoption of recombinant insulin across research and biomanufacturing segments.

Regional Market Share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe records steady growth supported by broad research funding commitments through continent-wide life science strategies. These programs channel more than USD 10 billion each year into biotechnology development, which increases demand for upstream reagents such as cell culture insulin across academic institutions, diagnostic companies and biologics manufacturers.

France experiences notable expansion due to the rapid scale-up of domestic bioproduction centers. In 2024, national industry leaders announced over USD 40 million for facility expansion, which strengthens local manufacturing of culture-grade materials and reduces reliance on external sourcing for research and therapeutic production.

Latin America Market Insights

Latin America market growth is supported by rising investments in healthcare research and bioprocessing infrastructure. Governments and private sector entities in Brazil, Mexico, and Argentina are expanding laboratory networks and biologics facilities, which increases procurement of cell culture insulin for diagnostics, research, and preclinical development across the region.

Argentina's market expansion is fueled by new national investments in biotechnology. The national biotechnology chamber announced around USD 700 million in funding over a two-year period, which supports domestic reagent production, increases the availability of culture materials, and enhances the adoption of recombinant insulin in research and diagnostic workflows.

Middle East and Africa Market Insights

The Middle East and Africa region records growth due to the widespread expansion of diagnostic and laboratory infrastructure in Saudi Arabia, the United Arab Emirates, South Africa, and Egypt. Increasing investments in modern testing centers strengthen demand for cell culture grade insulin used in immunoassays, bioprocess research, and early-stage biologics work.

Egypt's market progression is driven by the rapid expansion of advanced diagnostic laboratories that perform immunoassays and molecular investigations. Government-backed screening initiatives and rising prevalence of chronic diseases increase testing volumes, which elevates the requirement for upstream reagents, including cell culture insulin, across public and private laboratories.

Type Insights

The standalone powder segment dominated the market with a 75.12% revenue share in 2025, driven by its broad use across upstream bioprocessing, where dry format insulin provides extended stability and flexible formulation compatibility for diverse cell systems. Its capacity for long-duration storage and easy integration into nutrient media supports wide adoption across commercial manufacturing environments and research-scale workflows.

The combined kits and cocktails segment is projected to grow at a rapid pace with a 13.12% CAGR as producers adopt integrated reagent blends that streamline preparation steps and reduce manual handling during culture setup. This format supports consistent component distribution across media preparation, which improves workflow continuity in laboratories and pilot facilities exploring accelerated production cycles.

End Use Insights

The therapeutic protein originators segment dominated the market with a 23.41% share in 2025, supported by strong use of recombinant cell culture insulin in upstream processes for biologics discovery and protein expression enhancement. Its use in controlled nutrient supplementation allows originator companies to maintain uniform growth kinetics in established cell lines, which strengthens production consistency across early and late stage development programs.

The CDMO segment is the fastest growing with a 13.35% CAGR driven by expanding outsourcing activity from global biopharmaceutical manufacturers. CDMOs adopt recombinant cell culture insulin to support high-throughput operations and diverse client projects where flexible process configurations and rapid transitions between production batches are essential for maintaining competitive service offerings.

By End Use Market Share (%), 2025

Source: Straits Research

Competitive Landscape

The global recombinant cell culture insulin market is fragmented, with numerous regional and mid-scale manufacturers operating alongside established biotechnology suppliers due to expanding adoption in biopharmaceutical production and research workflows.

Novo Nordisk Pharmatech A/S: An emerging market player

Novo Nordisk Pharmatech A/S is an emerging participant in the recombinant cell culture insulin market, gaining wider visibility through its recombinant insulin formulations designed for controlled cell culture performance and consistent upstream process outcomes. By offering scalable and application-specific insulin variants for biomanufacturing environments, the company is establishing a stronger presence across global research and production ecosystems.

List of Key and Emerging Players in Recombinant Cell Culture Insulin Market

- Thermo Fisher Scientific Inc.

- Corning Incorporated

- Lonza

- GeminiBio LLC.

- Capricorn Scientific

- Novo Nordisk Pharmatech A/S

- Sanofi

- Biocon

- Wockhardt Limited

- BIOTON S.A.

- Gan & Lee Pharmaceuticals

- Julphar

- Fosun Wanbang (Jiangsu) Pharmaceutical Group Co., Ltd.

- SEDICO

- Others

Strategic Initiatives

- September 2025: Thermo Fisher Scientific Inc. launched in the U.S. the Gibco Efficient-Pro Medium (+) Insulin, which further enhanced CHO cell line productivity with up to 61% higher titers and streamlined bioprocessing.

- April 2024: The FDA announced the establishment and validation of a novel in vitro cell-based assay designed to accurately assess the biological activity of insulin products, marking a major step toward replacing traditional animal-based potency tests and supporting more consistent, efficient, and ethical regulatory evaluation.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 261.32 Million |

| Market Size in 2026 | USD 293.25 Million |

| Market Size in 2034 | USD 756.60 Million |

| CAGR | 12.58% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By End use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Recombinant Cell Culture Insulin Market Segments

By Type

- Stand-alone Powder

- Combined kits & Cocktails

- Liquid Insulin

By End use

- Therapeutic Protein Originators

- Therapeutic Proteins Biosimilars

- Vaccine Manufacturers

- Regenerative Medicine

- Academic Research Institutes

- Cell Culture Media Manufacturers

- CMOs & CROs

- CDMO

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.