Saccharin Market Size, Share & Trends Analysis Report By Product Type (Sodium Saccharin, Insoluble Saccharin, Calcium Saccharin), By Form (Powder, Granular), By Application (Food & Beverages, Pharmaceuticals, Personal Care, Industrial Applications, Others), By Distribution Channel (Offline, Online) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Saccharin Market Size

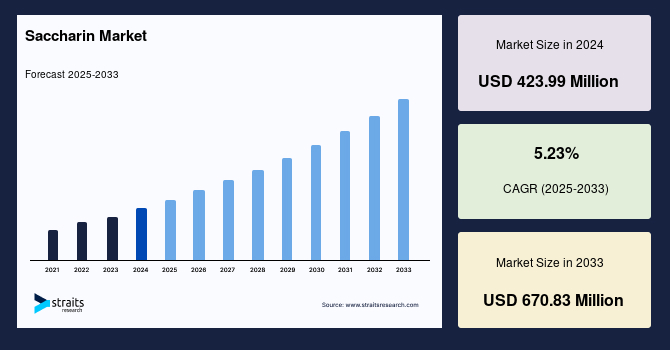

The global saccharin market size was valued at USD 423.99 million in 2024 and is estimated to grow from USD 446.17 million in 2025 to reach USD 670.83 million by 2033, growing at a CAGR of 5.23% during the forecast period (2025–2033).

One of the primary drivers of the global saccharin market is its extensive application in cost-sensitive industrial formulations, especially in the food and beverage sector. Saccharin is nearly 300 to 500 times sweeter than sucrose and requires minimal quantities to achieve the desired sweetness, which significantly reduces production costs for manufacturers. This economic advantage makes it an ideal choice for mass-produced soft drinks, confectionery, and baked goods, particularly in developing countries.

Additionally, saccharin's high thermal and chemical stability allows it to maintain its sweetness even under extreme processing conditions, further reinforcing its suitability for a wide array of industrial uses. Another significant factor is the growing use of saccharin in non-food industries such as pharmaceuticals, personal care, and electroplating. Moreover, in metalworking and electroplating applications, saccharin acts as a brightener in nickel baths. The versatility of saccharin across diverse end-use sectors has significantly contributed to its sustained demand and market expansion globally.

Emerging Market Trends

Growing Research & Development

Rising investments in research and development are significantly reshaping the global saccharin market. Traditionally valued as a non-nutritive sweetener, saccharin is now gaining attention for its potential therapeutic applications, driven by ongoing scientific discoveries.

- For instance, a research article published in EMBO Molecular Medicine in April 2025 highlights saccharin as a potential tool in combating antibiotic resistance. The study reveals that saccharin can eliminate multidrug-resistant bacteria by disrupting DNA replication and inhibiting biofilm formation. This novel finding not only redefines saccharin's biomedical value but also opens new pathways for its use in pharmaceutical formulations.

Such advancements underscore the market's shift from conventional food applications to high-value, cross-industry solutions. As research continues to uncover untapped benefits, saccharin is poised to become a strategic ingredient in both health and wellness sectors, encouraging greater innovation and investment in its development.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 423.99 Million |

| Estimated 2025 Value | USD 446.17 Million |

| Projected 2033 Value | USD 670.83 Million |

| CAGR (2025-2033) | 5.23% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Kaifeng Xinghua Fine Chemical Ltd., Tianjin North Food Co., Ltd., PMC Specialties Group, Shanghai Merry Yang Enterprise Co., Ltd., Salvi Chemical Industries Ltd. |

to learn more about this report Download Free Sample Report

Saccharin Market Growth Factors

Health Awareness and Lifestyle Diseases

The increasing incidence of lifestyle-related disorders, particularly diabetes and obesity, is a major factor fueling the demand for artificial sweeteners like saccharin. Consumers are becoming more health-conscious and are actively seeking sugar-free and low-calorie alternatives to manage their weight and minimize the risk of chronic illnesses. Saccharin, with its zero-calorie content and strong sweetness profile, is widely used in diet beverages, sugar-free foods, and pharmaceutical formulations.

- According to the International Diabetes Federation (2023), over 537 million adults globally are living with diabetes a number expected to rise to 643 million by 2030. Additionally, with around 212 million adults affected in 2022, India holds the highest number of diabetics, as reported in a global analysis published in The Lancet.

This growing health crisis is pushing both consumers and manufacturers toward healthier alternatives, boosting saccharin adoption worldwide.

Market Restraint

Concerns regarding Artificial Sweetener Safety

One of the primary restraints in the global saccharin market is the persistent concern regarding the safety of artificial sweeteners. Despite approvals from major regulatory bodies like the FDA and WHO, many consumers remain skeptical about the long-term health effects of saccharin consumption. Historical controversies, such as studies linking saccharin to bladder cancer in lab animals, continue to influence public perception, even though these findings have been refuted for human use.

This skepticism is further amplified by the rising preference for natural sweeteners like stevia. As health-conscious consumers increasingly favor clean-label products, negative perceptions about artificial ingredients can significantly hinder saccharin's growth prospects in both food and pharmaceutical applications.

Key Market Opportunities

Regulatory Approvals and Global Acceptability

Regulatory support plays a pivotal role in enhancing saccharin's market prospects. Global food safety authorities, including the U.S. Food and Drug Administration (FDA), Joint FAO/WHO Expert Committee on Food Additives (JECFA), and others, have approved saccharin as safe for consumption within established limits. These endorsements contribute significantly to consumer confidence and industry adoption.

- In November 2024, the European Food Safety Authority (EFSA) concluded its comprehensive re-evaluation of saccharin and its salts (E 954), reassessing available animal and human studies. It increased the ADI from 5 mg/kg to 9 mg/kg body weight per day, concluding that chronic saccharin exposure even among high consumers remains below this limit, posing no safety concerns. The International Sweeteners Association highlighted EFSA's findings as reinforcing saccharin's safety and its role in supporting sugar reduction trends.

Such regulatory developments are creating a favorable environment for saccharin's expanded use globally.

Regional Analysis

The market for saccharin in North America is experiencing steady growth, driven by the surging consumer preference for calorie-free sweeteners amid growing health awareness. The expanding diabetic and obese population is increasing the adoption of artificial sweeteners in food and beverage applications. Regulatory support and widespread use of saccharin in pharmaceuticals and personal care products further contribute to market demand. Additionally, a strong presence of R&D-focused food manufacturers and a shift toward clean-label and sugar-reduction initiatives are supporting saccharin's inclusion in reformulated product lines.

United States Saccharin Market Trends

The United States is driven by high demand for low-calorie sweeteners in processed foods and beverages. With major players like PepsiCo and Coca-Cola using artificial sweeteners in diet sodas, saccharin remains a key ingredient. The U.S. FDA's continued approval supports its use. Additionally, the diabetic population over 37 million in 2023 fuels consistent demand for sugar substitutes in pharmaceuticals and dietary products.

- Canada's market growth is supported by rising health awareness and the expanding diabetic population. Health Canada permits saccharin use in tabletop sweeteners, aiding its inclusion in products like diet soft drinks and sugar-free jams. Canadian food brands are increasingly opting for cost-effective sweeteners due to inflation-driven food price hikes, making saccharin a preferred alternative in both food and pharmaceutical applications. Companies like Lantic Inc. are exploring sweetener blends using saccharin.

Asia Pacific is witnessing robust growth in the saccharin market, fueled by urbanization, dietary shifts toward processed foods, and a rising middle-class population seeking affordable sugar alternatives. Increasing awareness of lifestyle-related diseases is boosting demand for low-calorie sweeteners across food, beverage, and health product sectors. The region's large-scale manufacturing base and favorable regulatory environments also make it a prime hub for production and export. Expansion in personal care and pharmaceuticals, alongside domestic consumption of low-cost sweeteners, further accelerates the saccharin market growth in this dynamic region.

China Saccharin Market Trends

China's market dominates global production, accounting for over 80% of the world's output. With strong manufacturing infrastructure and low production costs, Chinese companies like Kaifeng Xinghua Fine Chemical Ltd. export saccharin worldwide. Domestically, demand is driven by the widespread use of sweetened beverages, pickled foods, and personal care products. Supportive government policies and export incentives further enhance China's position as the global leader in saccharin supply.

- India's market for saccharin is witnessing growth due to rising diabetic cases and increasing demand for low-calorie sweeteners in processed foods and pharmaceuticals. The government's "Make in India" initiative is encouraging domestic production of saccharin, reducing reliance on imports from China. Indian companies like Aarti Drugs Ltd. are expanding product portfolios to meet local and export needs. Additionally, saccharin use in Ayurvedic syrups and health drinks boosts market potential.

In Europe, the saccharin market is growing due to increasing regulatory focus on reducing sugar intake and enhancing public health outcomes. Food and beverage companies are actively reformulating products to align with consumer demand for healthier options, which supports saccharin adoption. The market also benefits from growing applications in oral care and pharmaceutical products. Consumer skepticism around artificial additives is countered by strict quality standards and EFSA approval, which enhance product trust. The region's mature food processing industry also accelerates market penetration for saccharin-based blends.

Germany Saccharin Market Trends

Germany's saccharin market is driven by its robust food and beverage sector and rising demand for low-calorie products. Leading German brands like Haribo and Ritter Sport increasingly utilize artificial sweeteners to meet health-conscious consumer demands. Additionally, Germany's pharmaceutical industry uses saccharin in syrups and tablets, further boosting demand. Regulatory support from the European Food Safety Authority (EFSA) continues to reinforce saccharin's safe use in multiple applications across the country.

- The United Kingdom's market benefits from growing concerns about obesity and sugar taxes. Major beverage manufacturers, including Coca-Cola UK and Britvic, have reformulated drinks using saccharin to reduce sugar content. The popularity of low-calorie products among UK consumers has accelerated saccharin use in diet beverages and tabletop sweeteners. Furthermore, government initiatives like the Soft Drinks Industry Levy are encouraging food producers to adopt alternative sweeteners like saccharin.

Product Type Insights

Sodium saccharin holds the dominant position in the global saccharin market due to its high solubility, intense sweetness, and broad applicability across industries. It is specifically favored in the food and beverage industry for its ease of formulation and stability in various pH levels. Its cost-effectiveness compared to natural sweeteners makes it a preferred choice for mass production. Additionally, its use in pharmaceuticals and personal care products further strengthens its market share, especially in regions with growing demand for low-calorie, sugar-free alternatives.

Form Insights

The powder form holds a significant share in the saccharin market due to its superior solubility, ease of handling, and convenience in blending with other ingredients. Powdered saccharin is widely used in the food, beverage, and pharmaceutical sectors, where precise dosage and uniform mixing are essential. Manufacturers prefer this form for its extended shelf life and storage efficiency. Its versatility across applications, including personal care and industrial uses, has contributed to its widespread adoption, particularly in bulk manufacturing and large-scale commercial formulations.

Applications Insights

The food & beverages segment leads the saccharin market, driven by the surging demand for sugar-free and low-calorie products. Saccharin is extensively used in soft drinks, candies, baked goods, and dairy products as a non-nutritive sweetener. Growing health awareness, rising cases of diabetes, and consumer preference for healthier alternatives have propelled its usage in this segment. Its cost-efficiency, heat stability, and high sweetness intensity further enhance its appeal to food manufacturers seeking to reduce sugar content without compromising taste.

Distribution Channel Insights

The offline distribution channel dominates the saccharin market owing to its strong presence in B2B transactions and bulk purchasing by manufacturers. Wholesalers, distributors, and specialty chemical suppliers play a key role in supplying saccharin to end-users across the food, pharmaceutical, and industrial sectors. Offline channels allow for product verification, direct negotiation, and timely delivery, which are crucial for large-scale buyers. Despite the rise of e-commerce, traditional brick-and-mortar distribution continues to lead due to established supply chains and trust-based relationships.

Company Market Share

Companies in the saccharin market are focusing on expanding production capacities, improving product purity, and investing in R&D to develop better-tasting and more stable formulations. Strategic collaborations with food and pharmaceutical manufacturers are also helping enhance market penetration. In addition, firms are targeting emerging markets through cost-effective solutions and regulatory compliance to boost global reach. Marketing efforts highlight saccharin's safety, affordability, and suitability for diabetic-friendly and calorie-conscious products.

- Kaifeng Xinghua Fine Chemical Ltd : Kaifeng Xinghua Fine Chemical Ltd. is a leading Chinese manufacturer specializing in the production of saccharin and other fine chemicals. Established in 1994 and based in Henan Province, the company has become one of the largest global exporters of saccharin, serving food, pharmaceutical, and industrial sectors. It emphasizes quality control, technological innovation, and compliance with international standards such as ISO and FDA regulations, enabling it to maintain a strong presence in both domestic and international markets.

List of Key and Emerging Players in Saccharin Market

- Kaifeng Xinghua Fine Chemical Ltd.

- Tianjin North Food Co., Ltd.

- PMC Specialties Group

- Shanghai Merry Yang Enterprise Co., Ltd.

- Salvi Chemical Industries Ltd.

- Vishnu Chemicals Ltd.

- Blue Circle Organics Pvt. Ltd.

- Jainex Speciality Chemicals

- Chempro Pharma Pvt. Ltd.

- Sodium Saccharin Co., Ltd. (China)

to learn more about this report Download Market Share

Recent Developments

- April 2025- Researchers at Brunel University London reported in Technology Networks that saccharin‑infused hydrogel wound dressings significantly outperformed standard silver‑based antimicrobial dressings in lab tests, reducing bacterial loads more effectively and disrupting drug‑resistant biofilms, signaling a promising new medical application for saccharin beyond its role as a sweetener.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 423.99 Million |

| Market Size in 2025 | USD 446.17 Million |

| Market Size in 2033 | USD 670.83 Million |

| CAGR | 5.23% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Form, By Application, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Saccharin Market Segments

By Product Type

- Sodium Saccharin

- Insoluble Saccharin

- Calcium Saccharin

By Form

- Powder

- Granular

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care

- Industrial Applications

- Others

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.