SAP S/4HANA Application Market Size, Share & Trends Analysis Report By Deployment Mode (On-Premises, Cloud-Based), By Application (Finance and Accounting, Sales and Distribution, Supply Chain Management, Manufacturing and Production Planning, Human Capital Management, Customer Relationship Management, Asset Management, Others), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (Manufacturing, Retail & Consumer Goods, Banking, Financial Services, and Insurance (BFSI), Healthcare, Telecom and IT, Energy and Utilities, Government and Public Sector, Automotive, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Sap S/4hana Application Market Size

The global SAP S/4HANA application market size was valued at USD 20.35 billion in 2024 and is estimated to grow from USD 22.41 billion in 2025 to reach USD 48.46 billion by 2033, growing at a CAGR of 10.12% during the forecast period (2025–2033).

A major driver of the global SAP S/4HANA application market is the impending end of support for legacy SAP ECC systems by 2027, prompting enterprises to migrate to S/4HANA for continuity and innovation. Additionally, stringent regulatory and compliance requirements across sectors like banking, healthcare, and manufacturing are encouraging companies to adopt modern ERP solutions with built-in governance capabilities. SAP S/4HANA offers real-time compliance tracking, streamlined reporting, and audit-friendly processes, making it an attractive solution.

Another factor driving growth is the pursuit of enhanced operational efficiency. Organizations are shifting to S/4HANA to replace outdated, fragmented systems with a unified platform that supports automation, transparency, and faster decision-making. Moreover, the availability of industry-specific templates and best practices is accelerating deployments. The growing global network of SAP-certified consultants and system integrators also facilitates smoother, faster implementations for enterprises.

Current Market Trend

Integration of Ai and Ml

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into SAP S/4HANA is revolutionizing enterprise operations by enabling real-time analytics, process automation, and predictive insights. These intelligent technologies help organizations optimize decision-making, reduce manual workloads, and improve compliance.

- A prime example is SAP’s latest innovation in regulatory technology, wherein SAP has integrated AI capabilities into its S/4HANA EHS and Product Compliance modules, launching in beta by August 2025. New features include AI-assisted permit management, automated compliance documentation, and incident reporting via conversational AI (Joule), aimed at streamlining regulatory processes for industries like chemicals, pharmaceuticals, and energy. This enhances safety, compliance, and operational efficiency.

Additionally, AI and ML are increasingly being used in supply chain forecasting, financial reconciliation, and customer service, areas where speed, accuracy, and adaptability are critical for modern enterprises.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 20.35 Billion |

| Estimated 2025 Value | USD 22.41 Billion |

| Projected 2033 Value | USD 48.46 Billion |

| CAGR (2025-2033) | 10.12% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | SAP SE, Accenture, Deloitte, Capgemini, IBM Corporation |

to learn more about this report Download Free Sample Report

Sap S/4hana Application Market Growth Factor

Enterprise Demand for Real-Time Data Processing

Enterprises today operate in a highly dynamic and data-driven environment, where timely insights are critical for strategic decision-making and operational efficiency. Traditional ERP systems often fall short in delivering the speed and flexibility required. This has led to a surge in demand for real-time integrated platforms.

- A Forrester report highlights that 60% of enterprises now prioritize real-time integrated platforms, signaling growing demand for instant data access. Supporting this, Gitnux states 73% of businesses rely on real-time analytics for strategic decision-making. SAP S/4HANA addresses this shift with its in-memory architecture, enabling seamless, real-time processing across core enterprise functions.

With capabilities like predictive analytics, real-time inventory management, and intelligent automation, SAP S/4HANA empowers businesses to act quickly on insights, improve productivity, and maintain a competitive edge in volatile markets.

Market Restraint

High Implementation and Migration Costs

One of the primary restraints in the global SAP S/4HANA application market is the high cost associated with implementation and migration. Transitioning from legacy systems to SAP S/4HANA requires significant investment in infrastructure, software licensing, consulting, and skilled personnel. For many small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting adoption.

Additionally, the migration process is complex, time-consuming, and often disruptive to existing operations, leading to productivity losses during the transition. Customization needs and integration with third-party applications further increase expenses. As a result, despite the platform's capabilities, the overall total cost of ownership remains a major barrier, especially for budget-constrained organizations.

Market Opportunity

Partnership Ecosystem Expansion

The growing ecosystem of partnerships between SAP and global technology providers is creating significant opportunities in the SAP S/4HANA application market. Strategic collaborations with hyperscalers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud are enabling broader deployment options and optimized performance for enterprises transitioning to the cloud. These alliances are crucial in simplifying migration, improving scalability, and integrating advanced technologies like AI and machine learning.

- For instance, in November 2024, SAP partnered with luxury retailer Chalhoub Group, adopting RISE with SAP and SAP S/4HANA on Microsoft Azure as part of the “Transform Chalhoub” initiative. This cloud deployment enables real-time data visibility, embedded Business AI, and unified retail and warehouse operations—driving efficiency, automation, and enhanced decision-making across the Middle East.

Such collaborations are expected to boost customer confidence, reduce adoption complexity, and expand market reach.

Regional Analysis

The North American region shows robust growth in SAP S/4HANA adoption driven by advanced digital infrastructure, widespread cloud readiness, and high enterprise IT spending. Organizations are modernizing legacy ERP systems to streamline operations, enhance cybersecurity, and meet evolving compliance requirements. A strong ecosystem of SAP-certified service providers is accelerating cloud migrations and integrations. Additionally, the increasing emphasis on AI-powered analytics, sustainability reporting, and real-time decision-making further supports the uptake of S/4HANA, especially among large enterprises undergoing digital transformation across various industry sectors.

United States Market Trends

The United States SAP S/4HANA application market is driven by large-scale digital transformation across sectors like manufacturing, retail, and healthcare. Companies such as Coca-Cola and Johnson & Johnson have migrated to S/4HANA for real-time analytics and process automation. Cloud-based deployments are gaining momentum, supported by partnerships with AWS and Microsoft Azure. U.S. enterprises prioritize agility and data compliance, boosting the adoption of intelligent ERP platforms.

Canada’s SAP S/4HANA application market is expanding due to increased government digitization initiatives and enterprise modernization efforts. Firms like Maple Leaf Foods and TransLink have implemented S/4HANA to improve financial transparency and supply chain visibility. Canadian businesses favor hybrid cloud environments, with rising demand for managed services from local SAP partners. Data privacy regulations like PIPEDA further push firms to upgrade to compliant and secure ERP platforms.

Asia-Pacific's Market Growth Factors

Asia Pacific is witnessing accelerated SAP S/4HANA adoption due to increasing investments in industrial automation, rising enterprise cloud migration, and growing awareness of real-time business intelligence. Companies are embracing digital ERP to optimize operations, enhance competitiveness, and align with global standards. The region benefits from expanding SAP partner networks and a surge in demand for scalable cloud-based solutions among midsized and large businesses. Additionally, rising investments in smart manufacturing and digital finance are creating strong use cases for S/4HANA applications across diverse verticals in the region.

Chinese Market Trends

China’s SAP S/4HANA application market is expanding rapidly as enterprises modernize operations amidst digital transformation initiatives. Major firms like Sinopec and Lenovo have adopted S/4HANA to streamline supply chains and gain real-time insights. Government support for intelligent manufacturing (e.g., “Made in China 2025”) further accelerates adoption. Cloud deployment is gaining traction through partnerships with Alibaba Cloud, enhancing scalability and localized compliance for Chinese enterprises.

India’s SAP S/4HANA application market is witnessing strong growth, driven by IT modernization across sectors like BFSI, retail, and manufacturing. Companies like Tata Motors and Aditya Birla Group have integrated S/4HANA to automate finance, inventory, and production systems. SAP’s collaboration with Indian IT giants like Infosys and TCS is boosting implementation. Additionally, growing cloud adoption, especially among SMEs, is expanding the market in Tier 2 and Tier 3 cities.

European Market Trends

Europe's SAP S/4HANA application market is expanding due to stringent data privacy laws, evolving regulatory compliance needs, and strong emphasis on enterprise digitalization. Organizations across sectors are prioritizing next-generation ERP systems to enhance transparency, ESG tracking, and supply chain resilience. Government incentives for digital modernization and increased collaboration between SAP and regional cloud providers are also fostering migration to cloud-based S/4HANA solutions. Moreover, Europe's growing focus on energy efficiency and sustainability is pushing businesses to leverage S/4HANA’s real-time data and predictive capabilities for smarter resource management.

Germany's Market Trends

Germany’s SAP S/4HANA application market is driven by strong digital transformation initiatives among manufacturing and automotive giants like Siemens and BMW. As SAP's home country, Germany sees high local adoption and partner support. Companies are migrating from SAP ECC to S/4HANA to comply with data regulations and enhance operational agility, supported by government-backed Industrie 4.0 policies promoting cloud-based ERP modernization.

The UK’s SAP S/4HANA application market is expanding due to increased adoption across financial services and retail sectors. Major firms like Unilever and HSBC are leveraging S/4HANA to improve decision-making and real-time data processing. Post-Brexit, companies seek enhanced compliance and flexibility, making SAP’s cloud solutions attractive. Moreover, a growing base of SAP-certified consultants and cloud hosting partnerships with AWS and Azure accelerate the market’s growth.

Deployment Mode Insights

The cloud-based segment is witnessing rapid growth in the SAP S/4HANA application market due to its scalability, cost-efficiency, and ease of deployment. Organizations are increasingly opting for cloud models to reduce infrastructure costs and improve accessibility across global operations. The flexibility offered by cloud-based SAP S/4HANA enables real-time data processing, seamless updates, and enhanced security. This deployment mode is particularly appealing to businesses undergoing digital transformation, especially those seeking agility and resilience in a competitive and fast-evolving technological landscape.

Application Insights

The finance and accounting segment holds a significant share in the SAP S/4HANA application market, driven by the need for accurate financial reporting, compliance, and efficient management of financial operations. SAP S/4HANA streamlines processes such as general ledger, accounts payable and receivable, and asset accounting through its in-memory computing capabilities. It provides real-time insights, automates routine tasks, and ensures regulatory compliance, making it indispensable for enterprises aiming to enhance financial transparency and performance through intelligent ERP solutions.

Enterprise Size Insights

Large enterprises dominate the SAP S/4HANA application market due to their complex operational structures and need for integrated, scalable ERP solutions. These organizations benefit from the comprehensive suite of features offered by SAP S/4HANA, including real-time analytics, supply chain integration, and financial management. With the capacity to invest in digital transformation initiatives, large enterprises are prioritizing the shift to S/4HANA to drive efficiency, innovation, and global standardization across business units, ensuring better decision-making and enhanced competitiveness.

Industry Vertical Insights

The BFSI segment is a major adopter of SAP S/4HANA applications, driven by the industry's need for high data accuracy, regulatory compliance, and risk management. S/4HANA enables BFSI institutions to streamline core financial processes, enhance customer experiences, and gain real-time visibility into operations. Features like predictive analytics, fraud detection, and automated reporting make it a vital tool for digital transformation in this sector. The platform supports agile banking models and fosters operational efficiency in an increasingly competitive landscape.

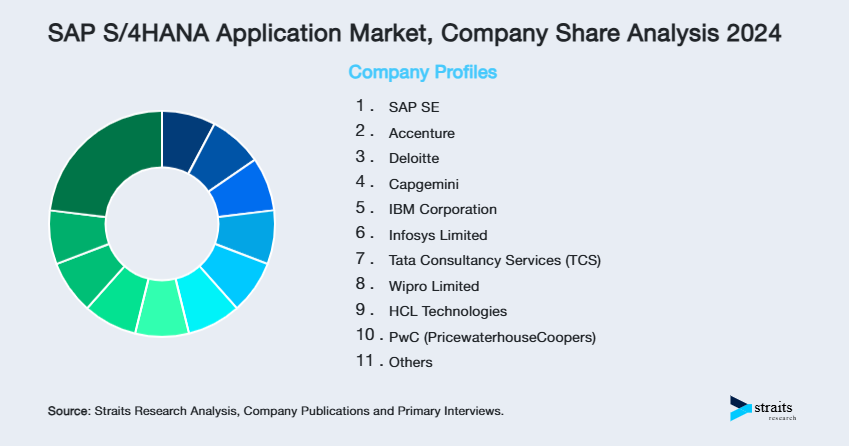

Company Market Share

Companies in the SAP S/4HANA application market are actively focusing on expanding their market share by enhancing cloud-based offerings, improving industry-specific functionalities, and integrating advanced technologies such as AI and machine learning. They are also investing in strategic partnerships with hyperscalers and IT service providers, streamlining migration tools, and offering flexible deployment models. Additionally, increased focus on customer training, support, and innovation labs helps drive client retention and global expansion.

Sap Se

SAP SE, headquartered in Walldorf, Germany, is a global leader in enterprise application software. Founded in 1972, SAP has pioneered ERP solutions and is the developer of SAP S/4HANA, its next-generation, in-memory ERP suite. With a customer base spanning over 180 countries, SAP supports businesses across industries in digital transformation. Through strong innovation, strategic cloud partnerships, and a vast partner ecosystem, SAP SE continues to drive the global adoption of intelligent ERP solutions like S/4HANA.

- In March 2025, SAP launched the SAP S/4HANA Cloud Private Edition 2023 FPS03 update, featuring advanced AI capabilities such as generative AI for journal uploads, predictive labor planning, AI-powered maintenance insights, and document extraction. The update also expanded the functionality of SAP’s AI assistant, Joule, enhancing user experience and operational efficiency across core processes.

List of Key and Emerging Players in SAP S/4HANA Application Market

- SAP SE

- Accenture

- Deloitte

- Capgemini

- IBM Corporation

- Infosys Limited

- Tata Consultancy Services (TCS)

- Wipro Limited

- HCL Technologies

- PwC (PricewaterhouseCoopers)

- Atos SE

- Cognizant Technology Solutions

to learn more about this report Download Market Share

Recent Developments

- June 2025- SAP has announced that its S/4HANA Cloud Public Edition tailored for retail, fashion, and vertical businesses will now be available in Indonesia, Malaysia, Philippines, South Korea, and Thailand later in 2025, expanding beyond its earlier rollout in Australia, India, New Zealand, and Singapore. This expansion supports omnichannel merchandising, store replenishment, and supply-chain optimization, enabling regional retailers to modernize their operations.

- April 2025- SAP Build is now fully included in SAP S/4HANA Cloud (both public and private editions) at no extra cost. Customers now gain built-in AI-powered, low‑code and code‑first tools, along with SAP HANA Cloud, to rapidly extend, automate, and personalise their ERP. This unifies development, removes licensing hurdles, and accelerates innovation.

- April 2025- SAP strengthened its position in Africa by partnering with AWS, Azure, and expanding Google Cloud, including a new region in Johannesburg. Their joint work under RISE with SAP supports regional ERP modernization and Business AI adoption.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 20.35 Billion |

| Market Size in 2025 | USD 22.41 Billion |

| Market Size in 2033 | USD 48.46 Billion |

| CAGR | 10.12% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Deployment Mode, By Application, By Enterprise Size, By Industry Vertical |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

SAP S/4HANA Application Market Segments

By Deployment Mode

- On-Premises

- Cloud-Based

By Application

- Finance and Accounting

- Sales and Distribution

- Supply Chain Management

- Manufacturing and Production Planning

- Human Capital Management

- Customer Relationship Management

- Asset Management

- Others

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- Manufacturing

- Retail & Consumer Goods

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Telecom and IT

- Energy and Utilities

- Government and Public Sector

- Automotive

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.