Savory Snacks Market Size, Share & Trends Analysis Report By Product Type (Potato Chips, Tortilla Chips, Extruded Snacks, Popcorn, Nuts and Seeds, Pretzels), By Flavor (Plain or Salted, Spicy, Cheese, Barbecue) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Savory Snacks Market Size

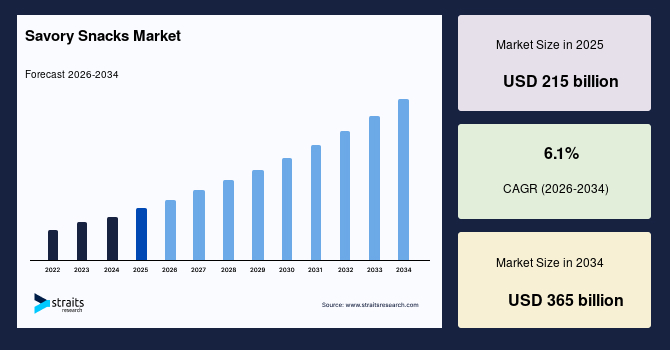

The savory snacks market size was valued at USD 215 billion in 2025 and is projected to grow from USD 228 billion in 2026 to USD 365 billion by 2034, growing at a CAGR of 6.10% during the forecast period (2026-2034), as per Straits Research Analysis.

Key Market Insights

- North America dominated the market with the largest share of 34% in 2025.

- The Asia Pacific region is expected to be the fastest-growing region in the market during the forecast period at a CAGR of 6.5%.

- By product type, the potato chips segment accounted for the largest share of 42% in 2025.

- By flavor, the spicy segment is anticipated to register the fastest CAGR of 6% during the forecast period.

- The US savory snacks market size was valued at USD 70 billion in 2025 and is projected to reach USD 73 billion in 2026.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 215 billion |

| Estimated 2026 Value | USD 228 billion |

| Projected 2034 Value | USD 365 billion |

| CAGR (2026-2034) | 6.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | PepsiCo, Mondelez International, Kellanova, The Kraft Heinz Company, General Mills |

to learn more about this report Download Free Sample Report

What are the Trends in Savory Snacks Market?

Consumers are adopting frequent, small-format eating habits due to hybrid work routines, commuting, and extended screen time, which increases reliance on portable and ready-to-eat savory snacks to fill hunger gaps throughout the day.

Rising health awareness is encouraging consumers to monitor calories, sodium, sugar, and trans fats, prompting manufacturers to reformulate products with cleaner labels, natural ingredients, and functional claims while maintaining taste and texture.

Premiumization drives manufacturers to introduce international flavors and limited-edition variants to attract urban and higher-income consumers. For instance, PepsiCo expanded premium offerings under Lay’s with gourmet flavor profiles to enhance value realization.

The growth of OTT platforms such as Netflix, Amazon Prime Video, and Disney+ increases in-home entertainment and binge-watching behavior, which raises the frequency of snack consumption across urban and emerging cities.

Retailers are expanding private-label portfolios at lower prices to compete directly with branded snacks. For example, Walmart strengthened its snack range under the Great Value brand as a value-driven alternative, intensifying price competition and shifting bargaining power toward retail chains.

What are the Driving Factors in Savory Snacks Market?

Urbanization and rising middle-class incomes increase consumer purchasing power, which strengthens demand for branded, packaged, and premium savory snacks. This encourages manufacturers to expand premium product lines and modern retail distribution.

Age-specific and lifestyle-oriented packaging strategies influence purchase decisions across demographics, as bright colors, cartoon characters, and collectible designs attract children, while clear labeling and easy-open formats appeal to older consumers. For instance, Kellogg's uses animated characters and engaging packaging formats to improve shelf visibility, resulting in higher consumption frequency and stronger cross-generational demand.

Limited-edition and culturally themed flavor launches stimulate novelty-driven purchases. Festive variants, regional blends, and fusion tastes create urgency and emotional engagement among consumers. This leads to short-term sales spikes and encourage manufacturers to adopt agile production and promotional planning.

Expansion of on-the-go retail channels such as convenience stores, vending machines, petrol stations, travel outlets, and workplace canteens improves product accessibility. This increases impulse purchases and consumption frequency and motivate suppliers to strengthen last-mile distribution networks and smaller pack formats.

Increased investment in digital marketing and celebrity endorsements enhances brand visibility and consumer engagement. Campaigns across platforms such as Instagram, YouTube, and TikTok amplify reach. Snack brands promote their products through collaborations with movie actors and sports stars, which increases penetration in rural and tier-2 markets and supports higher sales volumes in the savory snacks market.

Which Factors are Restraining Growth in Savory Snacks Markets?

Unpredictable weather patterns, climate change, and supply chain disruptions increase the volatility of key raw materials such as potatoes, corn, wheat, edible oils, nuts, and seeds. This raises input costs for manufacturers and compresses profit margins, leading to extended ROI delays.

Stringent front-of-pack labeling regulations enforced by authorities such as the Food Safety and Standards Authority of India (FSSAI) and the US Food and Drug Administration (FDA) increase transparency around salt, fat, sugar, and calorie content. This discourages the purchase of high-fat and high-sodium snacks and slows category growth, affecting high-volume sales of fat-induced snacks among the health-conscious consumer segment.

The rising popularity of low-carbohydrate diets such as keto and paleo, along with growing gym participation and calorie-tracking behavior among urban consumers, reduces demand for potato- and corn-based extruded snacks and limits volume expansion.

Global carbon neutrality initiatives promoted by organizations such as the United Nations push manufacturers to lower emissions from frying and processing operations, which increases capital expenditure on renewable energy and energy-efficient technologies and raises operational costs.

Trade disputes, sanctions, and tariff hikes, including broader US tariffs on imports from Mexico, Canada, and China, disrupt cross-border supply chains. This increases procurement costs for ingredients and packaging, which creates supply inconsistencies and affects pricing strategies.

What are the Emerging Opportunities in Savory Snacks Market?

Growing environmental awareness among Gen Z and millennial consumers opens avenues for snack manufacturers to position themselves as an eco-conscious brand by integrating recyclable, biodegradable, and reduced-plastic packaging solutions into their product lines. This strengthens brand loyalty and enables premium pricing. In the future, sustainability is expected to become a core competitive differentiator and drive long-term brand equity.

The increasing adoption of vegetarian, vegan, and flexitarian lifestyles offers lucrative opportunities for dietary diversification. Integrating plant-based ingredients such as chickpeas, lentils, peas, and quinoa into snack formulations expands the consumer base and supports product premiumization. Rising price sensitivity and the need for affordable indulgence act as a trigger for low-unit pack formats. Manufacturers integrate small packs and single-serve sachets into distribution strategies, as demonstrated by companies such as ITC Limited (Bingo!) and PepsiCo (Lay’s, Kurkure). This increases product accessibility and trial rates and helps companies bank on the sachet manufacturing segment to reach a remote and diversified consumer base.

Rising culture of at-home entertainment and sports viewing opens avenues for bundled consumption offerings, strategic collaborations with beverage brands, and combo packs for movie nights and sporting events. This increases overall basket size and cross-category partnerships to improve revenue per consumer for occasion-based purchases.

Regional Analysis

North America dominated the savory snacks market with the largest share of 34% in 2025. The growth is supported by strong consumption patterns and established brand presence. Consumers in the US and Canada have one of the highest per capita snack consumption rates globally. The region also has a presence of major snack manufacturers who drive innovations and aggressive marketing. Busy lifestyles and on-the-go consumption habits increase demand for convenient, ready-to-eat snack options, which supports steady volume growth across urban and suburban households. Events such as Super Bowl Week also drive high-volume snack sales in the US.

Asia Pacific Savory Snacks Market

The Asia Pacific region is expected to be the fastest-growing region in the market during the forecast period at a CAGR of 6.5%. This growth can be attributed to rising urbanization, as those who live in urban areas tend to snack more compared to consumers in rural areas. Migration of populations to urban areas has increased exposure to modern retail formats, convenience foods, and Western eating habits. Strong retail infrastructure, including supermarkets, convenience outlets, and e-commerce platforms, ensures high product visibility and easy accessibility, which sustains repeat purchases and impulse buying. Flavor localization strategies that incorporate regional tastes, such as spicy, masala, seaweed, and sea food flavors, improve consumer acceptance and brand loyalty.

Europe Savory Snacks Market

The Europe market is experiencing strong growth due to health-focused innovation and convenience demand. European consumers are highly health-conscious, thereby increasing demand for baked and air-popped snacks, organic & non-GMO variants, and gluten-free and plant-based options. This is further supported by regulatory guidance from the European Food Safety Authority (EFSA), which sets science-based standards on food safety, additives, contaminants, labeling, and nutrition claims. EFSA pushes manufacturers to reformulate products and adopt safer processing methods that build consumer trust in packaged snacks and encourage innovation in cleaner, healthier formulations.

Latin America Savory Snacks Market

The Latin America (LATAM) market is growing due to rising disposable income and strong retail expansion. Countries like Brazil and Mexico have seen steady middle-class expansion in recent years. Retail chains such as Grupo Bimbo (regional packaged foods leader) and large retail networks are also increasing distribution into tier-2 and tier-3 cities. Strong domestic agricultural production of corn and potatoes in countries such as Brazil and Argentina ensures steady raw material availability, which reduces import dependence and supports competitive pricing for corn-based and fried snacks. Large-scale sports culture, particularly football events linked to regional leagues and global tournaments, drives spikes in snack consumption during match seasons.

Middle East and Africa Savory Snacks Market

The Middle East and Africa savory snacks market growth is propelled by rising digital penetration and expansion of the tourism sector. Online platforms and quick-commerce services are expanding rapidly across the UAE, Saudi Arabia, and South Africa. Cities like Dubai and Doha also benefit from strong tourism inflows. A large youth base in countries such as Saudi Arabia, the United Arab Emirates, South Africa, and Nigeria increases demand for convenient and affordable packaged snacks, supporting steady volume growth.

What are the Key Segments in Savory Snacks Market?

|

SEGMENT |

INCLUSION |

DOMINANT SEGMENT |

SHARE OF DOMINANT SEGMENT, 2025 |

|---|---|---|---|

|

Product Type |

|

Potato Chips |

42% |

|

Flavor |

|

Plain or Salted |

33% |

|

Region |

|

North America |

34% |

Competitive Landscape

The savory snacks market is moderately competitive, with a mix of global multinational food companies and strong regional players. Competitive dynamics are influenced by product portfolio breadth, flavor innovation capabilities, distribution and supply chain efficiency, and the ability to cater to diverse consumer preferences, including health-oriented, premium, and regional taste profiles. Key participants compete based on their capacity to deliver varied product formats, multi-flavor portfolios, and packaging solutions tailored for convenience, sustainability, and portion control. Emerging trends in the savory snacks market are health-focused innovations, eco-friendly packaging, and functional snacking.

List of Key and Emerging Players in Savory Snacks Market

- PepsiCo

- Mondelez International

- Kellanova

- The Kraft Heinz Company

- General Mills

- WellBe Foods

- Intersnack Group

- ITC Limited

- Conagra Brands

- Nestle

- Mars Incorporated

- Grupo Bimbo

- The Hershey Company

- YUMBO

- Airly Foods

- HIPPEAS

- Biena Snacks

- The Good Crisp Company

- Cob Foods

- Too Yumm!

- Balaji Wafers

- Prataap Snacks (Yellow Diamond)

Latest News on Key and Emerging Players

|

TIMELINE |

COMPANY |

DEVELOPMENT |

|---|---|---|

|

January 2026 |

PepsiCo |

PepsiCo collaborated with Siemens and NVIDIA to transform plant and supply chain operations through advanced digital twin technology and AI. |

|

December 2025 |

PepsiCo |

PepsiCo partnered with the Mercedes-AMG PETRONAS F1 Team to penetrate the global sports market and, ultimately, the sports-viewing consumer base. |

|

November 2025 |

PepsiCo |

PepsiCo India launched Red Rock Deli, a gourmet chips brand, in the Indian market. |

|

November 2025 |

The Hershey Company |

The Hershey Company acquired LesserEvil to broaden its portfolio for savory snacks. |

|

October 2025 |

WellBe Foods |

WellBe Foods launched a new vacuum-cooked snacks range and 14 innovative healthy snack products. |

Source: Secondary Research

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 215 billion |

| Market Size in 2026 | USD 228 billion |

| Market Size in 2034 | USD 365 billion |

| CAGR | 6.1% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Flavor |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Savory Snacks Market Segments

By Product Type

- Potato Chips

- Tortilla Chips

- Extruded Snacks

- Popcorn

- Nuts and Seeds

- Pretzels

By Flavor

- Plain or Salted

- Spicy

- Cheese

- Barbecue

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Tejas Zamde

Research Associate

Tejas Zamde is a Research Associate with 2 years of experience in market research. He specializes in analyzing industry trends, assessing competitive landscapes, and providing actionable insights to support strategic business decisions. Tejas’s strong analytical skills and detail-oriented approach help organizations navigate evolving markets, identify growth opportunities, and strengthen their competitive advantage.