Seed Coating Market Size, Share & Trends Analysis Report By Product Type (Film coating, Polymer/powder coating, Pelleting, Encrusting, Priming and pelleting-plus, Dry seed dressings), By Coating Function (Protective, Nutrient and micronutrient, Biologicals and microbial inoculants, Enhancement and flow, Smart/controlled-release), By Crop Type (Cereals and grains, Oilseeds and pulses, Vegetables and horticulture, Turf, ornamentals and seed mixtures, Speciality seeds), By Distribution Channel (Seed companies and plant breeders, Large commercial farms and cooperatives, Agri-dealers and distributors, E-commerce and digital procurement, Contract seed treaters and toll coaters) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Seed Coating Market Overview

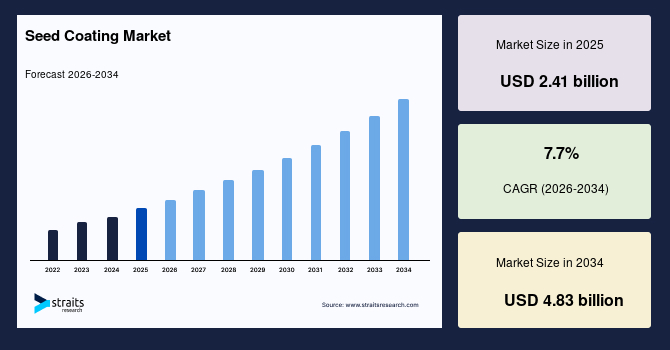

The global seed coating market is valued at USD 2.41 billion in 2025 and is projected to reach USD 4.83 billion by 2034, expanding at a CAGR of 7.7% during the forecast period. The growth is driven by the rising adoption of high-value seeds, increasing focus on crop resilience, advancements in agricultural inputs, and the global shift toward sustainable, precision-based farming practices.

Key Market Trends & Insights

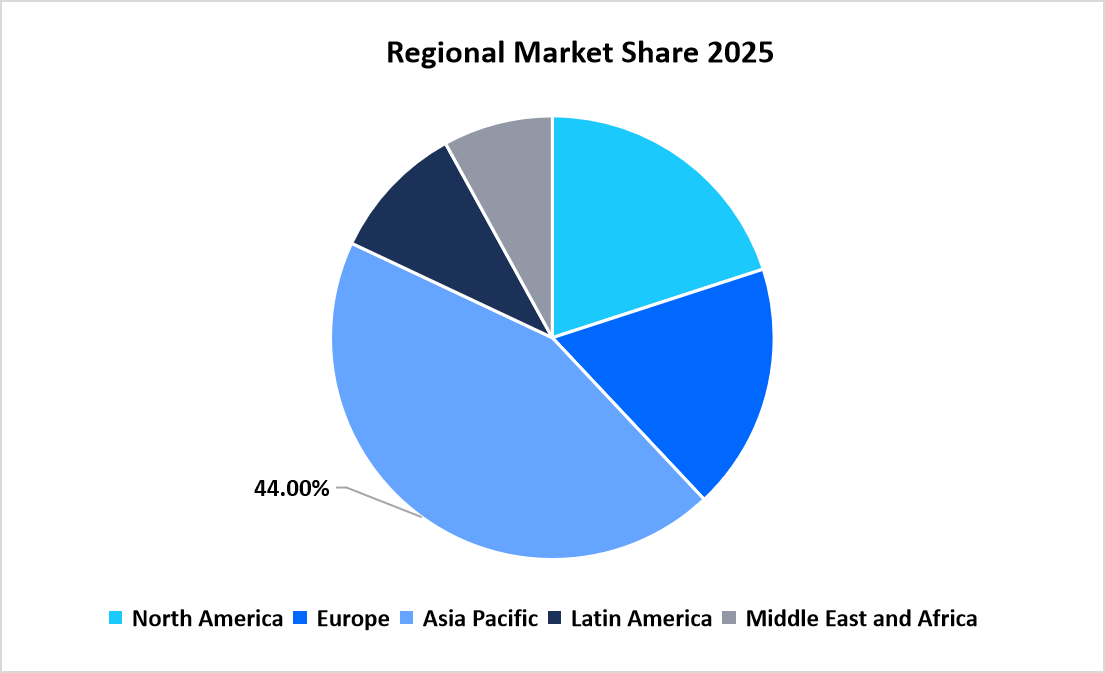

- Asia Pacific dominated the market with a revenue share of 44% in 2025.

- Latin America is anticipated to grow at the fastest CAGR of 9.0% during the forecast period.

- Based on Product Type, the Film Coating segment held the highest market share of 30% in 2025.

- By Coating Function, the Biological and microbial seed coatings segment is estimated to register the fastest CAGR growth of 16%.

- By Crop Type, the Cereals and grains dominated the market in 2025 with a revenue share of 38%.

- Based on the distribution channel, the Digital procurement channels segment is projected to register the fastest CAGR of 18% during the forecast period.

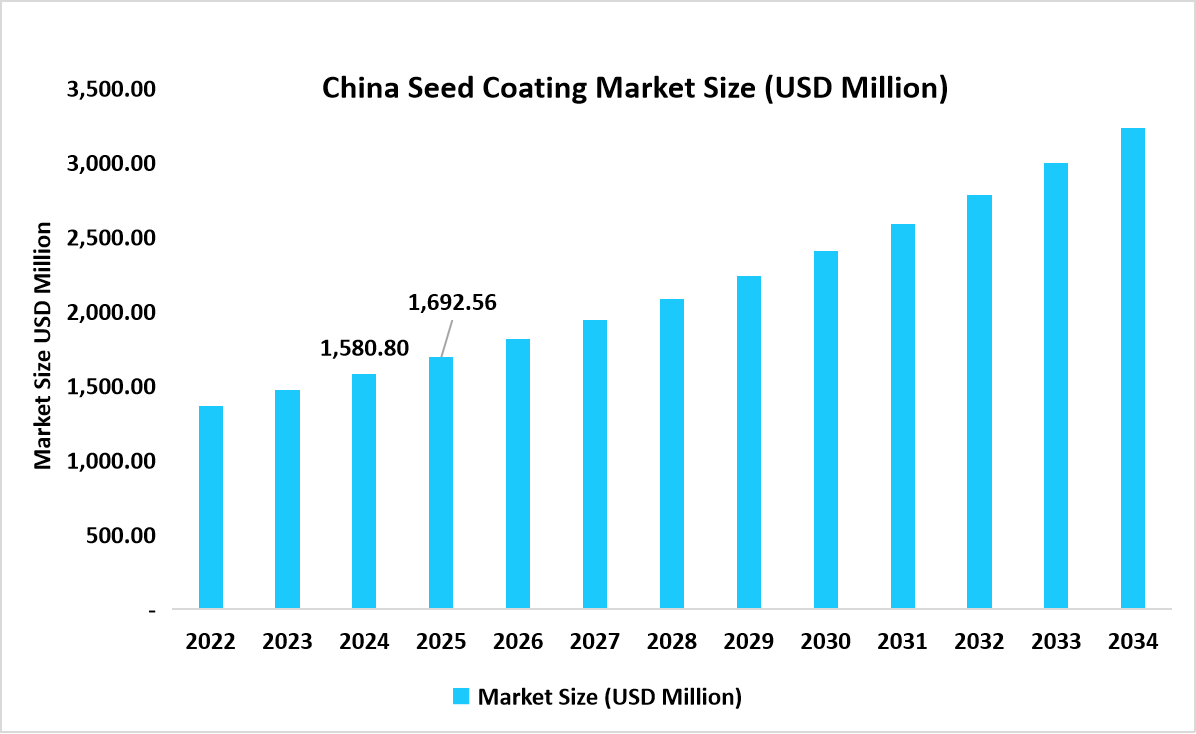

- China dominates the seed coating market, valued at USD 1,580.80 million in 2024 and reaching USD 1,692.56 million in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 2.41 billion

- 2034 Projected Market Size: USD 4.83 billion

- CAGR (2026-2034): 7.7%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

The seed coating market covers polymer coatings, film coatings, pelleting materials, colourants, binders, and active ingredient formulations designed for crops across row farming, horticulture, vegetables, and speciality agriculture. Seed coating enhances seed performance by improving germination, protecting seeds from pests and diseases, and enabling precise delivery of micronutrients and biologicals. Market expansion is supported by farmers’ demand for uniform crop establishment, the rise of hybrid and genetically improved seeds, and innovation in biological and environmentally compliant coatings that target both performance and sustainability.

Market Trends

Advanced Biological and Bio-stimulant Coatings

The integration of biological agents such as beneficial microbes, bio-stimulants, and bio-fungicides into seed coating formulations is a major trend reshaping the seed coating market. Biological coatings enhance nutrient uptake, improve early plant vigour, and help crops tolerate abiotic stress caused by drought, salinity, and irregular rainfall. These attributes are increasingly critical under changing climatic conditions. As agriculture transitions toward regenerative and climate-smart practices, biological seed coatings address both productivity and environmental goals, reinforcing their role as a key driver of growth across global cropping systems.

Precision Agriculture and High-Value Hybrid Seeds

The widespread adoption of precision agriculture is increasing demand for seed coatings that support accuracy, uniformity, and operational efficiency. Modern farming systems, which utilise GPS-guided planting and variable-rate technologies, require coated seeds that flow consistently through equipment and ensure precise placement. This trend is further reinforced by the growing use of hybrid, biotech, and premium vegetable seeds, which are high-value inputs requiring protection against mechanical damage and uneven germination. As precision farming becomes more prevalent, high-performance seed coatings remain essential for maximising returns on investment in advanced seed technologies.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 2.41 billion |

| Estimated 2026 Value | USD 2.59 billion |

| Projected 2034 Value | USD 4.83 billion |

| CAGR (2026-2034) | 7.7% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | Latin America |

| Key Market Players | BASF SE, Bayer CropScience, Syngenta AG, Croda International plc, Clariant AG |

to learn more about this report Download Free Sample Report

Market Drivers

Increasing Demand for High-Quality and Stress-Tolerant Seeds

Seed coating is increasingly essential as farmers adopt high-quality seeds designed for improved yield and resilience. Rising climate variability, including heat stress, water scarcity, and soil degradation, has intensified demand for coatings that support germination under challenging conditions. Coatings enriched with micronutrients, biological additives, and organic stimulants provide early metabolic support, improving seedling establishment and reducing crop failure risks. As growers seek to protect investments in premium seeds and minimise replanting costs, coated seeds offer a practical solution to improve yield stability. This growing reliance on performance-enhancing seed treatments sustains long-term demand for advanced seed coating technologies.

Uptake of Sustainable and Environmental Compliance Solutions

Stricter environmental regulations and growing public concern over chemical residues are accelerating the adoption of sustainable seed coating solutions. Governments are increasingly restricting pesticide usage and soil contamination, prompting manufacturers to develop eco-friendly coatings that reduce chemical load and dust emissions. Biodegradable binders, low-toxicity formulations, and biological alternatives are gaining acceptance as compliant solutions that maintain agronomic performance. As environmental compliance becomes integral to agricultural input selection, demand for responsible and low-impact seed coating technologies continues to rise across both developed and emerging markets.

Market Restraint

High Production Costs and Complex Formulation Requirements

The production of advanced seed coatings involves sophisticated polymers, biological agents, and multi-layer formulations, significantly increasing manufacturing costs. Biological coatings require controlled conditions to maintain microbial viability, adding further complexity. These higher costs are often passed on to farmers, limiting adoption in price-sensitive regions despite long-term agronomic benefits. Additionally, volatility in raw material prices can disrupt production planning and constrain product availability. As affordability remains a key consideration for smallholder farmers, high production and formulation costs continue to moderate market penetration in developing agricultural economies.

Market Opportunity

Growth of High-Value Vegetable, Horticulture, and Hybrid Seed Markets

The expansion of vegetable and horticulture cultivation is creating new opportunities for seed coating providers. High-value seeds used in vegetables, leafy greens, and speciality crops benefit significantly from pelleting and film coating due to their small size and sensitivity. Precision-coated seeds improve mechanical sowing efficiency, enhance emergence uniformity, and reduce wastage, making them essential in greenhouse and controlled-environment agriculture. As urbanisation, protected cultivation, and demand for fresh produce increase, seed coatings tailored to crop-specific requirements will see rising adoption, opening lucrative growth avenues for technology-driven suppliers.

Regional Analysis

According to Straits Research, Asia Pacific dominated the market in 2025, accounting for 44% market share, driven by extensive cultivation areas, rapid greenhouse expansion, and increasing mechanisation. Farmers adopt coated seeds to enhance germination, conserve resources, and achieve faster crop establishment, particularly for vegetables and hybrid crops. Strong local manufacturing capacity and access to polymers help keep costs competitive, supporting the broad adoption of these products.

China is the primary market in the Asia Pacific, supported by large-scale horticulture, concentrated seed production clusters, and rising mechanised planting. Domestic seed companies increasingly offer coated and pelleted seeds for both local consumption and export markets. Improved rural logistics and digital procurement platforms are expanding access to value-added seed products, thereby enhancing agricultural productivity.

Latin America Seed Coating Market Insights

Latin America is emerging as the fastest-growing region with a CAGR of 9.0% from 2026 to 2034, driven by expanding export horticulture, protected cultivation, and increasing farm commercialisation. Growers producing berries, tomatoes, and speciality vegetables rely on coated seeds to ensure uniformity, reduce replant risk, and meet residue standards in destination markets. Investments in greenhouse infrastructure, improved logistics, and traceability requirements support demand for pelleted and biologically enhanced seeds. As export-oriented production expands, growers are increasingly accepting premium pricing for coatings that enhance consistency and improve market access.

Brazil leads the Latin American market due to its large-scale agriculture, diverse climates, and growing horticultural exports. Farmers adopt coated seeds to secure reliable stands under variable conditions and comply with international quality standards. Domestic seed companies and toll coaters have scaled film coating and pelleting for both row crops and vegetables, positioning Brazil as the region’s primary seed coating hub.

Source: Straits Research

North America Market Insights

North America represents a mature and high-value seed coating market driven by mechanised agriculture, widespread precision planting, and strong commercial seed companies. Growers prioritise coated seeds that deliver uniform emergence, smooth planter flow, and reduced dust emissions, particularly for corn, soybean, and speciality crops. A well-defined regulatory environment and sustained investment in R&D support continued adoption of both chemical protective coatings and biological solutions. The region also benefits from advanced toll-coating infrastructure and strong collaboration between seed companies and technology providers, ensuring consistent performance, regulatory compliance, and product innovation.

The U.S. dominates the North American market due to its extensive hybrid seed usage, large-scale farming operations, and early adoption of mechanised sowing technologies. High planting speeds and tight planting windows drive demand for film coatings, pelleting, and precision application systems that ensure consistent stands. Ongoing innovation programs focused on stewardship, dust reduction, and performance optimisation reinforce the U.S. position as a technology and volume leader in seed coatings.

Europe Market Insights

Europe’s seed coating market is shaped by strict environmental regulations, strong traceability requirements, and intensive field and greenhouse cultivation. Manufacturers focus on developing low-dust formulations, reducing active ingredient loads, utilising biodegradable binders, and implementing controlled-release technologies to meet regulatory and retailer standards. The region’s emphasis on sustainability and integrated pest management drives innovation, positioning Europe as a leading market for compliant, premium, and environmentally responsible seed coating solutions.

France is a key European market supported by diverse cropping systems, a strong seed-breeding sector, and active vegetable and export clusters. The country’s focus on environmental stewardship and integrated pest management encourages adoption of reduced-residue and biologically enhanced coatings. A well-developed network of contract coaters and specialised seed firms enables rapid scaling of innovations, sustaining steady demand for premium and performance-oriented seed coatings.

Middle East & Africa Market Insights

The Middle East & Africa are a smaller but strategically important market, driven by water scarcity, protected agriculture, and export-focused production zones. In the Gulf, greenhouse investments favour coated seeds that support rapid emergence and efficient resource use. In parts of Africa, commercial farms adopt pelleted and primed seeds to reduce labour and improve stand establishment. Adoption remains uneven, with premium demand concentrated in wealthier regions and export hubs, while price sensitivity limits uptake among smallholders.

The UAE is the leading market in the region due to concentrated investment in greenhouse farming, water-efficient technologies, and high-value vegetable production. Government-supported clusters and investor-backed farms rely on coated and pelleted seeds to maximise yields and shorten crop cycles. These dynamics make the UAE a key entry point for suppliers offering advanced and high-performance seed coating technologies.

Product Type Insights

According to Straits Research, Film coating dominated the market with a revenue share of 30% in 2025, due to its cost efficiency, thin application, and ability to add multiple functions without increasing seed size. It improves flowability, enables colour coding, and provides basic protection while maintaining planter singulation in mechanised farming. Seed manufacturers prefer film coatings because they work well with water-based binders and biological additives, simplifying production. Their regulatory compatibility and suitability across various crops, including cereals, oilseeds, and many vegetables, ensure wide adoption.

Priming and Pelleting-Plus is the fastest-growing product type, exhibiting a 10.0% CAGR, due to its ability to enhance germination speed, uniform emergence, and sowing precision. These benefits are particularly valuable for high-value hybrid and vegetable seeds, where the risk of replanting is costly. Growers in protected cultivation increasingly prefer pelleted seeds for their reliable singulation and reduced labour, allowing this segment to gain share from basic coating solutions steadily.

Coating Function Insights

Protective chemical coatings hold the largest market share of 35%. They directly reduce early-stage crop losses caused by soilborne diseases and pests. Seed companies widely integrate low-dose fungicides and insecticides into coatings to ensure strong stand establishment and predictable yields. These formulations are well-tested, standardised, and trusted by large commercial growers.

Biological and microbial seed coatings are expanding rapidly at a CAGR of 16% as agriculture shifts toward sustainability and reduced chemical inputs. These coatings support nutrient uptake, stress tolerance, and disease suppression, attracting adoption in vegetables, pulses, and horticulture crops. Demand is reinforced by the growth of organic farming, supportive policies, and the potential for premium pricing. As performance data strengthens and supply chains mature, biological coatings are outpacing traditional chemical solutions in growth.

Crop Type Insights

Cereals and grains are the largest segment, with a market share of 38% in 2025, due to their vast cultivation areas and large seed volumes. Coatings in this segment focus on flowability, colour identification, and chemical protection. Cost-efficient film coatings and rotary production methods are well-suited for large-scale processing. Although per-seed value is lower, aggregate demand and consistent planting cycles keep cereals and grains the largest revenue contributor.

Vegetable and horticulture seeds are the fastest-growing crop segment, exhibiting a CAGR of 10% due to their high value and sensitivity. Pelleting, priming, and biological coatings improve emergence uniformity, support mechanised sowing, and reduce labour needs. Protected cultivation and greenhouse farming increasingly rely on coated seeds to meet quality and export standards.

Source: Straits Research

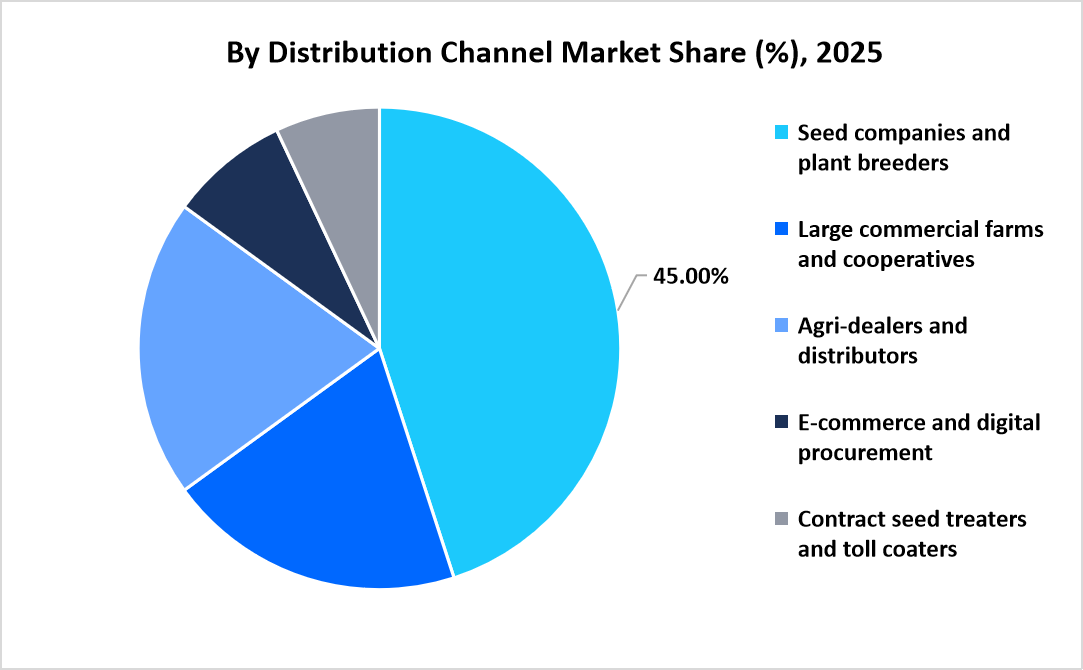

Distribution Channel Insights

Seed companies and breeders dominate the market, accounting for a 45% revenue share, as they sell coated seeds as finished, branded products. They control coating specifications to protect intellectual property and ensure consistent field performance. Their scale supports investment in advanced coating technologies, quality assurance, and regulatory compliance. By integrating R&D, marketing, and distribution, these firms capture added value from coatings, ensuring their continued dominance as the primary end users.

Digital procurement channels are growing at the fastest rate, with a CAGR of 18%, as farmers increasingly purchase coated and treated seeds online. E-commerce platforms enable small-volume purchases, particularly of pelleted and primed vegetable seeds, while offering traceability and technical guidance. Improved rural connectivity and demand for convenience are accelerating adoption. Digital marketplaces also support niche and biologically coated seed suppliers, expanding market access.

Competitive Landscape

The seed coating market is moderately fragmented, comprising global agrochemical leaders, specialised coating material manufacturers, and emerging sustainability-focused innovators. Established players dominate the market through scale, R&D capabilities, and global distribution, while mid-tier and newer firms compete on ecological compliance, biodegradable materials, and niche biological formulations. Market competition is shaped by rising sustainability requirements, regulatory pressure on residues, growth in emerging regions, and increased use of toll-coating and digital procurement channels by seed companies.

BASF SE: A Market Leader

BASF SE is a leading global player leveraging deep expertise in polymers and agricultural chemistry to deliver comprehensive seed coating solutions. Its modular platforms support both conventional chemical coatings and emerging bio-based or reduced-residue formulations, enabling crop- and region-specific customisation. BASF’s scale, regulatory strength, and global reach appeal to large seed companies seeking reliability and compliance. By integrating protection, flow-enhancing polymers, and application systems, BASF positions itself as a full-service provider across major agricultural markets.

List of Key and Emerging Players in Seed Coating Market

- BASF SE

- Bayer CropScience

- Syngenta AG

- Croda International plc

- Clariant AG

- Germains Seed Technology

- Sensient Technologies Corporation

- Covestro AG

- BrettYoung Seeds Limited

- Precision Laboratories LLC

- Milliken & Company

- Solvay S.A.

- Chromatech Incorporated

- DSM‑Amulix

- Universal Coating Systems

- Centor Group

- Seed Coating Solutions

- Chromaflo Technologies

- Buhler Group

- Incotec Group BV

Strategic Initiatives

- November 2025 - Precision Laboratories LLC highlighted the role of its oil-based adjuvants in fall burndown applications, signalling a continued focus on tailored, speciality chemistries that enhance the performance and longevity of seed-applied technologies for North American commercial farms.

- August 2025 - Germains reported on-farm, in-field trials for its Xbeet enrich 400 sugar beet treatment. This technology utilises beneficial microbes and specialised formulations to enhance germination and early growth under challenging conditions, highlighting the trend of integrating biologicals into coatings.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 2.41 billion |

| Market Size in 2026 | USD 2.59 billion |

| Market Size in 2034 | USD 4.83 billion |

| CAGR | 7.7% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Coating Function, By Crop Type, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Seed Coating Market Segments

By Product Type

- Film coating

- Polymer/powder coating

- Pelleting

- Encrusting

- Priming and pelleting-plus

- Dry seed dressings

By Coating Function

- Protective

- Nutrient and micronutrient

- Biologicals and microbial inoculants

- Enhancement and flow

- Smart/controlled-release

By Crop Type

- Cereals and grains

- Oilseeds and pulses

- Vegetables and horticulture

- Turf, ornamentals and seed mixtures

- Speciality seeds

By Distribution Channel

- Seed companies and plant breeders

- Large commercial farms and cooperatives

- Agri-dealers and distributors

- E-commerce and digital procurement

- Contract seed treaters and toll coaters

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.