Servers Market Size, Share & Trends Analysis Report By Product (Rack, Blade, Tower, Micro, Open Compute Project), By Enterprise Size (Micro, Small, Medium, Large), By Channel (Direct, Reseller, Systems integrator, Others), By End-Use (IT & Telecom, BFSI, Government & Defense, Healthcare, Energy, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Servers Market Size

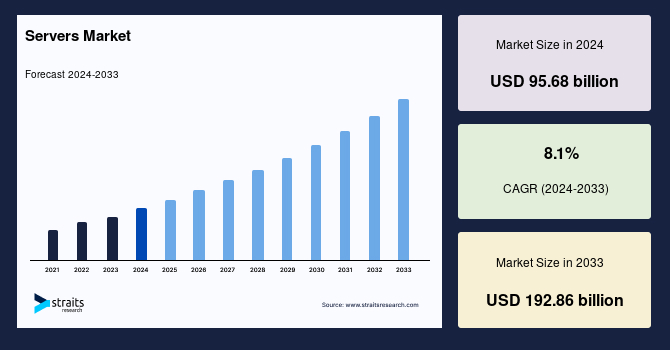

The global servers market size was worth USD 95.68 billion in 2024 and is estimated to reach an expected value of USD 103.43 billion in 2025 to USD 192.86 billion by 2033, growing at a CAGR of 8.1% during the forecast period (2025-2033).

A serveris a powerful computer or system that provides services, resources, or data to other computers, known as clients, over a network. Servers can be hardware- or software-based and are designed to manage processes and simultaneously store data for multiple users. They play a central role in IT infrastructure, enabling communication, data sharing, and resource management across organizations and the Internet. The primary purpose of servers is to manage network resources and provide services to client devices. These services can vary depending on the type of server and the specific requirements of users or organizations.

The global servers market is moving with accelerating due to growing demand in a wide variety of sectors. This market has vast potential to grow with increasing demands for digital transformation, with a focus on industries such as artificial intelligence applications, machine learning, and data processing. Server technology is evolving at pace due to developments in cloud computing, edge computing, and hybrid models, as leading players add newer products with expanded capabilities to their portfolios.

Furthermore, with the increasing complexity of enterprise IT needs, the global servers market is shifting toward scalable, energy-efficient, and AI-optimized solutions. The demand for customized server solutions catering to specific industries, such as healthcare and telecom, is also on the rise. Major players like Dell, HPE, and IBM continue introducing new products and partnerships, positioning themselves for long-term market dominance.

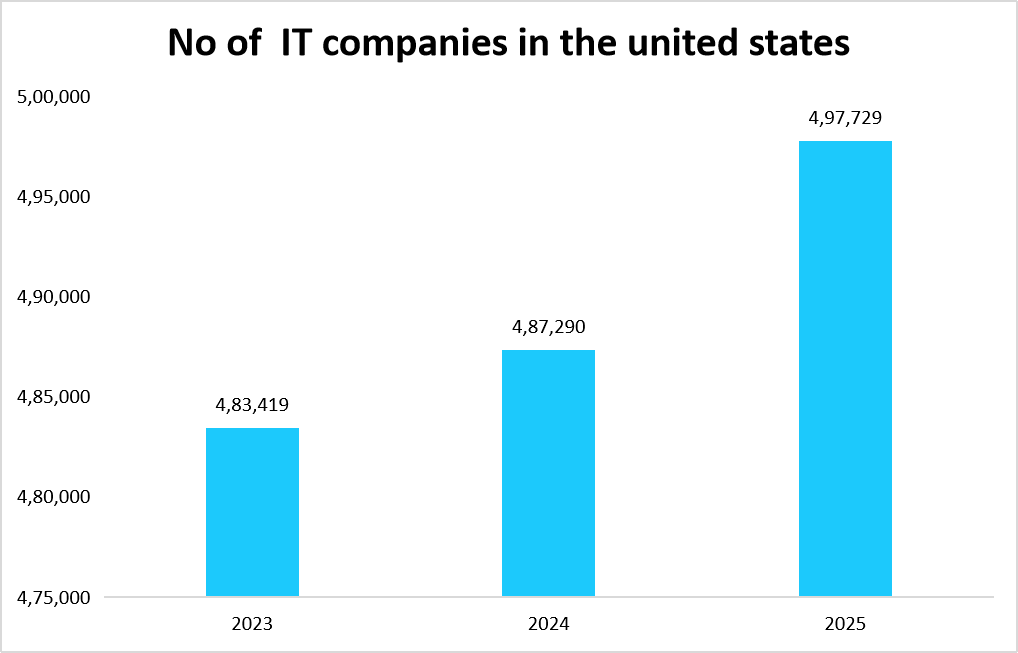

The below shows a steady increase in IT companies in the United States, growing from 483,419 in 2023 to an expected 497,729 by 2025. As more companies emerge, the demand for robust server solutions to handle data storage, computing power, and cloud services will continue to rise, creating a more significant opportunity for server providers.

Source: IBISWorld, Straits Research

Latest Market Trend

Growing Demand for Cloud Servers

Cloud-based server demands are evolving fast as the world changes into more cloud-based systems. Cloud servers offer greater flexibility, scalability, and cost savings over physical-based servers. Due to these facts, companies have realized the need for managed cloud services that can simplify operations and eliminate the need for on-site infrastructure maintenance. This enables companies to scale resources quite effortlessly and enhances their operational efficiency.

- For instance, AWS posted USD 24.2 billion in revenue for Q4 2023, a 13% year-over-year increase. The growth in cloud infrastructure is thus fueling the demand for cloud servers as companies opt for managed cloud services instead of maintaining physical servers.

In addition, edge computing is transforming the server market because data processing is no longer centralized in cloud data centers but closer to the source. The growth of IoT devices, autonomous systems, and real-time applications means more data can be handled efficiently with edge computing without burdening cloud infrastructure. Moreover, it also enhances operational efficiency across industries, including manufacturing, healthcare, and telecommunications, through localized computing power.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 95.68 Billion |

| Estimated 2025 Value | USD 103.43 Billion |

| Projected 2033 Value | USD 192.86 Billion |

| CAGR (2025-2033) | 8.1% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Dell, Inc., Hewlett Packard Enterprise Development LP, Nvidia Corporation, IBM Corporation, Hitachi Vantara, LLC |

to learn more about this report Download Free Sample Report

Servers Market Growth Factors

Integration of Artificial Intelligence (ai) and Advanced Technologies

The increasing power of artificial intelligence and other advanced technologies drives the global market. AI applications will expand further with increasing demands for specialized servers to support heavy computational powers and processing needs from AI algorithms and machine learning models. These new demands on technologies require superior processing ability, memory, and storage because they require large amounts of data management and complex computations.

- For instance,according to the Economic Times, in 2024, Dell Technologies reported a significant increase in AI-optimized server demand, reaching USD 3.2 billion in a quarter, marking a 23% sequential growth.

Increased Cloud Adoption

The increase in dependence on cloud adoption is a driving factor for expanding the global market. Businesses are increasingly moving their operations to the cloud, so the requirement for cloud infrastructure and servers is rising. Cloud adoption gives firms more flexibility, cost efficiency, and better scalability, such that they can manage and process unlimited data without needing on-premises servers.

- For instance, the European Commission has announced that 45.2% of EU enterprises bought cloud computing services in 2023, an increase of 4.2 percentage points compared to 2021. This growth is seen as a trend in industries adopting cloud-based technologies.

Market Restraint

High Energy Consumption and Environmental Concerns

A significant impediment in the global market relates to high power consumption and the corresponding environmental impact caused by data centers. Large-scale data centers consume substantial electricity for continuous operation and cooling, increasing operational costs and carbon footprint. As demand for servers rises, these environmental concerns are further exacerbated. This has led to increased pressure on industries and governments to develop more sustainable solutions that reduce the carbon footprint of IT infrastructure while maintaining high performance.

Market Opportunity

Development of Energy-Efficient Cooling Solutions

The need for energy-efficient cooling solutions in data centers represents a key growth factor in the global market. Data centers are significant energy consumers, and innovative cooling technologies help reduce operational costs while mitigating environmental impact. As global data infrastructure expands, high-performance solutions that consume less energy are in increasing demand. Innovations in energy-efficient cooling promote sustainability and help meet regulatory standards and market demands for greener data centers.

- For instance, the U.S. Department of Energy has selected 15 projects to share USD 40 million in funding to develop high-performance, energy-efficient cooling solutions for data centers. These facilities consume 2% of U.S. electricity, with cooling systems accounting for up to 40% of total energy consumption.

Regional Insights

North America: Dominant Region with A Significant Market Share

North America dominates the server market because of its advanced technological infrastructure, a high concentration of data centers, and major global players in cloud computing and technology services. It is a mature market with the maximum adoption of current technologies like artificial intelligence (AI) and machine learning, so the infrastructure of servers must be strong and sophisticated. All this adds up to economic stability, a good investment in R&D, and the increased requirement for data processing in various industries such as health care, finance, and e-commerce, bringing North America to the top in the global market.

- For instance,Data center power consumption in the U.S. is expected to rise to 35GW by 2030, almost double what it is currently in 2022. This is caused by increased demand for AI and machine learning-ready racks, creating a higher demand for advanced server infrastructure.

Asia Pacific: Rapidly Growing Region

Asia Pacific is a rapidly growing region because its digital economy is expanding, its cloud computing demand is rising, and the adoption of emerging technologies such as 5G, AI, and the Internet of Things (IoT) is growing more dramatically. The region contains the fastest-growing economies, and a vast population is increasingly accessing various online services, creating a surge in data generation and processing needs. In addition to this, governments and companies in the region are investing heavily in IT infrastructure to support digital transformation, thus driving demand for servers and data center services.

- For instance, in November 2022, Google Cloud and the Data Security Council of India launched the 'Secure with Cloud' initiative to demystify cloud security and empower government and public sector organizations to deploy and transform safely with cloud technologies for better efficiency and protection.

Countries Insights

- United States: The U.S. leads the global server market due to its massive tech industry, dominance of hyperscale cloud providers, and significant enterprise IT spending. It is home to leading server vendors like Dell, HPE, and IBM and primary data center operators such as AWS, Google Cloud, and Microsoft Azure. The country also boasts a vibrant startup ecosystem, continuously driving innovation in server technology.

- China: China’s rapidly expanding server market is fueled by its massive population, booming digital economy, and significant government investments in technology. Leading domestic vendors such as Inspur and Huawei dominate the market, supported by the growing needs of companies like Alibaba, Tencent, and Baidu. The surge in AI, 5G, and edge computing also contributes to the demand for high-performance servers.

- Germany: Germany’s strong manufacturing sector and Industry 4.0 initiatives drive demand for edge computing and industrial automation solutions. The country emphasizes data sovereignty and privacy regulations, leading to the development of specialized servers for secure data storage and processing. Companies like Siemens are at the forefront of integrating server technology into industrial processes.

- Japan: Japan’s IT market is mature, focusing strongly on reliability, quality, and research and development. Large financial institutions, telecom companies, and technology firms drive the country’s demand for high-performance servers. There is also growing interest in cloud computing and AI solutions.

- United Kingdom: The U.K. serves as a central hub for finance and technology in Europe, driving the demand for servers in these sectors. London’s position as a global financial center and the country’s growing tech startup ecosystem contribute to market growth. The U.K. also hosts a strong presence of cloud providers. The expansion of fintech and financial services and the increasing adoption of hybrid cloud solutions further support the market’s growth.

- India: India’s rapidly growing IT sector and large population create a significant demand for servers. The growth of IT services companies, increased cloud adoption, and government-led digitalization initiatives contribute to this trend. Emerging technologies like AI and 5G are also key factors. Government initiatives like Digital India and the growth of startups and IT service providers boost the regional market.

- Australia: Australia’s developed economy and increasing emphasis on technology lead to strong demand for servers across multiple sectors. The country’s financial services sector and rising interest in cloud computing and data analytics support server growth. The expanding fintech sector and growing data analytics and cloud computing adoption support growth.

- Canada: Canada’s strong economy and close relationship with the U.S. make it a significant user of servers across different sectors. The country has a growing tech sector, with increased use of cloud computing and an emphasis on data security and privacy. Rising adoption of AI and big data analytics and focus on compliance with strict data privacy laws boost market growth.

Segmentation Analysis

By Product

The rack servers segment dominates the server market. Customers prefer rack servers for their large scale, efficient space usage, and scalability. They provide variable performance dependent upon customers' needs by being readily customizable and configurable. As companies depend more on information technology, demand for rack servers goes hand in hand with business, keeping them the top product in the server market.

By Enterprise Size

The large enterprises segment dominates the market in terms of revenue. Larger enterprises require more extensive IT infrastructure to support complex operations, large volumes of data, and critical applications. These businesses invest heavily in advanced server solutions, increasing demand for more robust and scalable server systems. High-performance, reliable, and secure servers are needed to maintain operations and deliver services.

By Channel

The direct channel segment dominates the market in terms of revenue. Direct sales enable manufacturers to have control over their products and customer relationships. This channel offers businesses customized solutions, direct support, and often better pricing. Since most companies want to deal directly with server vendors to ensure they get the best configuration and service, the direct sales channel remains the leading segment in the market.

By End Use

IT & telecom dominates the market in terms of revenue. Increasing demand for data processing and cloud services within the IT and telecom sectors requires strong server infrastructure. The telecommunication industry requires servers for large amounts of data, mainly with the 5G technology rollout and increased usage of cloud-based services. The constant need for reliable, high-performance servers in data centers and telecom infrastructure makes IT and telecom the dominant end-use sector in the market.

Company Market Share

Key market players are investing in advanced Server technologies and pursuing strategies such as collaborations, acquisitions, and partnerships to enhance their products and expand their market presence.

Nvidia Corporation: An Emerging Player in the Servers Market

NVIDIA Corporation is an emerging player in the global market with cutting-edge technologies that go into its server solutions. Although the company has been around for ages as a pioneer in graphics processing units (GPUs), it has easily expanded its base in server infrastructure and established itself as the biggest name in high-performance computing. A very strong AI, machine learning, and deep learning expertise give it much leverage as more and more servers keep asking for AI-based servers. More notably, NVIDIA's energy efficiency with high-performance computing supports the firm in answering rising demands for sustainable server solutions with lower costs.

Recent Developments:

- In March 2024, NVIDIA unveiled the Blackwell platform, which revolutionizes computing with up to 25x improved cost and energy efficiency. It has six transformative technologies and accelerates breakthroughs in generative AI, quantum computing, engineering simulation, and more, empowering organizations to tackle emerging industry challenges.

List of Key and Emerging Players in Servers Market

- Dell, Inc.

- Hewlett Packard Enterprise Development LP

- Nvidia Corporation

- IBM Corporation

- Hitachi Vantara, LLC

- Inspur

- Lenovo

- Super Micro Computer, Inc.

- Cisco Systems, Inc.

- Fujitsu

to learn more about this report Download Market Share

Recent Developments

- November 2024- IBM unveiled its most advanced quantum processor, IBM Quantum Heron, which can perform up to 5,000 two-qubit gate operations. This development will enable faster and more accurate quantum computations, furthering scientific exploration in materials science, chemistry, and high-energy physics.

- February 2024- Scaleway introduced RISC-V servers, advancing innovation and supporting global semiconductor sovereignty. This open, license-free architecture is poised to reshape the microprocessor landscape, fostering independence and geopolitical freedom.

Analyst Opinion

As per our analyst, the global servers market is undergoing a significant transformation driven by advances in cloud computing, edge computing, and AI workloads. Hybrid and multi-cloud infrastructure expansion continues to replace traditional on-premise solutions as companies prioritize agility and scalability. The demand for high-performance computing (HPC), primarily through GPUs and TPUs, remains strong in applications such as healthcare, finance, and scientific research, where AI plays an increasingly critical role.

Moreover, energy efficiency and sustainability have become significant market drivers, with companies prioritizing eco-friendly server solutions that meet environmental regulations and improve cost-effectiveness.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 95.68 Billion |

| Market Size in 2025 | USD 103.43 Billion |

| Market Size in 2033 | USD 192.86 Billion |

| CAGR | 8.1% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Enterprise Size, By Channel, By End-Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Servers Market Segments

By Product

- Rack

- Blade

- Tower

- Micro

- Open Compute Project

By Enterprise Size

- Micro

- Small

- Medium

- Large

By Channel

- Direct

- Reseller

- Systems integrator

- Others

By End-Use

- IT & Telecom

- BFSI

- Government & Defense

- Healthcare

- Energy

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.