Solar Encapsulation Market Size, Share & Trends Analysis Report By Type (Crystalline Silicon Solar Technology, Thin- Film Solar Technology), By Material (Ethylene Vinyl Acetate (EVA), Thermoplastic Polyurethane (TPU), Polyolefin Elastomer (POE), Other materials), By End-Use (Construction, Solar Farms, Automotive, Electronics, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Solar Encapsulation Market Overview

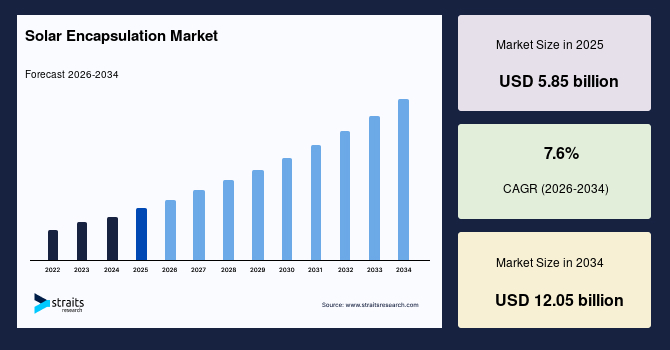

The global solar encapsulation market size is valued at approximately USD 5.85 billion in 2025 and is projected to grow to around USD 12.05 billion by 2034, expanding at a compound annual growth rate (CAGR) of about 7.6% during this period. This growth is driven by increasing worldwide adoption of solar energy, growth in photovoltaic installations, and rising demand for advanced encapsulation materials that protect solar cells, enhance durability, and improve efficiency. The market size is forecast to nearly double over the next decade, reflecting steady expansion in solar panel installations worldwide accompanied by advancements in encapsulation materials that ensure longer module life and improved resistance to environmental stresses.

Key Market Trends and Insights

- Asia Pacific holds the largest share of 61% of the solar encapsulation market in 2024, driven by rapid solar installations and strong manufacturing ecosystems in countries like China, Japan, South Korea, and India

- The market in the U.S. and broader North America is expected to grow significantly over the forecast period, supported by increasing adoption of solar technologies, government incentives, and innovations in solar materials.

- By application, ground-mounted solar installations accounted for the highest market share with 70.8% in 2024, reflecting large-scale utility projects dominating solar deployment.

- Based of technology, the crystalline silicon solar segment held the highest market share in 2024, as it is the most widely adopted photovoltaic technology globally.

Market Size and Forecast

- 2025 Market Size: USD 5.85 billion

- 2034 Projected Market Size: USD 12.05 billion

- CAGR (2025-2035): 7.6%

- Dominating Region: Asia Pacific

- Fastest-Growing Region: North America

The increasing global demand for renewable energy and continual advancements in solar module are the key factors propelling the solar encapsulation market forward. Significant investments in large scale solar energy projects, combined with favourable government policies aimed at reducing greenhouse emissions. are expected to further accelerate market growth. Encapsulants play a crucial role in maintaining the structural integrity and enhancing the performance of both crystalline silicon and thin-film solar technologies. Leading materials such as Ethylene Vinyl Acetate (EVA), Polyolefin, and Thermoplastic Polyurethane (TPU) dominate the market due to their cost-effectiveness and superior optical and adhesive properties. The adoption of emerging technologies like bifacial and high-efficiency photovoltaic (PV) modules is driving demand for next-generation encapsulation materials that offer improved ultraviolet (UV) stability and reduced degradation rates.

Major solar power-producing countries, including China, India, the U.S., and Germany, contribute significantly to market expansion through ambitious solar deployment targets and supportive manufacturing incentives. Overall, the outlook for the solar encapsulation market remains robust as the global energy mix increasingly shifts toward clean and sustainable energy solutions.

Latest Market Trends

Advanced Materials and Process Innovations Drive Excellence

The integration of cutting-edge encapsulation materials with advanced manufacturing technologies is significantly enhancing the performance and reliability of solar modules. High-performance materials such as Ethylene Vinyl Acetate (EVA), Polyolefin, and Thermoplastic Polyurethane (TPU) are optimized for better UV stability and reduced degradation, ensuring greater module longevity. Meanwhile, innovations in lamination and curing processes allow for more consistent protective layers that improve the structural integrity and environmental resilience of solar panels. This strategic combination enables manufacturers to deliver high-quality, durable modules that meet increasing global demands efficiently.

Flexible Deployment Models for Enhanced Production Scalability

The solar encapsulation industry is adopting flexible production and supply chain models, incorporating both in-house manufacturing and third-party partnerships to manage costs and scale output effectively. Companies leverage hybrid approaches that balance localized manufacturing for faster delivery and global procurement strategies for cost advantages. This flexibility supports rapid technology upgrades and adaptation to shifting market demands, ensuring manufacturers can respond swiftly to regulatory changes, raw material availability, and the evolving needs of bifacial and high-efficiency photovoltaic module technologies. Consequently, solar encapsulation solutions are becoming more tailored, scalable, and cost-efficient across diverse geographic market.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 5.85 billion |

| Estimated 2026 Value | USD 6.12 billion |

| Projected 2034 Value | USD 12.05 billion |

| CAGR (2026-2034) | 7.6% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | Arkema S.A , Mitsui Chemicals Tohcello, Inc , Solutia Inc , RenewSys , Specialized Technology Resources |

to learn more about this report Download Free Sample Report

Market Drivers

Growing demand for Renewable energy sources and Government Incentives

Concern about the environmental impact of fossil fuels have led many countries to prioritize the development of renewable energy sources to reduce their carbon footprints. . Reports from authoritative bodies like the UN Environment Programme and the IPCC have heightened public and policymaker awareness about the urgent need to transition to cleaner electricity.

Solar energy, being carbon-free and abundantly available, is at the forefront of this shift. Numerous nations, both developed and developing, have set ambitious targets to achieve net-zero emissions and source significant portions of their energy from renewables by mid-century. Alongside these goals, financial incentives such as low-interest loans, tax credits, and feed-in tariffs have been introduced to make solar projects more economically viable for both developers and consumers. These measures have significantly boosted the attractiveness of the rooftop solar systems and large photovoltaic installations, which is in turn drive the growth of solar encapsulation market.

Cost Reduction Driving Solar Encapsulation Market Growth

Declining solar manufacturing and installation costs are significantly boosting the solar encapsulation market. Lower production expenses for photovoltaic modules have made solar energy increasingly affordable, driving adoption across residential, commercial, and utility-scale projects. Affordable rooftop systems and low-cost building-integrated photovoltaics (BIPV) are encouraging wider deployment, creating higher demand for encapsulation materials that enhance durability and performance. As the price of solar power continues to fall, demand for reliable, cost-effective encapsulation solutions is expected to rise steadily, reinforcing market growth globally.

Government Incentives Boosting Domestic Manufacturing

Governments worldwide are implementing incentive programs to encourage domestic solar module manufacturing, which bolsters demand for locally sourced, high-quality encapsulation materials. Countries such as India and China are leading these efforts to reduce import dependence and strengthen their solar supply chains. Countries including India and China are implementing policies and incentive programs to promote domestic solar module manufacturing, which increases the procurement of high-quality, locally produced encapsulation materials. These initiatives aim to reduce import dependency and build resilient domestic supply chains for solar panel components.

Market Restraints

High Cost of the Encapsulation Materials and Manufacturing

The advanced materials used in solar encapsulation, such as POE and ionomers, are significantly more expensive than traditional EVA, pushing up raw material and production costs. Complex multi-stage manufacturing processes including compounding, casting, and curing require substantial capital expenditure, which manufacturers pass on to solar module producers and end customers. This high cost impedes large-scale adoption, especially in price-sensitive markets and developing economies where lowering system costs remains a priority.

Recycling and Sustainability Challenges

The tightly bonded encapsulation layers in solar panels make recycling arduous and costly, as material separation is labor-intensive and inefficient. Current solar PV panel designs were not optimized for end-of-life recyclability, leading to environmental and sustainability issues. Improving the recyclability of encapsulation materials while maintaining performance adds complexity to product development and poses future regulatory challenges as circular economy initiatives gain traction.

Supply Chain Disruptions and Raw Material Price Volatility

Volatility in the prices and supply of polymers and additives used in encapsulation materials, coupled with global supply chain disruptions, exert pressure on manufacturers to balance cost and performance effectively. Raw material scarcity or price surges can delay production timelines and increase costs, further complicating market growth in regions with less established supply networks.

Market Opportunities

Rising Global Demand for Renewable Energy

Global demand for renewable energy continues to surge with electricity generation from solar PV expected to increase substantially, especially in developing economies like China and India. Renewables will account for a significant portion of new electricity generation capacity, driving increased need for solar encapsulation materials. Global electricity generation from solar PV is expected to increase substantially, especially in developing economies like China and India, where renewable sources will constitute a significant portion of new capacity. This surge drives the demand for reliable solar encapsulation materials essential for enhancing panel durability and efficiency over the system’s lifespan.

Growth in Large-Scale Solar Projects

The installation of large-scale solar projects in harsh environments necessitates the use of highly durable and robust encapsulation materials. Such projects require encapsulants with superior thermal stability and UV resistance to ensure long-term performance and reliability. Large-scale solar projects in challenging environments require encapsulation materials with superior thermal stability, UV resistance, and moisture protection to maintain performance and longevity. This necessity boosts demand for advanced encapsulants designed to withstand extreme conditions, ensuring reliable functionality in utility-scale solar farms.

Regional Analysis

The Asia Pacific solar encapsulation industry accounted over 61% of the global revenue of the global market in 2024. The growth is primarily driven by massive solar storing capacity conditions in countries like China, Japan, South Korea, where aggressive shifts away from fossil fuels are supported by strong national solar policies, ample land availability, and highly competitive solar module manufacturing ecosystems. This dominance is driven by roboust solar installations and government incentives. The region enjoys abundant solar irradiance, supportive policies, and increasing investments in research and development, which enhance demand for high-quality encapsulation materials. Many manufacturers in this region are focusing on innovation and scaling up production capacities to meet both domestic and international demand.

In the Asia-Pacific region the fastest growing country is China. China leads due to its extensive solar panel manufacturing infrastructure, cost-effective production capabilities, and strong government support promoting renewable energy adoption.

North American Market Trends

North America solar encapsulation market is primarily driven by the integration of renewable energy and federal clean energy initiatives aimed at reducing carbon emissions and holds about 24% of the global volume in 2024. The reion has large scale photovoltaic deployments across utility and distributed generation sectors, boosting demand for encapsulants that provide durability, optical clarity, and long-term reliability. Declining costs of solar installations, enhanced net metering policies, and rising investor interest in green infrastructure have further accelerated market growth moreover, the growing use of bifacial solar modules and tracker-based systems in U.S. solar farms requires encapsulation materials that can withstand mechanical stresses and UV degradation. As a result, advanced encapsulant materials such as polyolefin and thermoplastic polyurethane are being increasingly adopted.

The United States is leading in the solar encapsulation market in North America region due to strong government support via policies like the Inflation Reduction Act, federal tax credits, and state-level renewable portfolio standards. Additionally, the country benefits from advanced R&D, a robust solar installation pipeline including utility-scale and rooftop projects, and a growing domestic manufacturing base focusing on high-performance encapsulation materials. Canada also shows significant growth, but the U.S. currently holds the largest share and drives the regional market.

European Market Insights

Europe held approximately a 15% market share of the global solar encapsulation market in 2024. The market also benefits from a strong focus on sustainability and circular economy principles, boosting demand for recyclable and low-carbon encapsulants, with ongoing innovations in bio-based polymers and thermoplastic solutions. Building-integrated photovoltaics (BIPV) is a significant growth area, with solar technologies increasingly incorporated into facades, rooftops, and windows of residential and commercial buildings. Europe is also seeing rising adoption of bifacial and high-efficiency solar modules, requiring encapsulants with superior transparency and stability.

Germany leads the European market due to its strong renewable energy policies, technological innovation, and extensive solar infrastructure under its Energiewende strategy. The country benefits from advanced R&D in solar technologies, fostering innovation in high-performance and durable encapsulation materials that meet stringent EU standards for efficiency and recyclability. Additionally, Germany's large-scale investments in utility and commercial solar projects, coupled with established manufacturing capabilities and a robust supply chain, further solidify its dominant position in the region. These factors collectively drive consistent demand for superior solar encapsulation solutions, reinforcing Germany's leadership in the European market.

Latin America Market Trends

The Latin America solar encapsulation market holds a smaller market share but steadily growing. The global market share of Latin America was 6% in 2024. Growth in this region is primarily driven by increasing investments in renewable energy infrastructure. Key market drivers include government support through energy auctions and feed-in tariff programs that promote solar park expansions, along with rising demand for durable encapsulants like EVA and POE films that withstand high temperatures and humidity common in Latin American climates.

The country which is currently leading in solar encapsulation market in Latin America region is Brazil. Brazil leads the market due to its solar power capacity, favorable government policies promoting renewable energy investments, and extensive solar irradiance making it ideal for large-scale solar projects. Additionally, Brazil's expanding infrastructure for decentralized energy solutions and ongoing solar park developments further drive demand for advanced encapsulation materials in the region.

Middle East and Africa Market Trends

The Middle East & Africa solar encapsulation market is witnessing rapid growth due to increasing investments in renewable energy infrastructure and rising solar PV installations. Key drivers include the expanding solar capacity in countries like the United Arab Emirates, which leads the region with significant solar projects and pipeline installations aimed at quadrupling its solar capacity by 2025. Favorable government initiatives, strong solar irradiance, and increasing energy demand in off-grid and remote areas fuel the proactive deployment of solar technologies. The demand for high-performance encapsulation materials is also growing due to the harsh climatic conditions requiring robust thermal stability and UV resistance in encapsulants.

The country where maximum growth is happening in this region is Saudi Arabia. Saudi Arabia leads the region due to its massive investments in solar infrastructure, and they are aiming that diversifying the energy mix and reducing reliance on fossil fuels. The country benefits from abundant solar resources and government-backed renewable energy projects such as the Sakaka solar plant and the NEOM smart city, which create substantial demand for high-performance encapsulation materials capable of withstanding extreme desert conditions like intense heat, UV radiation, and dust storms.

Type Insight

Crystalline silicon solar technology holds a strong place in the solar encapsulation market with a significant market share of 89% in 2024. This segment leads due to the widespread use of crystalline silicon solar cells in most commercially available photovoltaic modules because of their high efficiency, durability, cost-effectiveness, and environmental friendliness. The segment's dominance is bolstered by continuous advancements in crystalline silicon technology that enhance solar panel performance and reduce production costs, making it the preferred choice for both residential and commercial solar installations.

The fastest growing segment by type is thin-film solar technology, which is expected to exhibit a strong growth rate of 7%. Thin-film technology is gaining momentum due to its lightweight, flexible form factor, and ability to perform better in low-light conditions, which expands its application scope in building-integrated photovoltaics (BIPV), portable solar products, and areas with less sunlight. Innovations in thin-film materials and increasing demand for versatile solar solutions are primary drivers of its rapid growth in the solar encapsulation market.

Material Insight

The dominating segment in the solar encapsulation market by type is Ethylene Vinyl Acetate (EVA), which held the largest market share in 2024, accounting for over 60% of the global market. EVA is widely preferred due to its superior corrosion resistance, excellent barrier protection against UV radiation and moisture, and cost-effectiveness, which help enhance the efficiency and durability of solar modules. The segment’s dominance is further driven by its extensive use in crystalline silicon solar panels, the most prevalent solar technology worldwide.

Thermoplastic Polyurethane (TPU) is the material in the solar encapsulation market which is growing and is expected to grow at a CGAR of 10% during the forecast period. TPU is gaining traction due to its superior mechanical strength, excellent UV resistance, and high transparency, making it suitable for high-performance and flexible photovoltaic applications. Innovations in TPU formulations and increasing demand for flexible and lightweight encapsulation solutions, especially in emerging solar technologies like building-integrated photovoltaics and flexible modules, are key growth drivers for this segment.

End Use Insight

The construction sector is the leading end-use segment in the solar encapsulation market, capturing the largest market share in 2024. The construction sector demand of solar encapsulation primarily due to high adoption of solar panels in residential buildings, commercial complexes and industrial facilities. Encapsulation materials provide crucial protection to solar panels from environmental factors such as UV radiation, moisture, and temperature fluctuations, enhancing the durability and efficiency of rooftop and facade-integrated photovoltaic systems. The growing emphasis on sustainable building practices and increasing urbanization further propels this segment's dominance.

The fastest growing end-use segment is utility-scale solar projects, expected to grow at a CAGR exceeding 8% through the forecast period. This growth is driven by expanding large-scale solar farm installations worldwide as countries rapidly scale renewable energy capacity to meet climate goals. Utility scale requires advanced, highly durable encapsulant materials with superior performance to ensure long term reliability in diverse and harsh environmental conditions. Increasing government incentives, declining costs of solar technology, and the large volume procurement typical of utility projects are key factors accelerating demand in this segment.

Competitive Landscape

The competitive landscape of solar encapsulation market is characterized by the high level of competition among the key players who are focusing on innovation, technological advancements and strategic partnerships and expansion of global footprints to capture market share. Major companies in this market include Arkema S.A., Mitsui Chemicals Tohcello, Inc., RenewSys, Solutia Inc., and Specialized Technology Resources, among others. These companies are heavily investing in R&D to develop advanced, cost-effective, and eco-friendly encapsulants to enhance the performance and longevity of photovoltaic systems. Additionally, they are pursuing strategic collaborations, joint ventures, and acquisitions to strengthen their product portfolios and technological expertise.

The market concentration is relatively high due to the presence of these established players who dominate through advanced product offerings and a strong supply chain network. Factors such as increasing government incentives for renewable energy adoption, heightened demand for superior encapsulant materials to improve solar panel efficiency and durability, and the growing emphasis on sustainability are collectively fueling the market growth and competition. Players are also focusing on regional expansions to tap into the rapidly growing markets in Asia Pacific, North America, and Europe, particularly leveraging the booming solar installations in these regions. Innovation in transparent, UV-resistant, and recyclable encapsulation materials remains a critical competitive factor in the evolving landscape.

List of Key and Emerging Players in Solar Encapsulation Market

- Arkema S.A

- Mitsui Chemicals Tohcello, Inc

- Solutia Inc

- RenewSys

- Specialized Technology Resources

- DuPont

- 3M Company

- Hangzhou First Applied Material

- Dow Inc

- LG Stem, Ltd

Recent Development

- Arkema is focused on developing next-generation thermoplastic encapsulants suited for flexible solar and building-integrated photovoltaics (BIPV). It showcased innovations at K2025 in Düsseldorf in September 2025, emphasizing sustainability and advanced materials.

- RenewSys India Pvt. Ltd. launched the CONSERV Giga Fast Cure EVA encapsulant in February 2024 and is progressing with plans to expand 1 GW of TOPCon module capacity by April 2025, as well as add 2 GW of module and encapsulation film capacity by the end of 2024, bolstering its production footprint.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 5.85 billion |

| Market Size in 2026 | USD 6.12 billion |

| Market Size in 2034 | USD 12.05 billion |

| CAGR | 7.6% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type, By Material, By End-Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Solar Encapsulation Market Segments

By Type

- Crystalline Silicon Solar Technology

- Thin- Film Solar Technology

By Material

- Ethylene Vinyl Acetate (EVA)

- Thermoplastic Polyurethane (TPU)

- Polyolefin Elastomer (POE)

- Other materials

By End-Use

- Construction

- Solar Farms

- Automotive

- Electronics

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.