Sparkling Water Market Size, Share & Trends Analysis Report By Product Type (Flavoured Sparkling Water, Unflavored (Plain) Sparkling Water, Functional Sparkling Water (infused with vitamins, minerals, botanicals, etc.)), By Packaging Type (Plastic Bottles, Glass Bottles, Cans, Others (Cartons, Pouches)), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Speciality Stores, Foodservice (Restaurants, Hotels, Cafes)) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Sparkling Water Market Overview

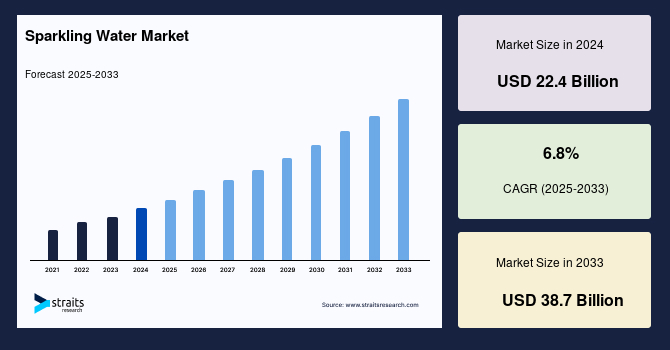

The global sparkling water market size was valued at USD 22.4 Billion in 2024 and is projected to reach from USD 24.0 Billion in 2025 to USD 38.7 Billion by 2033, growing at a CAGR of 6.8% during the forecast period (2025-2033).The growth of the market is attributed to increasing industrialization and urbanization in emerging economies.

Key Market Indicators

- Europe dominated the sparkling water market and accounted for a 45.5% share in 2024

- Based on product type, flavoured sparkling water holds the largest share within the product type segment.

- Based on packaging type, plastic bottles dominate the packaging segment.

- Based on distribution channel, supermarkets and hypermarkets remain the dominant distribution channel.

Market Size & Forecast

- 2024 Market Size:USD 22.4 Billion

- 2033 Projected Market Size:USD 38.7 Billion

- CAGR (2025-2033): 6.8%

- Europe: Largest market in 2024

- North America: Fastest growing market

The global sparkling water market is experiencing robust growth, driven by rising consumer preference for healthier alternatives and increasing demand for low-calorie, naturally flavoured drinks. Growing health consciousness worldwide has shifted consumer behaviour from sugary sodas to sparkling water, perceived as a refreshing and better-for-you option. The market is further fueled by expanding product portfolios including functional sparkling waters infused with vitamins, minerals, and botanicals. Increasing urbanisation and the millennial population’s inclination toward premium, artisanal beverages also contribute to rising sales. Innovations in packaging, such as eco-friendly bottles and cans, align with sustainability trends, enhancing market appeal.

Additionally, emerging markets in Asia-Pacific are witnessing rapid adoption, driven by expanding middle-class consumers and growing retail infrastructure. The rise of e-commerce platforms has also made sparkling water more accessible, offering a wider variety of brands and flavours directly to consumers. Leading beverage companies actively invest in R&D and acquisitions to capture market share, further accelerating innovation and expansion in the sparkling water segment globally.

Sparkling Water Market Trend

Premiumisation and Functional Beverages

The sparkling water market is shifting toward premiumisation and functional wellness-enhanced beverages. Modern consumers are increasingly attracted to products that offer more than basic hydration, favouring sparkling waters fortified with vitamins, adaptogens, nootropics, and electrolytes. Brands are launching curated flavour combinations such as pineapple-ginger, cucumber-lime, and lavender-mint, positioning them as premium lifestyle choices.

- For example, in February 2025, Spindrift introduced a new “Functional Refresh” line featuring immunity-boosting vitamin C and antioxidants, targeted at health-conscious millennials and Gen Z.

- Similarly, Sanzo, an Asian-inspired sparkling water brand, expanded its product line with natural caffeine-infused variants in April 2024, blending functional ingredients with regional fruit flavours like lychee and calamansi.

This premium trend is also fueled by sustainable packaging, including aluminium cans and recyclable glass bottles, aligning with eco-conscious consumer values. As wellness continues to dominate global consumption habits, this segment is expected to drive innovation and higher margins in the sparkling water space through 2033.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 22.4 Billion |

| Estimated 2025 Value | USD 24.0 Billion |

| Projected 2033 Value | USD 38.7 Billion |

| CAGR (2025-2033) | 6.8% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Nestlé Waters, PepsiCo, The Coca-Cola Company, Danone, Spindrift |

to learn more about this report Download Free Sample Report

Sparkling Water Market Growth Factors

Rising Health and Wellness Awareness

A major catalyst behind the growth of the global sparkling water market is the increasing global emphasis on health and wellness. Consumers are actively replacing sugary sodas with low-calorie, clean-label alternatives amid rising concerns over obesity, diabetes, and heart disease. The International Food Information Council (IFIC) 2024 survey revealed that 68% of consumers are reducing sugar intake, driving greater demand for unsweetened or naturally flavoured sparkling waters.

- For example, in July 2024, PepsiCo expanded its Bubly brand with a new line of electrolyte-enhanced sparkling water named Bubly Burst, targeting active lifestyles.

- Likewise, Nestlé Waters introduced S.Pellegrino Essenza Boost in Q1 2025, featuring functional botanical extracts and caffeine for natural energy.

This health-first behaviour is further amplified by public health initiatives, fitness influencers, and digital wellness platforms promoting hydration without sugar. The momentum is expected to persist, making sparkling water a staple in household and commercial beverage consumption.

Market Restraint

High Pricing Compared to Still Water

Despite its popularity, the sparkling water market faces a significant restraint in the form of higher pricing relative to bottled water and other beverages. Premium packaging, carbonation technology, and ingredient sourcing increase production costs, translating into a higher retail price point. Price sensitivity remains a challenge, especially in emerging markets with lower disposable incomes. This pricing barrier limits widespread adoption among cost-conscious consumers who may opt for cheaper alternatives.

Additionally, higher costs restrict availability and consumption in regions with limited distribution infrastructure. Retailers and brands are responding by introducing value-line products; however, these often lack the premium appeal necessary to attract the core target demographic. The price differential may also deter bulk purchases in institutional or hospitality sectors, affecting volume sales. Managing production costs while maintaining quality and innovation will be critical for market players aiming to broaden consumer access and sustain growth.

Market Opportunity

Expansion in Emerging Markets and E-Commerce Channels

Emerging markets and e-commerce channels offer substantial growth opportunities for the global sparkling water sector. Urbanisation, rising middle-class income, and growing lifestyle awareness in countries like India, Vietnam, and Brazil create new consumer segments willing to invest in healthier beverage options.

- For instance, in November 2024, Coca-Cola India expanded its SmartWater sparkling line, launching it exclusively through Flipkart and JioMart, achieving a 30% month-on-month sales increase in Tier-1 cities.

Social commerce, influencer endorsements, and tailored digital campaigns have further fueled product visibility. Additionally, localised manufacturing investments by companies like Perrier (Nestlé) in Brazil and Indonesia reduce supply chain costs and boost regional competitiveness. As consumer preferences in emerging regions shift toward wellness and digital shopping becomes mainstream, these channels represent vital frontiers for long-term market expansion.

Regional Analysis

Europe dominates the global market, with countries like Germany, Italy, and France leading consumption. The region’s preference for mineral and natural sparkling waters is rooted in cultural habits and a well-established bottled water industry. Health consciousness combined with strict regulations on sugar content in beverages promotes sparkling water as a preferred alternative. Premium brands like San Pellegrino and Gerolsteiner dominate, offering mineral-rich sparkling waters with artisanal branding.

European consumers also exhibit strong environmental awareness, prompting extensive use of glass bottles and aluminium cans. The European Union’s Green Deal policies have encouraged manufacturers to adopt circular economy practices, including reusable packaging and reduced plastic use, further strengthening the market. Public-private partnerships in countries like Germany promote sustainability and local sourcing, enhancing consumer trust and market stability.

Uk

The UK market is characterised by rapid growth in flavoured and functional segments, with a CAGR above 9% in recent years. The UK government’s Soft Drinks Industry Levy, effective since 2018, has accelerated consumer shift from sugary drinks to zero-calorie alternatives like sparkling water. Brands such as Appletiser and Perrier remain popular, supported by extensive distribution in supermarkets like Tesco and Sainsbury’s. The growing café culture and premiumisation trend fuel demand for artisanal and mineral sparkling waters. Government programs promoting healthy diets and sustainability, such as the UK Plastic Pact, encourage innovation in biodegradable and reusable packaging, contributing to the market’s dynamic expansion.

Germany, Europe’s largest economy, leads in premium sparkling water consumption, strongly focusing on mineral-rich and naturally sourced waters. Consumers prioritise authenticity, quality, and sustainability, favouring brands like Gerolsteiner and Apollinaris. Germany’s strict environmental policies, including the German Packaging Act, enforce recycling and waste reduction, prompting brands to invest in glass bottles and lightweight cans. The country’s well-developed retail network and rising e-commerce penetration also support growth. Local government incentives for green production technologies align with industry trends toward eco-friendly packaging and production methods, enhancing market resilience.

North America

North America is the fastest-growing market for sparkling water, driven by high health awareness and innovation in flavours and packaging. The trend toward healthier lifestyles and the decline in soda consumption strongly propel sparkling water demand. Market leaders like PepsiCo and Coca-Cola continually innovate with limited-edition flavours and functional ingredients, catering to evolving consumer preferences. The surge in e-commerce has further boosted accessibility, with online sparkling water sales growing by 25% year-over-year.

Government campaigns promoting sugar reduction, such as the U.S. FDA’s updated nutrition labelling rules implemented in 2024, indirectly support the shift towards low-calorie beverages like sparkling water. Sustainability efforts, including mandates for recyclable packaging, have prompted companies to invest in eco-friendly bottles, appealing to environmentally conscious consumers.

U.s.

The U. S. is the largest and most mature, driven by increasing health consciousness and declining soda consumption. Major players like LaCroix (Nestlé), Bubly (PepsiCo), and Spindrift lead the market through aggressive marketing and product innovation. The rise of e-commerce channels and subscription models enhances accessibility, especially among millennials. Government health initiatives such as the National Strategy on Hunger, Nutrition, and Health indirectly promote low-calorie beverages, boosting demand for sparkling water. Sustainability efforts by brands to reduce plastic waste through recycled PET bottles have also gained traction, aligning with U.S. consumer preferences for eco-friendly products.

Canada’s market is expanding steadily with a CAGR of approximately 7.5% during the forecast period. Health trends and increased demand for flavoured and organic sparkling water fuel growth. Canadian consumers show a strong preference for natural ingredients and locally sourced products. The government supports sustainability initiatives, including bans on single-use plastics in several provinces, pushing manufacturers to innovate eco-friendly packaging. Retail giants like Loblaw Companies have expanded their private-label sparkling water ranges, enhancing affordability and distribution reach. Canada’s multicultural population also contributes to diverse flavour experimentation, stimulating product variety and consumer engagement.

Asia-Pacific

Asia-Pacific represents a significant growth region due to rising disposable incomes, urbanisation, and increasing health awareness. Although the market penetration of sparkling water remains lower compared to Western countries, rapid expansion is underway, especially in China, Japan, India, and Southeast Asia. Urban millennials and Gen Z consumers in major cities are driving demand for healthier, low-calorie beverages, supported by increasing retail penetration and the proliferation of convenience stores and supermarkets. E-commerce platforms such as JD.com and Shopee have accelerated market reach by providing diverse product access.

Additionally, government initiatives to improve public health and reduce sugar consumption, such as China’s Healthy China 2030 plan, create favourable conditions for growth. Local and international brands invest in tailored marketing and product innovation, including regional flavours and smaller pack sizes, to appeal to diverse consumer tastes and price sensitivity.

China represents one of the fastest-growing markets globally, with a projected CAGR of 10.2%. Rising disposable incomes, urbanisation, and increasing health awareness drive demand for sparkling water, particularly among young urban consumers. International and local brands such as Perrier, Watsons, and HeySong compete vigorously, introducing new flavours and functional variants. The government’s Healthy China 2030 initiative promotes better dietary habits and reduced sugar intake, indirectly boosting sparkling water consumption. E-commerce platforms like JD.com and Alibaba play a vital role in distribution, while packaging innovations, such as smaller and convenient sizes, cater to busy urban lifestyles. Environmental policies encourage sustainable packaging solutions, which leading players increasingly adopt.

India’s market is nascent but rapidly expanding, with expected CAGR exceeding 12%. Growing urban middle class, rising health concerns, and exposure to global beverage trends drive adoption, especially in metropolitan areas. Local players like Himalayan Sparkling and international entrants like PepsiCo are investing heavily in product launches and regional distribution. The government’s Swachh Bharat Abhiyan and increasing focus on sustainable packaging influence companies to develop recyclable and eco-friendly bottles. E-commerce growth and convenience store proliferation enable easier consumer access. The market’s expansion is supported by rising consumer willingness to pay a premium for perceived healthier alternatives to traditional soft drinks.

Product Type Insights

Flavoured sparkling water holds the largest share within the product type segment, driven by growing consumer demand for refreshing beverages with taste but without added sugars or calories. Flavoured sparkling water sales grew by 12% globally, driven by millennial and Gen Z consumers seeking variety and novel taste experiences. Brands like LaCroix, Bubly, and Spindrift have significantly expanded their flavour portfolios, introducing exotic blends like mango, grapefruit, and lavender. The trend is fueled by health-conscious consumers substituting sodas with flavorful, natural, and often organic options. Flavoured sparkling water’s appeal lies in its ability to offer indulgence without guilt, aligning well with wellness trends. Its versatility also supports innovation in ready-to-drink cocktails and mixers, further broadening market potential.

Packaging Type Insights

Plastic bottles dominate the packaging segment, accounting for the largest market share due to convenience, lightweight nature, and cost-effectiveness. Over 60% of sparkling water sales globally come in plastic bottles, favoured for portability and resealability, which is important for on-the-go consumption. Technological advancements in biodegradable plastics and recycled PET (rPET) are helping brands meet sustainability goals while maintaining functionality.

For example, Nestlé Waters announced in 2024 that 100% of its plastic bottles in Europe will use rPET, significantly reducing its carbon footprint. Despite growing environmental concerns, plastic bottles remain popular in emerging markets where glass or cans are less accessible or affordable. Innovation in bottle design and improved recycling programs are expected to sustain growth in this subsegment.

Distribution Channel Insights

Supermarkets and hypermarkets remain the dominant distribution channel, accounting for the largest share due to their extensive reach and product variety. These retail formats provide consumers convenience, competitive pricing, and access to premium and value brands under one roof. Retailers have increasingly focused on wellness aisles and health-focused beverage sections, promoting sparkling water with strategic placements and in-store marketing campaigns.

- For instance, Walmart and Tesco have dedicated shelf space for flavoured and functional sparkling waters, boosting visibility and trial. Large retailers' growth of private label sparkling water brands is also increasing competition and affordability, expanding consumer adoption.

List of Key and Emerging Players in Sparkling Water Market

- Nestlé Waters

- PepsiCo

- The Coca-Cola Company

- Danone

- Spindrift

- LaCroix (National Beverage Corp.)

- San Pellegrino (Nestlé)

- Perrier

- AHA (Coca-Cola)

- Mountain Valley Spring Company

- Hint Water

- Talking Rain

- Waterloo Sparkling Water

- Polar Beverages

- Keurig Dr Pepper

to learn more about this report Download Market Share

Recent Development

- September 2025:Danone announced its plan to issue benchmark euro-denominated notes to professional investors, a common financial development for large corporations.

- August 2025: PepsiCo reported that it replenished 75% of the water used in its company-owned manufacturing facilities located in high-risk watersheds throughout 2024. This is part of the company's broader ESG (Environmental, Social, and Governance) strategy related to water management.

- August 2025:Spindrift announced it will discontinue its Spiked hard seltzer line. The company stated this decision was made to focus resources and time on its core sparkling water business.

- July 2025: In its second-quarter 2025 results, The Coca-Cola Company reported that its water, sports, coffee, and tea category was even, with growth in the water segment in Asia Pacific and Europe, Middle East and Africa offsetting a decline in Latin America.

- June 2025: Spindrift introduced a new sparkling water flavor, Yuzu Mandarin, as part of its portfolio expansion.

- April 2025: Danone successfully held its 2025 Shareholders' Meeting, with all proposed resolutions approved.

- February 2025: Nestlé confirmed its commitment to its water business, including premium brands like S.Pellegrino and Perrier, and stated it is not planning to sell the division. However, it is seeking partnership opportunities for the business.

- February 2025: Danone released strong financial results for the full year 2024, demonstrating the relevance of its health-oriented portfolio, which includes its water brands.

- January 2025: A private equity firm acquired a majority stake in Spindrift, and Dave Burwick, former CEO of Boston Beer, was appointed as the new CEO.

- January 2025: A market report by The Insight Partners highlighted The Coca-Cola Company as a major player in the global sparkling water market, driven by the increasing consumer trend toward healthy, low-calorie beverages.

- November 2024:Nestlé announced it would separate its water and premium beverages business into a standalone unit starting in 2025. This was part of a larger company-wide cost-cutting and strategic review initiative.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 22.4 Billion |

| Market Size in 2025 | USD 24.0 Billion |

| Market Size in 2033 | USD 38.7 Billion |

| CAGR | 6.8% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By Packaging Type, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Sparkling Water Market Segments

By Product Type

- Flavoured Sparkling Water

- Unflavored (Plain) Sparkling Water

- Functional Sparkling Water (infused with vitamins, minerals, botanicals, etc.)

By Packaging Type

- Plastic Bottles

- Glass Bottles

- Cans

- Others (Cartons, Pouches)

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Speciality Stores

- Foodservice (Restaurants, Hotels, Cafes)

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.