Substation Automation Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Communication Protocol (IEC 61850, DNP3, Modbus, IEC 60870-5-101), By Voltage Level (Low Voltage Substations, Medium Voltage Substations, High Voltage Substations), By End Use Application (Utilities, Industrial Facilities, Renewable Energy Integration, Transportation Infrastructure) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Substation Automation Market Overview

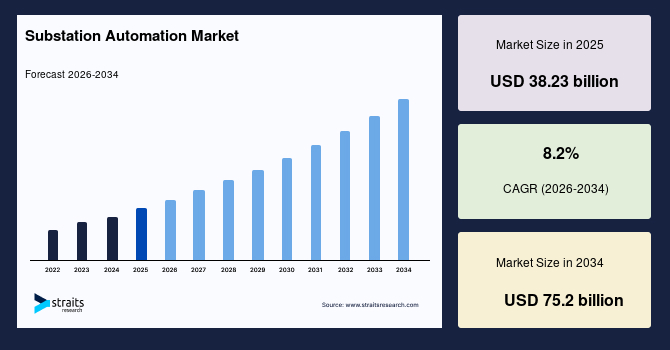

The global substation automation market size is valued at USD 38.23 billion in 2025 and is estimated to reach USD 75.2 billion by 2034, growing at a CAGR of 8.2% during the forecast period. Consistent growth of the market is supported by increasing investments in power grid modernization, rising adoption of digital substations, and the integration of advanced communication protocols that enhance grid reliability, operational efficiency, and real-time monitoring, enabling utilities and industries to manage growing electricity demand more effectively.

Key Market Trends & Insights

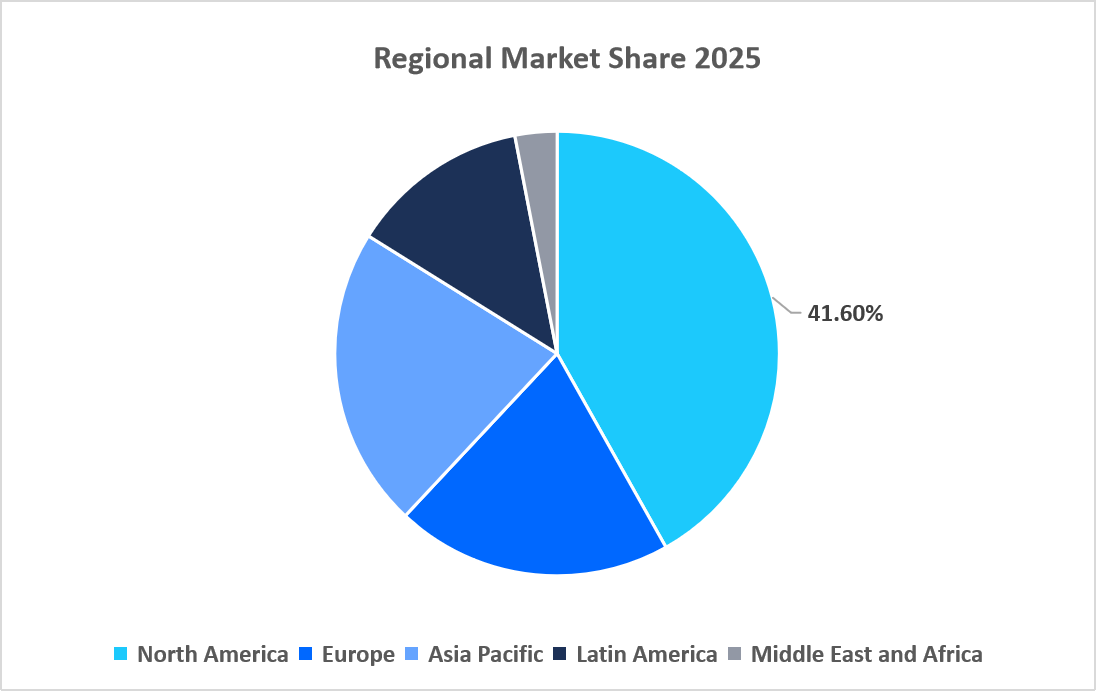

- Asia Pacific dominated the market with a revenue share of 41.6% in 2025.

- North America is anticipated to grow at the fastest CAGR of 9.4% during the forecast period.

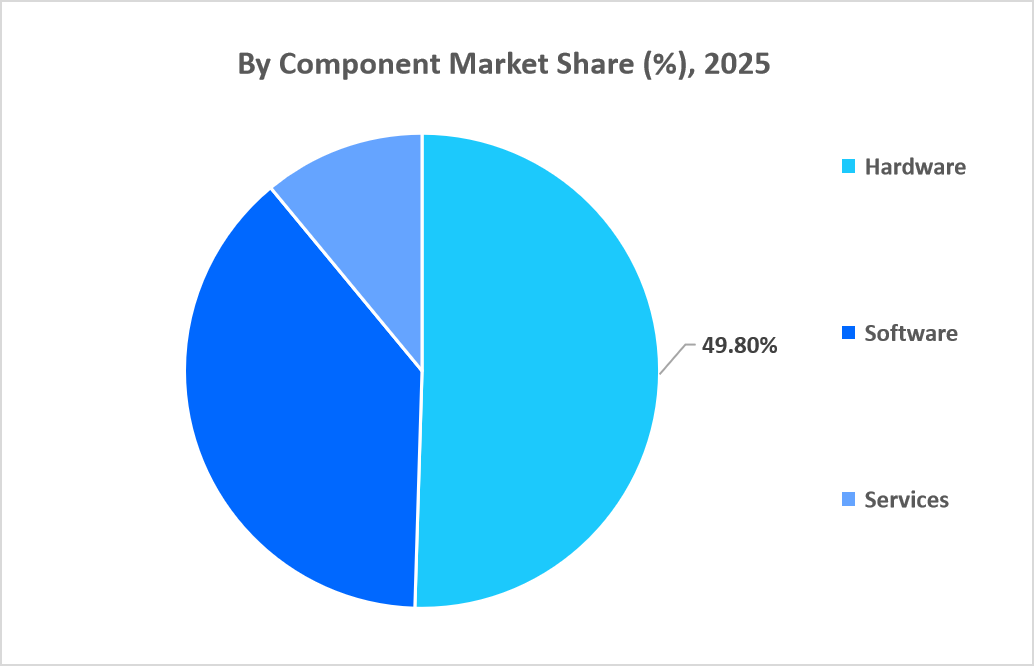

- Based on component, the Hardware segment held the highest market share of 49.8% in 2025.

- By communication protocol, the IEC 61850 segment is estimated to register the fastest CAGR growth of 9.9% during the forecast period.

- Based on voltage level, the Medium Voltage Substations segment dominated the market in 2025, accounting for a revenue share of 44.3%.

- Based on end-use application, the Utilities segment is projected to grow at a CAGR of 8.6% during the forecast period

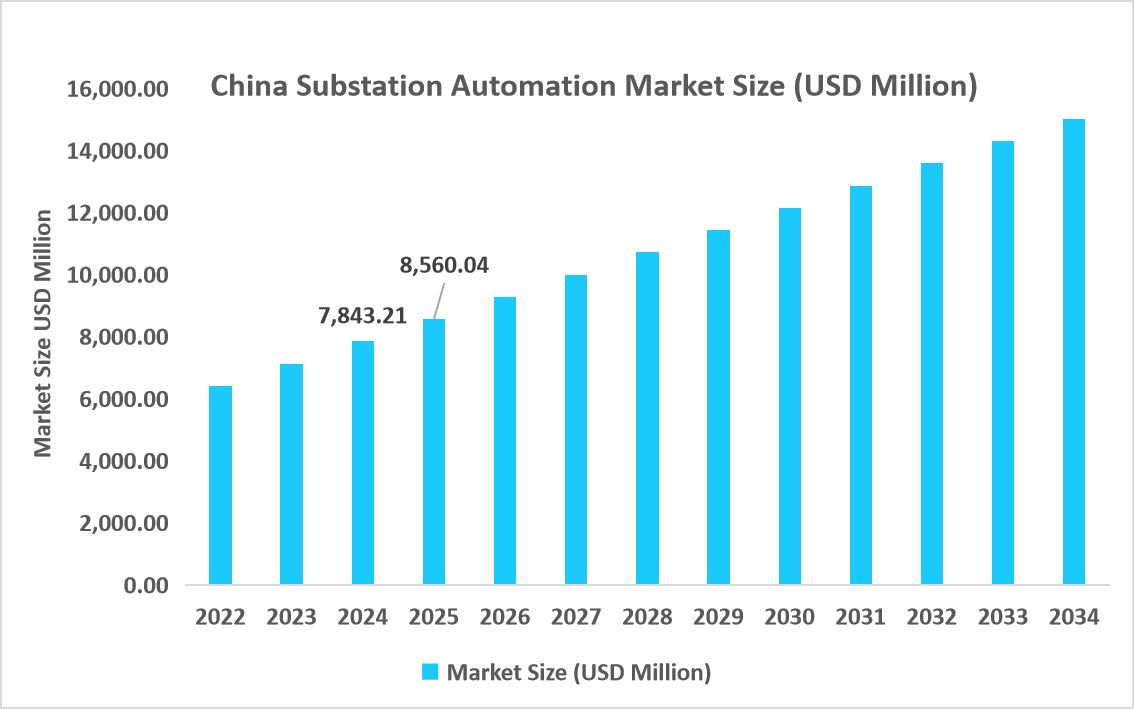

- The China dominates the substation automation market, valued at USD 7.84 billion in 2024 and reaching USD 8.56 billion in 2025.

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 38.23 billion

- 2034 Projected Market Size: USD 75.2 billion

- CAGR (2026-2034): 8.2%

- Dominating Region: Asia Pacific

- Fastest Growing Region: North America

The international market for substation automation involves a wide range of hardware, software, and services integrated in a collective way to control, monitor, protect, and optimize electrical substations in a power grid. This is done using standard communications protocols, including IEC61850, DNP3, Modbus, and IEC 60870-5-101, which enables the simultaneous exchange of real-time data with effortless cooperation and control of various electrical substations with differing levels of voltages, from lower to higher ones. The applications of substation automation products involve several end users, including the electricity supply industry, industrial installations, projects involving renewable energy, and transportation sectors, with the aim of enhancing the reliability, efficiency, and digitalization of the power market.

Market Trends

Transition from Conventional Substations to Fully Digital and Intelligent Grids

Conventional substations were characterized by fragmented control systems, a lack of data visibility, and a wait-and-watch approach to maintenance. All this has led to system downtime and a greater risk of failures. Today, the industry is adopting digital substations that are replete with intelligent devices and standardized communication interfaces. The effect has been a system that can track events in real time, detect potential failures before their occurrence, and implement control operations from a central point. The results include seamless information flow between substations, faster identification and isolation of faults, and optimal usage of assets. Digital substations have overall improved the stability of the grid system and reduced losses. They have ensured more optimal usage of the increasing electricity demand."

Rapid Integration of Renewable Energy and Distributed Power Sources

The accelerating integration of renewable energy sources has emerged as a defining trend in the substation automation market.. In traditional design concepts, there was a unidirectional flow of power from generation stations, and there was difficulty in adaptability with the variability of solar, wind, and DER. With the increasing adoption of these sources of energy, there has been an upgrade of the automated stations to adapt to the bidirectionality of flows, the variations in voltages, and the balancing of the load at a rapid rate of time. The latest technology allows adaptability and rapid adjustment in grid control with the generation of power. This reinforces that substation automation has become an essential milestone in the energy revolution for efficient integration of renewables into the grid.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 38.23 billion |

| Estimated 2026 Value | USD 41.4 billion |

| Projected 2034 Value | USD 75.2 billion |

| CAGR (2026-2034) | 8.2% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | ABB Ltd., Siemens AG, Schneider Electric SE, General Electric, Hitachi Energy Ltd. |

to learn more about this report Download Free Sample Report

Market Driver

Government-Mandated Grid Reliability And Digital Compliance Frameworks

Power infrastructure governance is increasingly shifting from advisory standards to mandatory compliance regimes, creating a strong structural driver for substation automation adoption. Governments and regulatory authorities are enforcing stringent grid reliability, outage reduction, and digital monitoring requirements to improve national energy security. In the United States, the Federal Energy Regulatory Commission (FERC) and the North American Electric Reliability Corporation (NERC) have introduced enforceable Critical Infrastructure Protection (CIP) standards that require utilities to implement advanced monitoring, protection, and automated control systems across substations. Similarly, the European Union’s Clean Energy Package and Network Codes for Electricity mandate real-time system visibility, interoperability, and fault response capabilities at the substation level. These regulations compel utilities to upgrade legacy substations with automated protection, communication, and control technologies, directly accelerating market demand.

Market Restraint

Fragmented Regulatory Approval And Cross-Border Interoperability Constraints

The most significant barriers in the substation automation industry are that there is no common regulatory approval framework and compatibility standards among various countrywide and regional electricity grids. Though there may be international standards, in some cases, there might be countrywide electricity grid standards, cybersecurity standards, and certifications that can hinder the signing off of projects. In other words, the variability in communication standards, data ownership, and electricity grid standards among various geographic locations makes it difficult for utilities to sign off on projects before deployments.

Market Opportunity

Expansion of Lifecycle-Based Asset Management And Performance Optimization Models

Increased investments in lifecycle-based asset management and performance enhancement are creating new opportunities in the substation automation market. The acceptance by power companies is progressing from the mere maintenance aspect toward more focused asset management based on a lifecycle approach, emphasizing availability, risk mitigation, and stability. The automated substation enables persistent visibility into condition monitoring, event recording, and performance comparison at various voltage levels. Moreover, this changes the market scenario for automation solution suppliers by opening opportunities for delivering integrated systems that can address overall asset management strategies for power companies.

Regional Analysis

In the year 2025, the Asia Pacific market is at the forefront with an approximate share of 41.6% market revenue. This is due to large efforts underway in the transmission and distribution of power, urbanization, and increased power consumption in the developing nations. There is substantial implementation of automatic substations for the support of industrial corridors, urban electrification, and large solar parks in the Asia Pacific market. Moreover, the power sectors in the Asia Pacific market are implementing standardization in substations for improved stability and reduced outage durations in the power grids by implementing automation in lower, medium, and high-voltage substations.

The growth of substation automation in China is supported by the extension of ultra-high voltage transmission lines and smart power grids to equalize the distribution between industry and urban areas. The drive to automate substation systems is intended to enhance load management and fault detection, especially in areas with high population density. The large-scale adoption of digitally controlled substation systems in industry and renewable energy base stations has made China one of the main drivers of market power.

North America Market Insights

North America is projected to witness the quickest growth, with a CAGR of 9.4% during the forecasting period. This is owing to the gradual replacement of old power infrastructure, along with the growing adoption of automated monitoring in the distribution networks. The utilities are banking on faster outage restoration, along with improved visibility of the grid for addressing the mounting power requirements stemming from the growing use of data centers, EV charging stations, and the subsequent industrialization of the grid.

The US market for substation automation is expanding steadily as the traditional substations are being modernized and upgraded by the adoption of control systems at the medium and high voltage levels. The growing adoption by the utilities of the benefits offered by automation, such as improved efficiency, reduced outage time, and the integration of DER, will also propel the growth of the North American market. The requirement for a reliable and smart power grid system will keep the US at the forefront.

Source: Straits Research

Europe Market Insights

The adoption of substation automation in the European power market has been registering steady growth, driven by the rapid integration of transportation sector power, massive integration of offshore wind, and an increasing trend of sharing power across borders in an integrated grid. In the European power market, utilities have been giving paramount importance to substation automation to successfully synchronize their grids, reduce transmission losses, and enhance their resilience in response to the variability in power demand.

The German market for substation automation is driven by the rising number of renewable energy-based grids, as well as efforts to stabilize power flow in industrial areas. Further, there has been an increasing trend towards decentralized energy production, leading to higher adoption of automated substations capable of coping with varying loads and bidirectional power flow. Upgrades in medium- and high-voltage substations for automation purposes are making Germany a crucial player in the European market.

Latin America Market Insights

The market for substation automation in Latin America is picking up pace as the upgrading of old power infrastructure and the augmentation of access to electrified connections in urban as well as rural areas are increasing in the region. The adoption of substation automation is increasing as a means to reduce outage periods and a consequence of the growing demand for industry-based electrification.

The Brazilian market for automating substations is expanding with increasing megascale renewable projects and industrial power consumption. The use of automated substations is increasing to handle remote transmission and stabilize the power grid in various regions. Increasing investment in digital monitoring and automatic control solutions is helping power utilities enhance efficiency and maintain a stable power supply.

Middle East & Africa Market Insights

The Middle East and Africa market for substation automation is growing due to investments made by nations within this region to develop power infrastructure that translates to their growth and consumption of electricity. Utilities within this region are also implementing substation automation technology that is used to boost power grid reliability, optimize power distribution, and cut down power outages.

The population of the UAE substation automation market has been growing due to the increased focus on the power grid by the UAE to support smart cities, large-scale infrastructural developments, and growing industrial operations. The increased adoption of automated substations has been for the uninterrupted supply of power, improved grid operations, and increased reliability during high-demand periods. The UAE has been a significant contributor to the growth of the Middle East & Africa substation automation market.

Component Insights

Hardware led the substation automation industry, with a revenue share of around 49.8% in 2025. The prominent market share is primarily due to the long-standing adoption of hardware infrastructure such as intelligent electronic devices, protection relays, sensors, and communication systems, especially in the transmission and distribution stations.

The software segment, on the other hand, will record the highest growth, with a projected CAGR of approximately 9.6%. The growth will come about as a result of increased demand for sophisticated monitoring, control, and analysis solutions capable of facilitating real-time data visualization, as well as those allowing for distant functionality and centralized management of power grids.

Source: Straits Research

Communication Protocol

In 2025, the DNP3 market accounted for a leading share in the substation automation industry, with a revenue share of approximately 32.4%. The major reason for this is its extensive use in older transmission and distribution systems, especially where utilities require reliable long-range communication capabilities and compatibility with existing supervisory control systems.

The IEC 61850 segment is anticipated to witness the fastest growth, registering a projected CAGR of 9.9% during the forecast timeframe. This accelerated growth is driven by its object-oriented architecture, high-speed data exchange, and seamless interoperability across intelligent electronic devices, making it the preferred protocol for digital substations and future-ready grid automation projects.

Voltage Level Insights

In 2025, the Medium Voltage Substations were the highlight in the substation automation industry, capturing around 44.3% market revenue. The medium voltage substation plays an integral role in the power distribution chain, implemented in most factories, business areas, and urban areas.

The market for high voltage substations is likely to expand at the fastest pace. The main reason for this is the growth in long-distance transmission, increasingly interconnected large-scale power generation stations, as well as the need for automated monitoring and protection systems for efficiently controlling high-capacity and complex power flows.

End Use Application

The Utilities industry is estimated to grow at the fastest CAGR of approximately 8.6% during the forecasted period. This is driven by an increased need for reliability, real-time monitoring, and automation within power transmission and distribution. With an increase in power consumption and the rise in the complexity of power distribution, the focus on automation is increasing for the utility industry, thereby ensuring steady growth for this market.

Competitive Landscape

The global substation automation market is moderately consolidated, characterized by the strong presence of multinational electrical equipment manufacturers and automation solution providers with broad product portfolios and global delivery capabilities. A limited number of established players account for a significant share of the market due to their end-to-end offerings encompassing hardware, software, and services, along with deep integration expertise across transmission and distribution networks.

The major players in the market include ABB Ltd., Siemens AG, Schneider Electric SE, and others. These industry leaders compete to strengthen their market positions through continuous portfolio expansion, strategic partnerships, digital substation deployments, and targeted mergers and acquisitions aimed at enhancing technological capabilities and expanding their regional footprint.

NovaTech Automation: An emerging market player

NovaTech Automation, a U.S.-based automation solutions provider, has distinguished itself in the market by focusing on utility-grade networking and digital substation components tailored for modern grid environments.

- In January 2025, NovaTech introduced the Hermes 2000 Ethernet switch series with 28 ports optimized for substation automation communication and real-time data exchange across distributed grid assets.

Thus, NovaTech Automation emerged as a notable player in the global market, leveraging specialized communication hardware solutions that address the growing demand for robust digital substation networking and interoperability.

List of Key and Emerging Players in Substation Automation Market

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- General Electric

- Hitachi Energy Ltd.

- Eaton Corporation

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Larsen & Toubro

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Cisco Systems, Inc.

- Emerson Electric Co.

- NR Electric Co., Ltd.

- Schweitzer Engineering Laboratories

- CG Power and Industrial Solutions

- Hyundai Electric & Energy Systems

- Fuji Electric Co., Ltd.

- Open Systems International

- Belden Inc.

- Others

Strategic Initiatives

- June 2025: Advantech showcased future-proof substation automation solutions, including IEC 61850-3 certified compute platforms and Ethernet switches for virtualized protection, control, and monitoring systems, at the CIRED 2025 conference in Geneva, strengthening its automation portfolio ecosystem with partners like Nvidia and Fortinet to enhance grid automation capabilities.

- May 2025: Hitachi Energy announced it will deliver the world’s first SF₆-free 550 kV gas-insulated switchgear to the Central China Branch of State Grid Corporation of China, advancing eco-efficient high-voltage solutions that complement automated grid control and reduce environmental impact.

- March 2025:Schneider Electric launched its One Digital Grid Platform, an integrated AI-powered solution designed to enhance grid resiliency, reliability, and operational efficiency for utilities, supporting seamless substation automation and grid modernization efforts globally.

- February 2024: General Electric Vernova – GE Grid Solutions secured multi-million-dollar substation automation equipment orders from Power Grid Corporation of India Ltd. (PGCIL) to support renewable integration and transmission network upgrades across India’s 765 kV grid infrastructure.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 38.23 billion |

| Market Size in 2026 | USD 41.4 billion |

| Market Size in 2034 | USD 75.2 billion |

| CAGR | 8.2% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Component, By Communication Protocol, By Voltage Level, By End Use Application |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Substation Automation Market Segments

By Component

- Hardware

- Software

- Services

By Communication Protocol

- IEC 61850

- DNP3

- Modbus

- IEC 60870-5-101

By Voltage Level

- Low Voltage Substations

- Medium Voltage Substations

- High Voltage Substations

By End Use Application

- Utilities

- Industrial Facilities

- Renewable Energy Integration

- Transportation Infrastructure

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.