Transduction Technologies Market Size, Share & Trends Analysis Report By Product (Transduction Kits, Transduction Enhancers, Others), By Target Cell Type (Stem Cells, Cancer Cells, Immune Cells, Others), By Application (Gene Therapy, Cell Therapy, Vaccines, Others), By End Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, CROs & CDMOs) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Transduction Technologies Market Overview

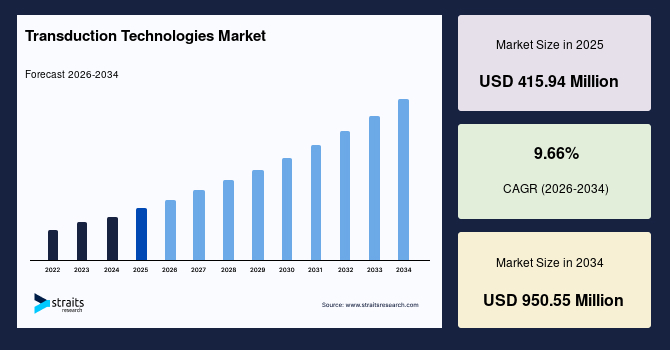

The global transduction technologies market size is valued at USD 415.94 million in 2025 and is estimated to reach USD 950.55 million by 2034, growing at a CAGR of 9.66% during the forecast period. The consistent market growth is supported by the rising adoption of gene delivery platforms across expanding cell and gene therapy development pipelines.

Key Market Trends & Insights

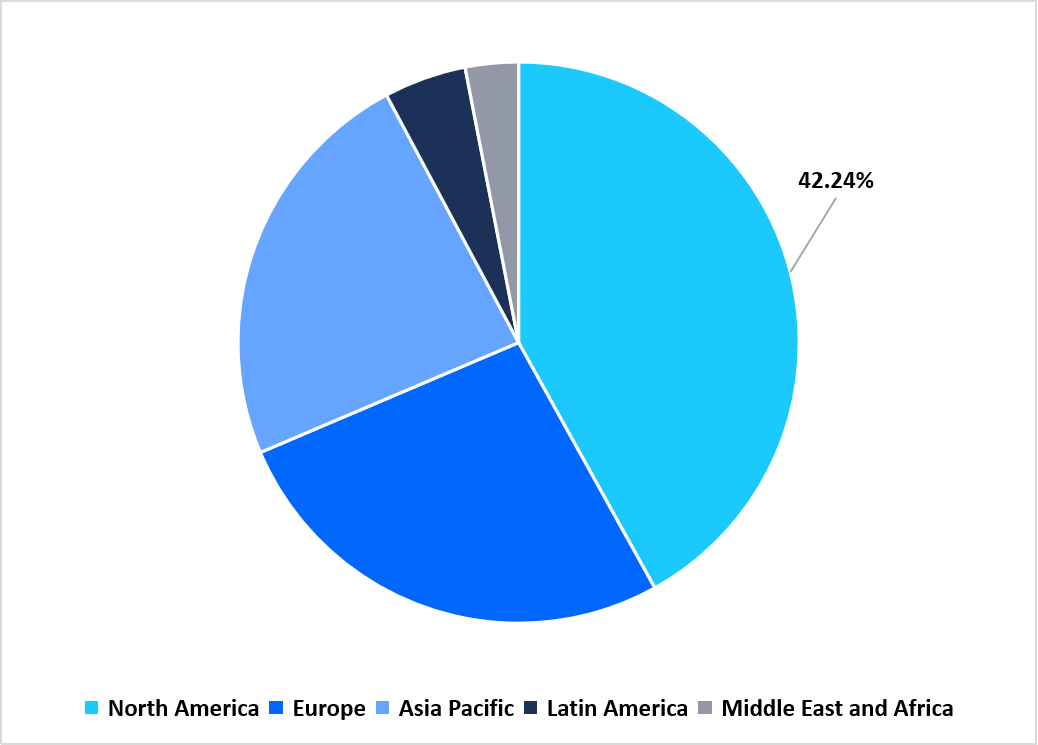

- North America held a dominant share of the global market, accounting for 42.24% in 2025.

- The Asia Pacific region is projected to grow at the fastest pace, with a CAGR of 9.66%.

- Based on product, the transduction kits segment held the highest revenue market share of 50.23% in 2025.

- By target cell type, the immune cells segment dominated the market in 2025 with a revenue share of 41.23%.

- Based on application, the gene therapy segment dominated the market in 2025 with a revenue share of 47.82%.

- By end use, the pharmaceutical and biotechnology companies segment held the largest market share of 46.12% in 2025.

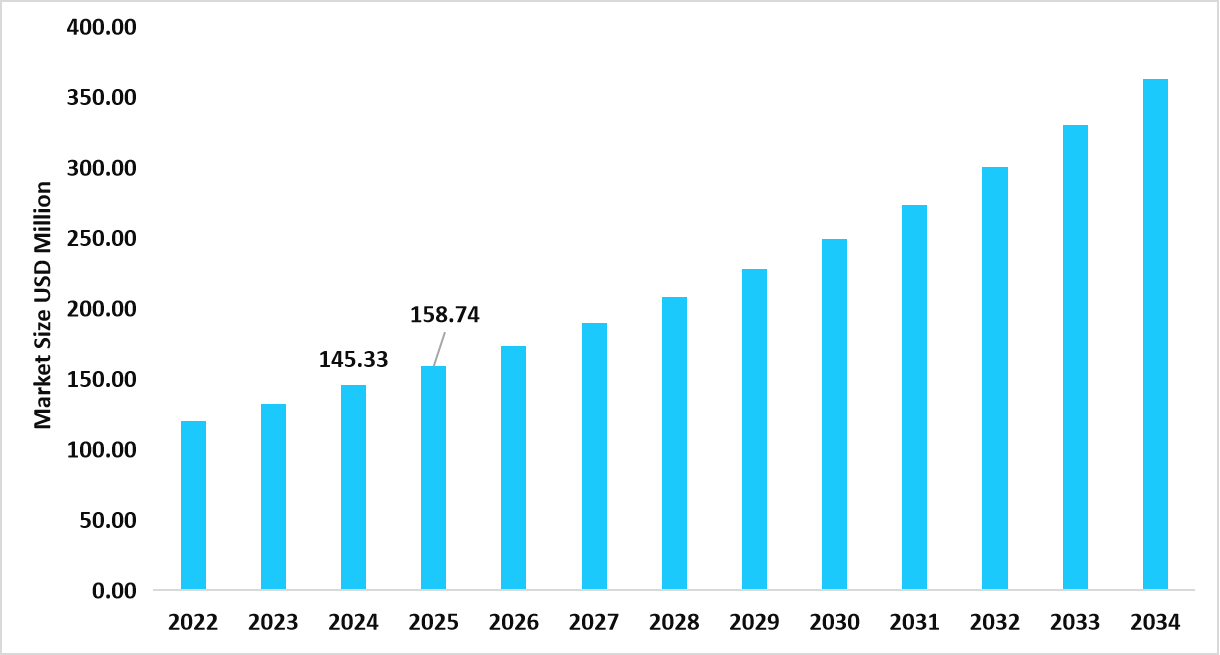

- The U.S. dominates the transduction technologies market, valued at USD 145.33 million in 2024 and reaching USD 158.74 million in 2025.

Table: U.S. Transduction Technologies Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 415.94 million

- 2034 Projected Market Size: USD 950.55 million

- CAGR (2026-2034): 9.66%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

The transduction technologies market encompasses the tools, reagents, delivery platforms, and workflow systems used to introduce genetic material into target cells for research, therapeutic development, and production applications. This market includes transduction kits, enhancers, and related consumables that support gene-transfer processes across stem cells, cancer cells, immune cells, and other biological models. Transduction technologies form a core component of gene therapy, cell therapy, and vaccine research, enabling controlled modification of cells for functional studies and therapeutic design.

Demand is driven by expanding activity in pharmaceutical and biotechnology companies, academic and research institutes, and CROs and CDMOs that integrate these systems within discovery pipelines and development programmes. The market continues to evolve as laboratories adopt structured workflows and specialized delivery approaches to meet growing requirements in engineered-cell platforms and vector-based research.

Latest Market Trends

Expansion of Modular Transduction Workstations in high-throughput Labs

A growing trend in the transduction technologies market is the adoption of modular workstations that consolidate multiple gene-delivery steps into a single controlled setup. These platforms incorporate environmental regulation, integrated dosing channels, and automated sequence execution that reduce manual intervention and maintain steady conditions across experiments. High-throughput laboratories are increasingly adopting these systems to handle rising assay volumes and maintain uniformity when running large panels of gene-transfer studies. This transition toward structured workstations reflects a broader movement within research centres to stabilise complex workflows and boost overall productivity.

Growing Uptake Of Serotype-customised Vector Panels for Precision Research

The emerging trend is the rising utilisation of vector panels crafted with specialised capsid serotypes that target specific cellular receptors. These customised serotype libraries enable researchers to explore tissue-selective delivery patterns and understand vector performance across nuanced biological environments. Institutes engaged in therapeutic discovery are expanding their use of such panels to fine-tune dose ranges, assess cell-specific uptake, and shorten early optimisation cycles. The push toward serotype differentiation is contributing to a more comprehensive understanding of vector behaviour across diverse investigative models.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 415.94 Million |

| Estimated 2026 Value | USD 454.63 Million |

| Projected 2034 Value | USD 950.55 Million |

| CAGR (2026-2034) | 9.66% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Akron Biotech, Lonza, Oxford Biomedica PLC, Catalent, Inc , Fujifilm |

to learn more about this report Download Free Sample Report

Market Driver

Rising demand for high-titre vector batches in accelerated development programmes

A key driver accelerating the market is the growing requirement for concentrated vector batches that support rapid progression through preclinical workflows. Research teams advancing therapeutic constructs often run parallel modification cycles, and access to high-titre lots ensures uninterrupted execution across iterative evaluations. High-yield vector supply also minimizes schedule delays linked to production bottlenecks, enabling projects to maintain momentum as they transition through analytical, functional, and scale-up stages. This growing reliance on concentrated vector volumes is strengthening demand for transduction systems capable of supporting intensive development timelines.

Market Restraint

Protocol variability across cell models is limiting transfer standardization

A notable restraint for market expansion is the considerable variation in transduction behaviour across different cell populations. Adjustments to culture density, exposure windows, media supplements, and vector ratios are often required to achieve target performance, creating complexity when organizations attempt to establish unified workflows. These variations increase optimization time and reduce the transferability of established protocols across programmes. As a result, institutions face an added workload when adapting transduction designs for new cell models, which slows broader process standardization across research settings.

Market Opportunity

Rising Establishment of Regional Vector-training Hubs Supporting Workforce Expansion

A strong opportunity is emerging through the creation of regional training hubs focused on vector handling, transduction workflow execution, biosafety competence, and quality-guided laboratory practice. These centres equip early-career scientists, technicians, and manufacturing personnel with practical skills that align with growing research and clinical development pipelines. Expansion of training infrastructure raises overall workforce capacity, enabling institutions to scale programmes that depend on advanced transduction workflows. As more regions invest in these educational hubs, adoption of transduction technologies is expected to grow steadily across academic and commercial environments.

Regional Analysis

North America Market Insights

North America held a leading position in the transduction technologies market in 2025 with a 42.24% share, supported by a strong base of gene therapy developers and large-scale vector manufacturing facilities. The region benefits from active collaborations between biotechnology firms and federal research institutions, which speed up evaluation of new transduction tools and reinforce adoption across research and clinical settings. This environment encourages broad utilization of viral and non-viral gene delivery systems across academic laboratories and commercial production units.

In the U.S., rising demand for high-volume vector supply from cell and gene therapy manufacturers is driving rapid expansion of specialized production hubs. These facilities are incorporating advanced transduction enhancers and optimized reagent platforms to streamline upstream and downstream processes, which strengthens the country’s position as a central production and development zone for gene delivery technologies.

Asia Pacific Market Insights

Asia Pacific is progressing at a rapid pace with steady growth of 11.66% supported by the expansion of local biopharmaceutical manufacturing clusters and increasing investment in cell-based research. Regional suppliers are ramping up production of cost-focused transduction reagents, which increases accessibility for small and mid sized laboratories across metropolitan and developing research zones. These dynamics contribute to wider utilization of transduction platforms across clinical research and preclinical development pipelines.

In Japan, adoption is rising due to strong integration of automated laboratory workflows that incorporate precision transduction modules. Japanese institutes are deploying digitally coordinated bioprocess systems that enable accurate gene transfer procedures in stem cell and regenerative medicine programs which elevates national demand for specialized reagents and vector delivery kits.

Regional Market share (%) in 2025

Source: Straits Research

Europe Market Insights

Europe maintains stable growth supported by unified regulatory pathways that simplify approvals for research-grade and GMP-compliant transduction tools across EU member countries. This coherence shortens entry timelines for suppliers and improves market access across laboratories involved in gene modification studies and biotherapeutic development.

In Germany, expansion is driven by extensive partnerships between universities and biotechnology firms focused on optimizing vector engineering and transduction efficiency studies for various cell populations. These collaborative research clusters provide continuous experimental data that encourages the adoption of advanced viral vector platforms across national research networks.

Latin America Market Insights

Latin America is experiencing steady expansion supported by the growing availability of compact vector preparation systems that suit hospitals and research facilities with limited infrastructure. These systems allow regional laboratories in major cities such as São Paulo and Mexico City to engage in gene modification programs without large-scale equipment investments, which broadens access to transduction technologies.

In Argentina, demand is increasing due to government-supported capability-building programs that emphasize workforce training in viral vector handling and gene delivery methods. National institutes are investing in specialized education modules that raise technical proficiency, which encourages broader integration of transduction tools within the country’s biomedical research sector.

Middle East and Africa Market Insights

The Middle East and Africa region is advancing due to flexible procurement structures that reduce upfront acquisition barriers for laboratories adopting transduction systems. Subscription-based access to reagents and vector delivery kits offers a feasible model for institutions with constrained budgets, which supports wider penetration across emerging research environments.

In South Africa, market growth is driven by the expansion of genomic and cell-based research units within public universities and medical teaching centers. These institutions are establishing dedicated vector study labs that incorporate modern culture suites and controlled transduction rooms, which increase national uptake of gene delivery technologies.

Product Insights

The transduction kits segment dominated the market in 2025, accounting for 50.23% revenue share, supported by the wide utilization of ready-to-use viral and non-viral kits that streamline gene transfer across varied cell models. These kits provide structured components that allow consistent performance in laboratory workflows, reinforcing their strong adoption across research and manufacturing environments.

The transduction enhancers segment is projected to register the fastest CAGR of 10.12% during the forecast period. Growth is driven by expanding use of enhancer formulations that raise gene-transfer efficiency in challenging cell types, enabling laboratories to improve transduction output without major workflow changes.

Target Cell Type Insights

The immune cells segment dominated the market, accounting for 41.23% share in 2025. Rising utilization of T cells, NK cells, and dendritic cells in engineered-cell programs has elevated demand for transduction tools suited for immune-cell modification, positioning this segment as the leading contributor within the market.

The stem cells segment is estimated to record the fastest CAGR of 10.23%, supported by growing research in regenerative platforms that require stable and controlled gene incorporation. Increasing application in disease modelling and early-stage therapeutic exploration elevates demand for transduction systems tailored for stem-cell populations.

Application Insights

The gene therapy segment dominated the market in 2025, capturing 47.82% revenue share as vector-based gene transfer remains central to functional studies, therapeutic construct development, and preclinical validation. High utilization across discovery pipelines reinforces its leading position.

The cell therapy segment is expected to register the fastest CAGR of 10.55%, driven by expanding adoption of engineered immune-cell programmes and modified stem-cell lines. Rising integration of transduction steps in clinical candidate generation supports rapid growth within this segment.

End Use Insights

The pharmaceutical and biotechnology companies segment dominated the market, accounting for 46.12% share in 2025. Strong investment in vector development, engineered-cell platforms, and scalable production workflows sustains high utilization of transduction technologies across commercial pipelines.

The CROs and CDMOs segment is poised to record the fastest CAGR of 10.78%, driven by rising outsourcing of vector production, transduction optimization, and development-stage studies. Demand for external expertise and flexible capacity contributes to steady acceleration in this segment.

Competitive Landscape

The global transduction technologies market remains moderately fragmented, with biotechnology tool manufacturers and gene delivery solution providers maintaining dominant positions. These companies strengthen their market presence through continuous product refinement, strategic alliances with research institutions, and wider distribution footprints that expand laboratory and clinical access.

Takara Bio Inc.: An emerging market player

Takara Bio Inc. continues to broaden its role within the transduction technologies market through a focused portfolio of viral vector reagents and transduction enhancers that support consistent gene delivery performance. The company engages with research institutions and therapy developers to extend usage of its platforms across diverse cell models. Through continued product refinement and strengthened relationships with end users, Takara Bio USA is advancing its presence within the competitive landscape.

List of Key and Emerging Players in Transduction Technologies Market

- Akron Biotech

- Lonza

- Oxford Biomedica PLC

- Catalent, Inc

- Fujifilm

- WuXi AppTec

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Takara Bio Inc.

- OZ Biosciences

- Mirus Bio

- System Biosciences, LLC.

- Miltenyi Biotec

- Applied Biological Materials Inc. (abm)

- Takara Bio Inc.

- Others

Strategic Initiatives

- May 2024: Takara Bio Inc. introduced its Lenti-X Transduction Sponge to the U.S. market. This dissolvable microfluidic tool was designed to enhance lentiviral gene delivery and had improved transduction efficiency in multiple human cell types.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 415.94 Million |

| Market Size in 2026 | USD 454.63 Million |

| Market Size in 2034 | USD 950.55 Million |

| CAGR | 9.66% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Target Cell Type, By Application, By End Use |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Transduction Technologies Market Segments

By Product

- Transduction Kits

- Transduction Enhancers

- Others

By Target Cell Type

- Stem Cells

- Cancer Cells

- Immune Cells

- Others

By Application

- Gene Therapy

- Cell Therapy

- Vaccines

- Others

By End Use

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- CROs & CDMOs

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.