Vacation Rental Market Size, Share & Trends Analysis Report By Accommodation Type (Homes, Resorts/Condominiums, Apartments, Villas, Hometowns), By Booking Mode (Online, Offline), By Price Point (Economical, Mid-Range, Luxury), By End-User (Leisure Travellers, Business Travellers, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Vacation Rental Market Size

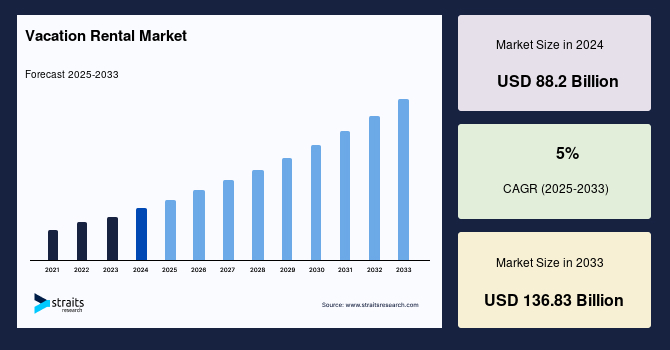

The global vacation rental market size was valued at USD 88.2 billion in 2024 and is projected to grow from USD 92.61 billion in 2025 to USD 136.83 billion in 2033, exhibiting a CAGR of 5% during the forecast period (2025-2033).

The global market is experiencing robust growth, driven by evolving traveller preferences, technological advancements, and the rise of the sharing economy. Travellers increasingly seek unique, personalised accommodations that offer home-like amenities, privacy, and flexibility. Digital platforms such as Airbnb, Vrbo, and Booking.com have revolutionised the booking process, making it more accessible and user-friendly. Technological integration, such as smart home features and seamless booking platforms, enhances guest experiences and operational efficiency. The proliferation of remote work and the blending of work and leisure travel ("workcations") have further fueled demand for vacation rentals.

Additionally, the growing middle class in emerging economies and increased disposable incomes are expanding the customer base for vacation rentals. However, the market faces challenges, including regulatory hurdles in various cities and concerns over housing affordability. Despite these challenges, the market is poised for sustained growth, with opportunities for innovation and expansion in developed and emerging markets.

Market Trend

Rise of Luxury and Experiential Stays

The vacation rental market is increasingly shifting toward luxury and experiential accommodations, as travellers seek stays that offer more than just a place to sleep. Guests now prioritise curated experiences, high-end amenities, and personalised services. This trend is visible in platforms like Airbnb, which expanded its “Airbnb Luxe” and “Airbnb Experiences” categories.

- For instance, in May 2024, Airbnb introduced a new “Icons” collection premium listings tied to celebrities and iconic destinations, offering curated stays such as Barbie’s Malibu DreamHouse and the X-Men Mansion.

Luxury properties now feature unique add-ons like private chefs, spa services, and themed décor designed by hospitality designers such as Jessica Duce and Paula Oblen, who tailor experiences for niche traveller types. Hosts also incorporate sustainability and local culture into their offerings eco-lodges, vineyard villas, and historic castles are increasingly sought after. Technology further enhances this trend, with AI-driven concierge apps providing custom itineraries and local recommendations. As travellers value authenticity and exclusivity, the demand for memorable, experience-rich stays is expected to grow, prompting platforms and hosts to innovate continually.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 88.2 Billion |

| Estimated 2025 Value | USD 92.61 Billion |

| Projected 2033 Value | USD 136.83 Billion |

| CAGR (2025-2033) | 5% |

| Dominant Region | Europe |

| Fastest Growing Region | North America |

| Key Market Players | Airbnb, Vrbo, Booking.com, TripAdvisor Rentals, Expedia Group |

to learn more about this report Download Free Sample Report

Global Vacation Rental Market Growth Factor

Technological Advancements

Technological innovations are significantly propelling the vacation rental market forward. Smart home technologies, including keyless entry systems, smart thermostats, and voice-activated assistants, enhance guest convenience and security.

- For example, in May 2025, Airbnb introduced an AI-powered concierge that offers personalised recommendations based on user preferences, enhancing the overall guest experience. This AI integration streamlines trip planning and provides tailored suggestions, fostering customer loyalty and repeat bookings.

Advanced property management software also aids hosts by automating booking processes, managing dynamic pricing, and facilitating real-time communication with guests. These technological advancements improve operational efficiency and elevate the guest experience, positioning vacation rentals as a competitive alternative to traditional accommodations.

Market Restraint

Regulatory Challenges

Regulatory hurdles are among the most pressing challenges facing the global vacation rental market. Governments and municipalities worldwide are implementing stricter rules to combat rising housing costs, noise complaints, and the overtourism impact of short-term rentals. These regulations often limit the days a property can be rented, enforce license requirements, or impose hefty taxes on hosts and platforms.

In Spain, a leading tourist destination, authorities in January 2025 ordered Airbnb and other platforms to remove over 65,000 illegal listings, especially in over-saturated regions like Barcelona, Ibiza, and the Canary Islands. Similar crackdowns have occurred in New York City, where Local Law 18 now requires hosts to register with the city and meet strict occupancy criteria.

These actions reduce inventory and increase compliance costs for hosts and platforms. The lack of uniform regulations across cities and countries complicates cross-border operations for global providers. Regulatory constraints may hinder market growth and innovation in key regions without a balanced policy framework that protects housing availability while encouraging tourism.

Market Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for growth in the vacation rental industry. As travel becomes more accessible and disposable incomes rise in regions like Asia-Pacific and Latin America, demand for alternative accommodations is increasing. Platforms are expanding their reach into these markets, offering localised services and culturally tailored experiences to attract new customer segments.

- For instance, in May 2025, Airbnb introduced new features in cities like San Antonio, Austin, and Rockport, allowing guests to book personalised services and local experiences directly through the platform. By tapping into these emerging markets, vacation rental providers can diversify their portfolios and capitalise on the growing demand for unique and affordable travel experiences.

Furthermore, Airbnb's expansion into Southeast Asia, including countries like Vietnam, Thailand, and the Philippines, demonstrates the platform's commitment to tapping into high-growth regions. By localising content and engaging with communities, vacation rental providers can tap into a vast, underserved market. The continued democratisation of travel in these regions presents a compelling opportunity for long-term growth and market diversification.

Regional Analysis

Europe continues leading the global vacation rental market with a 34% share in 2024, driven by its vast cultural, architectural, and geographic diversity. Tourists flock to destinations such as France, Italy, Spain, and Greece for unique experiences ranging from vineyard stays in Tuscany to alpine chalets in Switzerland. Cities like Paris and Barcelona also attract urban travellers seeking short-term rentals. The region’s well-established regulatory frameworks support quality standards and guest safety, fostering consumer trust. Moreover, the surge in eco-conscious travel and sustainable lodging options like eco-cabins and solar-powered villas draws interest from environmentally aware tourists. Local platforms like Holidu and HomeToGo are expanding their footprint alongside global giants like Airbnb and Booking.com. The growing preference for “slow travel” and cultural immersion further drives demand for vacation rentals over hotels, with extended stays becoming increasingly common.

The UK market benefits from increased domestic tourism and growing interest in regional heritage and nature-based stays. Following the popularity of staycations post-Brexit, areas like Cornwall, the Lake District, and the Scottish Highlands have seen a rise in bookings. The UK Government’s 2025 tourism recovery plan promotes investment in local attractions and lodging quality. Platforms are working with local councils to enforce safety and tax compliance, enhancing trust. Airbnb’s 2024 partnership with VisitBritain aims to promote cultural and rural tourism experiences.

Germany's vacation rental market is growing, supported by its efficient infrastructure, environmental initiatives, and cultural heritage. Berlin and Munich are introducing new rental licensing systems, promoting transparency and responsible hosting. The government’s Green Tourism Initiative encourages the development of sustainable accommodations. Vacationers increasingly opt for countryside escapes, especially in Bavaria and the Black Forest. Digital check-in services and eco-retreats are gaining traction among younger demographics.

North America Market Trends

North America is the fastest-growing region in the global vacation rental market, fueled by shifting traveller preferences, rising disposable incomes, and increasing tech adoption. The rise of “bleisure” travel blending business and leisure has boosted demand for rentals equipped with workspaces and high-speed internet. Airbnb reported a 20% increase in U.S.-based long-term stays in Q1 2025 compared to the previous year, highlighting a shift in travel behaviour. Technology continues to reshape the landscape with smart home integrations, AI-driven guest personalisation, and enhanced mobile apps, making the rental experience seamless. North America’s legal landscape is also maturing, with clearer regulations in cities like New York and Los Angeles helping stabilise the market.

The U.S. remains the largest vacation rental market globally due to its extensive geographic and cultural diversity. Remote work and “live-anywhere” trends drive long-term rental bookings, especially in scenic locations like Colorado, Florida, and the Pacific Northwest. Airbnb's "Icons" feature, offering celebrity-themed stays, illustrates the shift toward experiential lodging. Government policies supporting tourism and infrastructure upgrades also bolster market growth. Short-term rental regulations continue to evolve, offering more stability to hosts and platforms.

Canada’s market is expanding, particularly in provinces offering immersive outdoor experiences. British Columbia’s Whistler and Quebec’s Laurentians are favoured for year-round tourism. Expedia reported a 17% increase in 2025 in vacation rental demand across Canada compared to 2023. The country's focus on sustainable tourism and digital connectivity (like 5G expansion in rural areas) enhances accessibility and the traveller experience. Short-term rental guidelines are being streamlined, encouraging more participation from professional hosts.

Asia-Pacific Market Trends

The Asia-Pacific vacation rental market is growing steadily, projected at a CAGR of 4.9% through 2030, fueled by economic expansion, rising middle-class incomes, and increased regional tourism. China and India are major contributors, while emerging markets like Vietnam, Indonesia, and the Philippines are gaining traction due to their natural beauty and affordability. Technology adoption is another driver, with a surge in smartphone bookings and digital wallets making rentals more accessible. Companies like Tujia and Xiaozhu in China, and MakeMyTrip in India, are enhancing customer engagement through app-based loyalty programs and local experience packages. Additionally, the region is witnessing a rise in luxury rentals and wellness retreats, especially in resorts like Bali and Phuket.

China continues to witness strong growth in vacation rentals, with a CAGR of 6% projected through 2030. The rise of domestic tourism, particularly among millennials and Gen Z, is fueling demand. In 2024, Tujia announced a strategic partnership with local governments to expand rural tourism. Smart city initiatives and 5G infrastructure are improving digital connectivity, making it easier for travellers to find and book accommodations. Tourist hotspots like Yunnan, Sichuan, and Hainan are experiencing high demand for experiential and heritage-focused stays.

India is emerging as a high-growth market, with a forecasted CAGR of 15.7% through 2033. The young demographic, the growing middle class, and digital innovation are key drivers. Platforms like StayVista and Airbnb are investing in vernacular language support and localised experiences. Demand for heritage stays in Rajasthan and eco-retreats in Kerala and Himachal Pradesh is surging. Mobile-first travellers, influencer marketing, and digital nomadism are reshaping the market’s trajectory.

Accommodation Type Insights

Homes dominate the vacation rental market due to affordability, privacy, and suitability for families and groups. Unlike hotels, rental homes offer full kitchens, multiple bedrooms, and private amenities like pools or yards. Platforms such as Airbnb and VRBO have made home rentals easily accessible, offering millions of listings globally. The post-COVID travel landscape favoured homes as travellers sought less crowded, safer spaces. Homes are also ideal for longer stays and remote work getaways. Their versatility and comfort continue attracting domestic and international travellers, making them the preferred accommodation type in this market.

Booking Mode Insights

Online booking is the leading mode in the vacation rental market, driven by digital adoption, mobile penetration, and consumer preference for convenience. Travellers can compare options, read verified reviews, view images, and book instantly on platforms like Airbnb, Booking.com, and Vrbo. Integrating AI-powered tools, personalised suggestions, real-time pricing updates, and chat-based support enhances the user experience. Contactless check-in features and digital payment systems have further fueled this shift. As travel becomes more digitally integrated, online booking will remain the dominant channel, especially among tech-savvy millennials and Gen Z travellers.

Price Point Insights

Mid-range vacation rentals dominate the price segmentation due to their balance of affordability and quality. These properties typically offer comfortable amenities such as Wi-Fi, air conditioning, and modern furnishings, catering to leisure and business travellers seeking value without compromising comfort. Mid-range options are popular among middle-income families, couples, and digital nomads. They are often located in tourist-friendly areas and offer better flexibility and services than economical rentals. Platforms highlight these listings with premium visuals and verified reviews, helping them appeal to a broad customer seeking reliable, well-priced accommodation.

End-User Insights

Leisure travellers represent the largest end-user segment in the vacation rental market, driven by growing global tourism and a rising interest in experiential travel. These users prioritise comfort, location, and immersive experiences, often choosing rentals that reflect local culture or unique design. Families, couples, and groups booking vacations, weekend getaways, or holiday stays form the core of this segment. Platforms like Airbnb cater to their needs by offering curated stays and personalised recommendations. Seasonal demand, festivals, and school holidays heavily influence booking patterns. As travel becomes more lifestyle-oriented, leisure travellers continue shaping the vacation rental landscape.

List of Key and Emerging Players in Vacation Rental Market

- Airbnb

- Vrbo

- Booking.com

- TripAdvisor Rentals

- Expedia Group

- Tujia (China)

- OYO Rooms

- Agoda Homes

- 9flats

- RedAwning

- Homestay.com

- FlipKey

- Roomorama

- Couchsurfing

to learn more about this report Download Market Share

Recent Developments

- August 2024- RedAwning, a vacation rental platform, has partnered with Amazon to introduce Smart Concierge™ services. This collaboration leverages Amazon's technology to provide guests with enhanced services, such as voice-activated assistance and personalised recommendations, to elevate the guest experience.

- June 2024- Indian hospitality firm OYO expanded its high-end vacation rental brand, Belvilla, into the UK market. Collaborating with Sojo Stays, OYO offers exclusive vacation homes in major UK cities, targeting travellers seeking premium accommodations.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 88.2 Billion |

| Market Size in 2025 | USD 92.61 Billion |

| Market Size in 2033 | USD 136.83 Billion |

| CAGR | 5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Accommodation Type, By Booking Mode, By Price Point, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Vacation Rental Market Segments

By Accommodation Type

- Homes

- Resorts/Condominiums

- Apartments

- Villas

- Hometowns

By Booking Mode

- Online

- Offline

By Price Point

- Economical

- Mid-Range

- Luxury

By End-User

- Leisure Travellers

- Business Travellers

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.