Vitrification Market Size, Share & Trends Analysis Report By Product (Instruments, Vitrification Kits & Media, Consumables & Accessories), By Specimen (Oocytes, Embryos, Sperm), By End-User (Fertility Clinics & IVF Centers, Cryobanks & Biobanks, Research Institutes & Academic Centers, Hospitals & Specialty Clinics, Pharmaceutical & Biotechnology Companies) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Vitrification Market Size

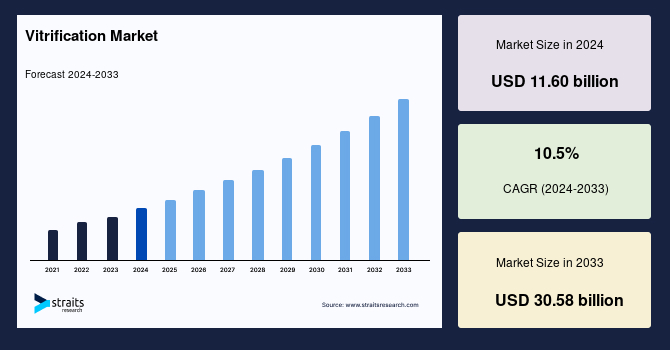

The global vitrification market size was valued at USD 11.6 billion in 2024 and is anticipated to grow from USD 12.82 billion in 2025 to reach USD 28.49 billion in 2033, growing at a CAGR of 10.5% during the forecast period (2025–2033).

The market is experiencing steady growth, driven by the increasing adoption of assisted reproductive technology (ART) and the rising demand for fertility preservation. Vitrification, a rapid freezing technique used to preserve reproductive specimens, prevents crystallization and has revolutionized reproductive medicine. Compared to traditional slow-freezing methods, vitrification significantly improves survival rates, leading to higher embryo implantation and better pregnancy success rates.

- For example, a study published in Agro Productivity in January 2024 highlights that vitrification is a cost-effective and easily executed alternative for embryo preservation, with pregnancy rates ranging from 40-46% for both vitrified and fresh embryos. Such findings are raising awareness about the effectiveness of vitrification as a key ART technique, driving its growing adoption.

In addition to embryo vitrification, sperm vitrification is gaining attention, particularly with the expansion of sperm banking for both medical and donor-assisted reproduction. Ongoing innovations in vitrification media, cryoprotectants, and storage techniques continue to improve the efficiency and reliability of the process. With increasing investments in reproductive healthcare and the global expansion of fertility clinics, the market is set for continued growth in the coming years.

Market Trends

Automation in Cryopreservation Processes

Automation in cryopreservation is revolutionizing the vitrification market by increasing precision, reducing human error, and enhancing efficiency. Automated systems are streamlining the entire process, from the preparation of cryoprotectants to the storage and retrieval of specimens.

- For instance, in December 2023, an article published in National Center for Biotechnology Information(NCBI) stated that researchers had developed an automated vitrification thawing system (AVTS) based on cryo-handle. This system is developed to address the challenges associated with manual vitrification.

Such innovations are improving consistency and throughput in fertility clinics, leading to higher IVF success rates and accelerating the adoption of vitrification techniques in reproductive medicine.

Single-Sperm Vitrification Techniques

Single-sperm vitrification is gaining prominence in addressing male infertility. This method focuses on preserving individual sperm cells, particularly for men with low sperm count or quality. Recent advancements have optimized this technique, improving sperm viability after thawing.

- For instance, in February 2022, a study published in the Cryobiology Journal demonstrated the successful use of single-sperm vitrification in patients with severe male infertility.

These breakthroughs are improving intracytoplasmic sperm injection (ICSI) outcomes, enabling men with previously unmanageable sperm quality to benefit from successful fertility treatments, driving market growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 11.60 Billion |

| Estimated 2025 Value | USD 12.82 Billion |

| Projected 2033 Value | USD 28.49 Billion |

| CAGR (2025-2033) | 10.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Vitrolife, Genea BIOMEDX, NidaCon International AB., MINITÜB GMBH, Cryo Bio System |

to learn more about this report Download Free Sample Report

Vitrification Market Growth Factors

Rising Demand for Oncofertility Solutions

The increasing survival rates of cancer patients are driving demand for fertility preservation before chemotherapy or radiation treatments. Vitrification offers an effective solution for the long-term storage of oocytes, embryos, and sperm, enabling cancer survivors to conceive post-treatment.

- For instance, in July 2024, an article in the American Society of Clinical Oncology Journal, according to updated ASCO guidelines from 2018, stated that vitrification can be used when traditional fertility preservation techniques are not feasible, particularly in patients with breast cancer.

This growing recognition has led to an increase in demand for vitrification services among oncology patients seeking fertility preservation options.

Advancements in Cryoprotectant Formulations

New innovations in cryoprotectants are improving vitrification efficiency by reducing toxicity and enhancing post-thaw survival rates. These advancements are making vitrification more effective and reliable for long-term specimen storage.

- For instance, in September 2024, according to the article of Technology Networks Informatics, researchers from the Universities of Manchester and Warwick developed a machine learning-based methodology to enhance cryoprotectant. By identifying chemicals that inhibit the development of ice crystals during freezing, the novel technology enhances the storage of specimens while lowering dependency on conventional techniques.

Such advancements are driving greater adoption of vitrification techniques in fertility clinics, ensuring better clinical outcomes and expanding accessibility to fertility preservation options.

Restraining Factor

Ethical and Legal Complexities in Cryopreservation

Varying regulations on the storage, ownership, and use of embryos and gametes create barriers to widespread adoption. In countries like Germany and Italy, strict laws limit long-term embryo freezing, impeding market growth. Legal disputes over embryo ownership, such as high-profile custody battles, further complicate the situation. Moreover, varying ethical standards and regulatory uncertainty in different regions limit the availability of vitrification services. These legal and ethical hurdles create difficulties for fertility clinics and cryostorage providers, restricting market expansion and access to advanced reproductive technologies.

Market Opportunity

Integration of Blockchain for Cryostorage Tracking

Blockchain technology is revolutionizing cryostorage management by offering enhanced transparency, security, and traceability. It provides tamper-proof records for the storage and handling of reproductive cells, significantly reducing mix-ups, administrative errors, and data manipulation. By ensuring that all storage and retrieval processes are accurately logged and easily accessible, blockchain boosts patient confidence in the system.

- For instance, in March 2024, TMRW Life Sciences introduced a blockchain-based tracking system for frozen embryos and oocytes, ensuring real-time monitoring and minimizing mix-ups in fertility clinics.

With increasing regulatory demands for compliance in ART procedures, blockchain integration presents a significant opportunity to enhance cryostorage accountability.

Regional Insights

North America holds a dominant position in the global vitrification market, driven by high adoption rates of elective fertility preservation, strong regulatory support for assisted reproductive technology, and robust investments in cryopreservation research. The region benefits from increasing oncofertility initiatives, with organizations such as the American Society for Reproductive Medicine pushing for fertility preservation among cancer patients.

Moreover, leading fertility clinics in the U.S. and Canada are integrating AI-driven vitrification systems, further enhancing specimen viability and streamlining the process. The presence of industry leaders like CooperSurgical and FUJIFILM Irvine Scientific further strengthens North America's position, driving advancements in vitrification technology and ensuring sustained growth in the market.

The U.S. vitrification industry is driven by strong regulatory oversight and high adoption rates of assisted reproductive technology (ART), with 12% of reproductive-aged individuals affected by infertility. The American Society for Reproductive Medicine (ASRM) plays a key role in shaping ART policies, while federal agencies like the CDC, FDA, and CMS maintain strict quality controls. The CDC’s ART surveillance, the FDA’s regulation of reproductive tissues, and state-level fertility specialist licensing contribute to a highly structured and growth-oriented market.

Asia Pacific Vitrification Market Trends

Asia Pacific is poised to experience the highest CAGR in the global vitrification market, driven by increasing government support for ART procedures, rising medical tourism, and greater awareness of fertility preservation options. Countries such as Japan and South Korea are boosting demand for vitrification with insurance coverage for ART, while India and Thailand are emerging as global IVF hubs, offering cost-effective and high-quality cryopreservation services. The expansion of specialized fertility centers, including Virtus Health’s recent expansion in Singapore (May 2024), further propels market growth in the region.

China’s vitrification industry is expanding due to rising infertility rates and supportive government policies amid declining birth rates. With 12% of couples experiencing infertility, demand for ART services, including vitrification, is increasing. The Three-Child Policy and relaxed ART regulations have fueled growth, while cities like Beijing and Shanghai are promoting state-backed fertility clinics. Moreover, in 2023, China’s National Health Commission expanded insurance coverage for fertility treatments, further driving the adoption of oocyte and embryo vitrification.

South Korea’s market for vitrification is rapidly expanding due to government-backed fertility programs and high IVF success rates exceeding 60%. With one of the world’s lowest birth rates, recorded at 0.72 in 2023, the government has increased ART subsidies and insurance coverage for fertility treatments, boosting demand for oocyte and embryo vitrification. Moreover, South Korea has over 50 advanced IVF clinics integrating cutting-edge cryopreservation technologies, making it a key player in the Asia-Pacific ART market.

India’s vitrification industry is witnessing significant growth due to the rise of medical tourism for IVF and the affordability of advanced fertility treatments. With over 250,000 IVF cycles performed annually, India has become a global hub for ART services. The cost of vitrification procedures is significantly lower compared to Western countries, attracting international patients. Moreover, advancements in cryopreservation technologies and the presence of world-class fertility centers in cities like Mumbai and Delhi are driving market expansion.

Europe Vitrification Market Trends

Germany’s market is influenced by strict embryo protection laws under the Embryo Protection Act. Due to legal restrictions on embryo selection and storage, oocyte vitrification is more common than embryo freezing. The German Ethics Council and Leopoldina, the National Academy of Sciences, have called for policy reforms to align with modern ART advancements. Despite regulatory hurdles, the growing demand for fertility preservation and ART has driven the expansion of vitrification services, making Germany a prominent market player.

Product Insights

The instruments segment leads the global market, contributing the highest revenue due to their critical role in ensuring ultra-rapid cooling and maintaining precise cryopreservation conditions for oocytes, embryos, and sperm. Advanced devices such as automated freezing systems and closed vitrification kits minimize contamination risks, enhance efficiency, and improve post-thaw survival rates.

- For example, in February 2024, Cook Medical launched the NEST-VT Vitrification Device, which standardizes freezing protocols and improves specimen handling, resulting in better outcomes for IVF clinics.

Specimen Insights

The oocytes segment holds the largest share of the market, driven by the increasing demand for fertility preservation among women delaying childbirth and cancer patients undergoing treatment. Oocyte vitrification is preferred due to its higher survival rates and improved success in assisted reproductive technology (ART) compared to traditional slow-freezing methods. This has made oocyte vitrification a key solution for fertility preservation, further boosting its adoption and market growth.

End-User Insights

Fertility clinics and IVF centers dominate the global market, contributing the highest revenue due to their central role in providing fertility preservation services. These centers integrate advanced assisted reproductive technology (ART) with specialized cryopreservation facilities, ensuring standardized protocols, expert supervision, and better patient outcomes. Their ability to offer vitrification as a part of IVF treatments has led to its widespread adoption, further strengthening their position in the market.

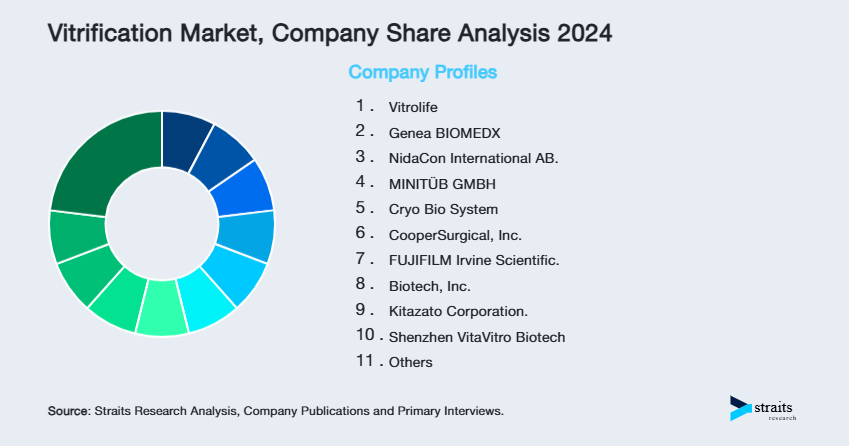

Company Market Share

Key players in the vitrification industry are increasingly focusing on adopting strategic business approaches to strengthen their market position. These strategies include forming strategic collaborations with research institutions, expanding product portfolios through regulatory approvals, pursuing acquisitions to enhance technological capabilities, and launching innovative products tailored to evolving market needs.

Kitazato Corporation: An Emerging Player in the Global Vitrification Market

Kitazato Corporation is a leading Japanese company specializing in reproductive medicine, particularly in assisted reproductive technologies (ART). Kitazato also offers advanced embryo transfer catheters, culture media, and other ART-related products. With a strong global presence, the company continues to drive innovation in fertility treatments, collaborating with clinics and research institutions worldwide to enhance reproductive success rates.

Recent Developments by Kitazato Corporation:

- In December 2024, Kitazato Corporation highlighted advancements in vitrification through its Wrapped 2024 initiative, showcasing breakthroughs in cryopreservation techniques for oocytes, embryos, and sperm. The initiative emphasizes the company's commitment to enhancing the viability of preserved specimens and improving post-thaw survival rates.

List of Key and Emerging Players in Vitrification Market

- Vitrolife

- Genea BIOMEDX

- NidaCon International AB.

- MINITÜB GMBH

- Cryo Bio System

- CooperSurgical, Inc.

- FUJIFILM Irvine Scientific.

- Biotech, Inc.

- Kitazato Corporation.

- Shenzhen VitaVitro Biotech

- Fairtility

- IVF Store

- FERTIPRO NV

- Cryoport Systems, LLC

- Pluristyx, Inc.

to learn more about this report Download Market Share

Recent Developments

- March 2024 – TMRW Life Sciences launched CryoLink, an innovative platform designed to help fertility clinics adopt a digital management system for the storage of frozen eggs and embryos. This cutting-edge technology enhances cryostorage practices by improving safety, security, and transparency through real-time tracking and monitoring.

Analyst Opinion

As per our analyst, the global vitrification market is experiencing robust growth, driven by continuous advancements in cryopreservation techniques and the increasing demand for fertility preservation. The rising adoption of assisted reproductive technologies (ART) is a key factor, with innovations such as automation in cryopreservation, single-sperm vitrification, and blockchain integration for cryostorage tracking enhancing efficiency and patient outcomes.

Despite these advancements, the market faces several challenges, including ethical and legal complexities surrounding embryo storage and ownership, as well as high costs associated with advanced cryopreservation technologies. Regulatory restrictions in certain regions and the need for specialized equipment can also limit accessibility to these technologies, especially in emerging markets.

However, the expansion of oncofertility applications and regenerative medicine, along with increasing support from regulatory bodies and healthcare organizations, provides significant growth opportunities. The continued investment in research and development, as well as advancements in cryopreservation materials and methods, is expected to overcome current challenges, positioning the vitrification for sustained expansion.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 11.60 Billion |

| Market Size in 2025 | USD 12.82 Billion |

| Market Size in 2033 | USD 28.49 Billion |

| CAGR | 10.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Specimen, By End-User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Vitrification Market Segments

By Product

- Instruments

- Vitrification Kits & Media

- Consumables & Accessories

By Specimen

- Oocytes

- Embryos

- Sperm

By End-User

- Fertility Clinics & IVF Centers

- Cryobanks & Biobanks

- Research Institutes & Academic Centers

- Hospitals & Specialty Clinics

- Pharmaceutical & Biotechnology Companies

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.