Workwear Market Size, Share & Trends Analysis Report By Product Type (General Workwear, Protective Workwear, Corporate Workwear), By End-Use Industry (Manufacturing, Construction, Oil & Gas, Healthcare, Hospitality, Others), By Distribution Channel (Direct Sales, Retail Stores, E-commerce Platforms) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Workwear Market Size

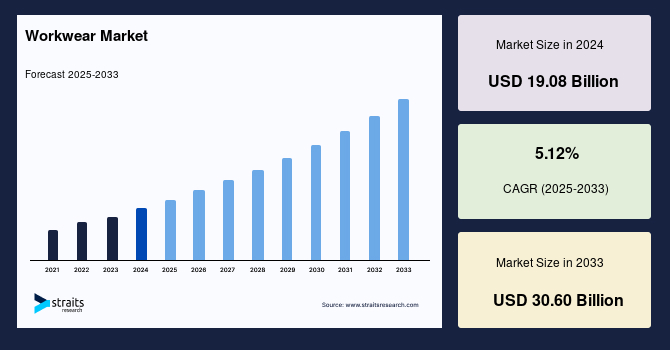

The global workwear market size was valued at USD 19.08 billion in 2024 and is projected to grow from USD 20.06 billion in 2025 to USD 30.60 billion by 2033, exhibiting a CAGR of 5.12% during the forecast period (2025–2033).

The global workwear market encompasses clothing and accessories designed for employees across various industries to ensure safety, functionality, and professionalism. This includes protective gear for hazardous environments, uniforms for brand representation, and specialised attire for specific job functions. Workwear serves multiple purposes: safeguarding workers from occupational hazards, promoting company identity, and enhancing performance through comfort and utility. The market caters to manufacturing, construction, healthcare, hospitality, and corporate offices. With evolving workplace standards and increasing emphasis on employee well-being, the demand for innovative, durable, and compliant workwear has surged.

The workwear market is driven by stringent occupational safety regulations, growing industrialisation, and heightened awareness of workplace hazards. The rise in construction and manufacturing activities, especially in emerging economies, has amplified the need for protective clothing. Additionally, the increasing focus on corporate branding has led companies to invest in customised uniforms that reflect their identity. Trends shaping the market involve integrating advanced materials offering flame resistance, high visibility, and moisture-wicking properties. Sustainability has become paramount, with manufacturers adopting eco-friendly fabrics and ethical production practices. Furthermore, incorporating smart technologies, such as wearable sensors for health monitoring, is revolutionising workwear, enhancing safety, and operational efficiency.

Latest Market Trend

Integration of Smart Technologies in Workwear

Integrating smart technologies into workwear continues to transform the industry, driven by innovations in IoT, AI, and wearable sensors. Construction and manufacturing industries are also adopting augmented reality (AR)-enabled smart helmets like those from Trimble and DAQRI, which help workers visualise infrastructure schematics on-site.

- For example, in August 2024, Honeywell introduced a line of connected safety wearables integrated with real-time monitoring for hazardous environments, used extensively in the oil & gas sectors.

These technologies improve productivity and significantly reduce error margins and downtime. Moreover, logistics companies like DHL have tested smart uniforms with embedded sensors to monitor body temperature and stress levels to prevent fatigue-related injuries.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 19.08 Billion |

| Estimated 2025 Value | USD 20.06 Billion |

| Projected 2033 Value | USD 30.60 Billion |

| CAGR (2025-2033) | 5.12% |

| Dominant Region | Asia-Pacific |

| Fastest Growing Region | North America |

| Key Market Players | VF Corporation, Fristads Kansas Group, Carhartt, Alsico, Wesfarmers |

to learn more about this report Download Free Sample Report

Workwear Market Growth Factors

Emphasis on Workplace Safety and Regulatory Compliance

Heightened focus on occupational health and safety remains a major market driver. Regulatory frameworks have tightened further post-pandemic, compelling firms to reassess and upgrade their workwear standards.

- For instance, in the EU, EU-OSHA's revised directive on protective gear in high-risk industries now mandates flame-resistant and anti-static clothing in the petrochemical and energy sectors. Additionally, in the Asia-Pacific region, governments in India and China are increasing workplace audits and mandating certified protective gear, especially in construction and mining.

Businesses like DuPont and 3M have responded by releasing new product lines that meet or exceed international safety standards. These measures enhance safety and serve as a business safeguard against penalties and litigation, driving steady demand across verticals such as manufacturing, transportation, and utilities.

Market Restraint

High Costs Associated with Advanced Workwear

Despite technological advancement, cost remains a significant barrier, especially for SMEs. Premium smart or eco-friendly workwear can cost 20–50% more than conventional clothing. For example, connected garments from Wearable X or Hexoskin incorporate biometric tracking, but their high production and maintenance costs limit adoption outside of large-scale enterprises. Sustainable options like organic cotton or recycled fibre-based uniforms from Fristads or Patagonia Workwear are priced above market averages due to higher raw material and processing expenses.

This cost challenge is exacerbated by the need for ongoing maintenance, calibration of embedded tech, and shorter life cycles for some advanced textiles. Addressing this restraint will require broader collaboration on standardisation, cost-efficient supply chains, and government incentives.

Workwear Market Opportunity

Growing Demand for Sustainable and Eco-Friendly Workwear

With sustainability rising as a global imperative, the workwear industry is witnessing a significant shift toward environmentally responsible practices.

- For instance, in January 2025, leading brands such as Carhartt and Engelbert Strauss expanded their eco-friendly collections, utilising Global Organic Textile Standard (GOTS)-certified cotton and recycled polyester. Similarly, Spanish company Ecoalf collaborated with industrial clients across the EU to supply durable uniforms made from recycled ocean plastics, reflecting a growing demand for ethical materials.

Major manufacturers adopt circular economy approaches by implementing take-back schemes and textile recycling programs. Brands like Tensar and Dassy have invested in closed-loop production systems to reduce textile waste and lower carbon emissions. This momentum is further reinforced by the rise of green procurement mandates in sectors such as public infrastructure, energy, and utilities.

This evolving landscape encourages innovation across material science and ethical manufacturing, positioning eco-conscious workwear as a core growth opportunity for the market.

Regional Insights

Asia-Pacific commands over 42.6% of the global workwear market share, solidifying its position as the dominant and fastest-growing region. Rapid industrialization, urban expansion, and strong growth in sectors like automotive, electronics, logistics, and infrastructure continue to fuel demand. Countries such as China, India, Vietnam, and Indonesia are experiencing a surge in manufacturing activities, which boosts the need for high-performance and compliant workwear. Additionally, local players are collaborating with international brands to produce smart and sustainable workwear tailored for regional needs. The growth of the e-commerce sector and rising awareness about workplace safety are also major contributors.

- China’s workwear demand continues to grow, especially in Tier 2 and Tier 3 cities, due to increased construction and smart factory development. In 2024, local companies began mass-producing low-cost smart vests equipped with heat sensors and biometric monitoring to comply with revised labor safety laws.

- India is emerging as a key growth frontier, with increased investments in industrial corridors and smart city projects. Government-backed schemes such as “Shram Suvidha” enforce stricter workwear mandates, while local manufacturers like Arvind Limited push eco-friendly and affordable PPE options.

North America Workwear Market Trends

North America represents over 40% of the global workwear revenue, with an estimated market size of USD 26.70 billion in 2025. Key industries driving this growth include construction, manufacturing, oil & gas, and healthcare. Innovations in protective textiles, such as antimicrobial, fluid-resistant, and stretchable fabrics, are becoming industry standards. In 2024, brands like Cherokee and Dickies launched new workwear lines featuring smart fabrics and ergonomic designs specifically for healthcare professionals and frontline workers. Regulatory oversight by OSHA and the CDC ensures continuous demand for compliant workwear, while ESG (Environmental, Social, and Governance) goals are pushing businesses toward adopting more sustainable and ethically sourced uniforms.

- The U.S. workwear market thrives on a diverse economy and regulatory enforcement. In 2024, brands like Carhartt, Red Kap, and 5.11 Tactical focused on integrating anti-microbial, flame-resistant, and moisture-wicking technologies into their apparel. The growing gig economy and increase in remote and field-based workers have also driven demand for hybrid utility workwear that blends style with functionality.

- Canada's market benefits from ongoing energy sector activity, particularly in Alberta’s oil sands and new mining projects in British Columbia. The Canadian Centre for Occupational Health and Safety (CCOHS) has also introduced updated guidelines encouraging the adoption of heat-stress mitigation clothing, driving R&D in climate-adaptive fabrics.

Europe Workwear Market Trends

Europe’s workwear market is experiencing steady growth, underpinned by strict labour safety regulations and increasing corporate responsibility standards. As of 2024, demand for flame-retardant, chemical-resistant, and high-visibility clothing has increased by 25% in industries such as construction, energy, and healthcare. The EU’s Green Deal and updated PPE directives are prompting businesses to invest in eco-friendly and ethically sourced workwear materials. Germany, France, and the UK spearhead innovation in sustainable textiles, with companies like Fristads and Engelbert Strauss launching product lines using recycled polyester and biodegradable packaging. Additionally, a growing number of companies are adopting circular economy models, including uniform recycling programs and “rental + reuse” platforms.

- The UK’s emphasis on carbon neutrality and ethical labour practices has prompted major corporations to require eco-certifications from suppliers in 2024. Brands like Portwest and Leo Workwear are scaling up sustainable collections and introducing modular uniforms that reduce waste.

- Germany remains a manufacturing powerhouse, with a workwear market rooted in performance, precision, and compliance. The DIN standards around PPE have influenced innovation in modular and multi-season workwear. Local companies are leading the shift toward durable, repairable garments, in line with EU waste-reduction goals.

Product Type Insights

Protective workwear is the fastest-growing segment, spurred by stricter safety regulations, especially in high-risk industries. According to the World Health Organisation (WHO) and OSHA, workplace-related injuries result in over 2.78 million deaths annually, highlighting the urgent need for high-performance safety gear. This segment includes flame-retardant, high-visibility, chemical-resistant, and anti-static clothing. The construction, oil & gas, and utilities sectors are key consumers, but new demand is emerging from food processing and agriculture, particularly in Europe and Asia. Smart PPE is a game-changer here companies like Guardhat and 3M are integrating sensors, communication modules, and climate adaptation into protective gear.

End-Use Insights

The manufacturing sector remains one of the largest consumers of workwear globally, fueled by the need for functional, durable, and often protective clothing. Employees require clothing that ensures safety and comfort across varied operational conditions, from automotive to electronics and heavy machinery. Increased automation and smart factory environments are driving demand for apparel compatible with sensors and wearables. Companies like Honeywell and VF Corporation have introduced machine-washable smart workwear with temperature and motion sensors to reduce accidents in manufacturing floors. The growth in female workforce participation is also encouraging brands to diversify fit and design offerings, making the segment more inclusive. With sustainability targets tightening, demand is rising for low-impact textiles that meet industrial durability standards, further reshaping procurement strategies.

Distribution Channel Insights

Direct sales remain a dominant distribution model for enterprise-scale purchases. Companies prefer dealing directly with manufacturers or authorized distributors for large-volume, custom-branded, and regulation-compliant workwear orders. This model allows better pricing control, quality assurance, and post-sales support. Leading players such as Aramark, Cintas, and Alsico maintain dedicated enterprise sales teams to serve large corporations and government agencies. Subscription-based uniform rental and laundering services are also commonly delivered through this channel. Recent digitalization of B2B operations has allowed companies to streamline procurement through online platforms with real-time inventory, customization tools, and automated compliance checks, cutting procurement lead times by up to 30%.

List of Key and Emerging Players in Workwear Market

- VF Corporation

- Fristads Kansas Group

- Carhartt

- Alsico

- Wesfarmers

- Cintas

- Vostok Service

- Engelbert Strauss

- Aramark

- UniFirst

- Adolphe Lafont

- Technoavia

to learn more about this report Download Market Share

Recent Developments

- January 2025 - Carhartt announced a new trade-in program aimed at promoting sustainability in the workwear industry. This initiative allows customers to return used garments, which are then recycled or repurposed, reducing textile waste and encouraging circular fashion practices.

- December 2024 - Avolta, a leading global travel experience company, partnered with Spanish sustainable fashion brand Ecoalf to create employee uniforms made from recycled materials for duty-free stores in Palma de Mallorca, Ibiza, and Mahón airports. This collaboration resulted in significant environmental savings, including 3.21 million litres of water and 12,100 kg of CO₂ emissions. The uniforms are certified by PETA Vegan Approved, Global Recycled Standard, and Organic 100 Content Standard, reflecting a strong commitment to sustainability.

Analyst Opinion

As per our analyst, the global workwear market is on a robust growth trajectory, buoyed by industrial expansion, technological innovation, and evolving regulations. From AI-integrated apparel to carbon-neutral production models, the sector is undergoing a significant transformation. Analysts note that customisation driven by industry-specific needs, body diversity, and climate considerations is becoming a central theme, with modular and gender-inclusive designs gaining popularity.

Moreover, the rise of direct-to-consumer (DTC) brands and digital procurement platforms like Workwear Outfitters and Snickers Workwear is reshaping the distribution landscape, offering more flexible and cost-efficient solutions. The ongoing convergence of functionality, safety, and fashion positions workwear as an essential gear and a strategic investment for employers and workers.

As ESG metrics grow more important to corporate governance, stakeholders who align with sustainability and innovation are expected to thrive in the competitive landscape of 2025 and beyond.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 19.08 Billion |

| Market Size in 2025 | USD 20.06 Billion |

| Market Size in 2033 | USD 30.60 Billion |

| CAGR | 5.12% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product Type, By End-Use Industry, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Workwear Market Segments

By Product Type

- General Workwear

- Protective Workwear

- Corporate Workwear

By End-Use Industry

- Manufacturing

- Construction

- Oil & Gas

- Healthcare

- Hospitality

- Others

By Distribution Channel

- Direct Sales

- Retail Stores

- E-commerce Platforms

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.