Xanthan Gum Market Size, Share & Trends Analysis Report By Form (Dry Powder, Liquid), By Function (Thickening Agent, Stabilizing Agent, Emulsifying Agent, Suspending Agent, Others), By Source (Corn-based, Wheat-based, Soy-based, Dairy-based, Others), By End-User Industry (Food Industry, Oil & Gas Industry, Pharmaceutical Industry, Cosmetic & Personal Care Industry, Chemical Industry, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Xanthan Gum Market Size

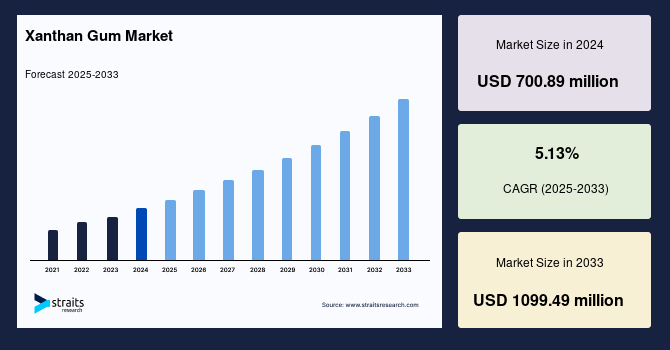

The global xanthan gum market size was valued at USD 700.89 million in 2024 and is anticipated to grow from USD 736.84 million in 2025 to reach USD 1099.49 million by 2033, growing at a CAGR of 5.13% during the forecast period (2025–2033).

Xanthan gum is a natural polysaccharide commonly utilized as a food additive and thickening agent. It is produced through the fermentation of sugar by the bacterium Xanthomonas campestris. Widely used in the food industry, it improves the texture, stability, and shelf life of products like salad dressings, sauces, and gluten-free baked goods. Xanthan gum can also suspend solid particles and prevent ingredients from separating. Beyond food, it finds applications in cosmetics, pharmaceuticals, and industrial products. It is generally recognized as safe and suitable for people with gluten intolerance.

The global xanthan gum market is witnessing robust growth primarily driven by the surge in processed and convenience food consumption across developed and developing regions. Moreover, the booming oil and gas industry, particularly the rise in shale gas exploration and extraction activities, is significantly propelling xanthan gum demand. Furthermore, expanding pharmaceutical applications, especially in the formulation of controlled-release drugs and oral suspensions, are further supporting market growth, with xanthan gum valued for its biocompatibility and stability.

Emerging Market Trends

Expanding Applications in Cosmetics, Personal Care, and Pharmaceutical Industries

The application of xanthan gum is rapidly expanding in the cosmetics, personal care, and pharmaceutical sectors, driven by increasing consumer preference for natural, multifunctional ingredients. Xanthan gum's unique properties, such as its ability to thicken, stabilize, and provide bioadhesion, make it a key component in these industries.

- For example, in 2025, researchers developed XanterDES, an ophthalmic formulation combining 0.2% xanthan gum with 0.025% desonide sodium phosphate. This novel eye drop aims to manage ocular surface discomfort by enhancing drug retention and minimizing side effects. Additionally, a new niaprazine-loaded xanthan gum formulation has been introduced, offering a shear-thinning, mucoadhesive solution suitable for pediatric patients, improving dosing flexibility and compliance.

These advancements are likely to foster greater adoption of xanthan gum in advanced pharmaceutical and cosmetic products.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 700.89 Million |

| Estimated 2025 Value | USD 736.84 Million |

| Projected 2033 Value | USD 1099.49 Million |

| CAGR (2025-2033) | 5.13% |

| Dominant Region | Asia Pacific |

| Fastest Growing Region | North America |

| Key Market Players | CP Kelco, Cargill Incorporated, ADM (Archer Daniels Midland Company), Deosen Biochemical Ltd., Jungbunzlauer Suisse AG |

to learn more about this report Download Free Sample Report

Xanthan Gum Market Growth Factors

Rising Prevalence of Gluten Allergy and Sensitivity

The growing prevalence of gluten allergies and sensitivities is significantly driving the demand for xanthan gum in gluten-free food products. Gluten-related disorders, like Celiac disease and non-celiac gluten sensitivity (NCGS), are increasing globally, encouraging the food industry to adopt xanthan gum as a gluten substitute.

- For instance, Celiac disease, an autoimmune disorder triggered by gluten, affects approximately 1.4% of the global population based on serologic tests, with higher rates observed in children and women. In addition to Celiac disease, NCGS is becoming more recognized, with estimated prevalence rates ranging from 1% to 13% in the general population.

This surge in gluten intolerance is boosting the demand for gluten-free food products, where xanthan gum is extensively utilized as a thickening and stabilizing agent.

Market Restraint

Price Volatility of Raw Materials

The price volatility of raw materials, particularly corn sugar and other carbohydrates, poses a significant restraint to the growth of the global xanthan gum market. As xanthan gum is manufactured through fermentation, variations in the cost of raw materials can cause instability in production expenses. This volatility makes it difficult for manufacturers to maintain stable pricing, potentially affecting profit margins and resulting in higher prices for consumers. Additionally, dependence on agricultural inputs, which are subject to weather conditions and global supply chain disruptions, further exacerbates these cost-related challenges in the market.

Market Opportunity

Innovation in Product Formulations

The innovation in xanthan gum formulations presents significant opportunities for market expansion, particularly in the food, pharmaceutical, and personal care industries. Manufacturers are increasingly focusing on developing specialized xanthan gum variants to meet consumer demand for sustainable, clean-label, and allergen-free ingredients.

- For instance, in January 2025, CP Kelco introduced the KELTROL® CG series biodegradable xanthan gums certified by COSMOS and NATRUE designed to enhance texture and stability in natural personal care products like shampoos and lotions. These innovations cater to the surging consumer preference for natural and eco-friendly solutions, driving the demand for functional and specialty xanthan gum products.

As industries seek more sustainable and versatile ingredients, such innovations are expected to accelerate market growth.

Regional Insights

Asia Pacific: Dominant Region

Asia-Pacific is emerging as a high-growth region for xanthan gum, driven by rapid expansion in the food processing and packaged food industries. Rising health awareness is fueling demand for gluten-free, low-fat, and allergen-free products, boosting xanthan gum application. The region's booming oil and gas exploration sector is also generating significant industrial demand. Furthermore, increasing investments in pharmaceutical manufacturing and personal care production are creating new opportunities for xanthan gum as a versatile formulation ingredient.

- The Indian market is expanding steadily and is driven by the growing processed food and pharmaceutical industries. Companies like Hindustan Gum and India Glycols are increasing production capacity. Rising demand for gluten-free bakery products and oil & gas exploration activities, especially in Gujarat and Rajasthan, are creating robust growth opportunities for xanthan gum suppliers.

- The China market is flourishing due to its dominance in global production and export. Major manufacturers like Fufeng Group and Deosen Biochemical lead the market. High demand from food processing and oil drilling sectors, particularly shale gas projects, fuels growth. China's focus on natural food additives further drives domestic consumption and international supply.

North America: Significantly Growing Region

The xanthan gum market in North America is witnessing strong growth due to the surging demand for gluten-free and low-fat food products. Expanding oil and gas exploration activities are driving industrial-grade xanthan gum consumption, particularly for drilling fluids. Additionally, the growing trend toward clean-label and plant-based ingredients in the food and beverage sector is boosting adoption. Robust investments in pharmaceutical research further enhance xanthan gum utilization in drug formulations, supporting regional market expansion.

- The U.S. market thrives on strong demand from processed foods, pharmaceuticals, and oil & gas sectors. Companies like General Mills use xanthan gum in gluten-free product lines. The shale boom across Texas and North Dakota significantly boosts industrial xanthan gum consumption for oilfield operations, while cosmetic brands incorporate it in personal care formulations.

- Canada's market is growing due to the rising popularity of gluten-free products and clean-label foods. Major food companies like Maple Leaf Foods are incorporating xanthan gum in plant-based and bakery products. Additionally, the country's expanding shale gas activities in Alberta drive xanthan gum demand for drilling fluids and oil recovery operations.

Europe: Substantial Potential for Growth

In Europe, the xanthan gum market is expanding steadily, fueled by the increasing preference for natural and sustainable food additives. Stringent food safety regulations promote the use of high-quality, non-synthetic thickeners, which benefits xanthan gum adoption. Growth in the vegan and vegetarian food sectors has amplified demand for alternative stabilizers and emulsifiers. Moreover, the cosmetics and personal care industries are increasingly integrating xanthan gum into formulations for natural and organic product lines, reinforcing regional market prospects.

- Germany's market is driven by its robust food and beverage industry, with demand growing due to the increasing preference for gluten-free and organic food products. For example, brands like Kraft Heinz and Nestlé incorporate xanthan gum as a stabilizer in sauces and dressings, boosting their market presence in the region.

- The UK's market is expanding due to rising consumer demand for clean-label and gluten-free products. The adoption of xanthan gum in beverages and dairy alternatives, such as Alpro's plant-based drinks, showcases its importance as a thickener and emulsifier in a variety of products, further supporting market growth in the region.

Form Insights

The liquid form of xanthan gum is gaining traction owing to its ease of blending and faster dispersion in industrial applications. It offers uniform consistency, eliminating the need for pre-hydration steps required in dry powders. In the food and personal care industries, liquid xanthan gum is preferred for formulating smooth-textured products like dressings, sauces, lotions, and gels. Its convenience and process efficiency are driving its growing demand across multiple sectors.

Function Insights

Xanthan gum is widely recognized as an effective thickening agent across diverse industries. In food products, it enhances viscosity without altering flavor, making it ideal for soups, sauces, and gluten-free baked goods. In oil drilling, it stabilizes drilling fluids, while in cosmetics, it improves product texture. Its high efficiency at low concentrations and stability under varying temperatures and pH levels make it a critical ingredient for thickening applications.

Source Insights

Corn-based xanthan gum dominates the market due to the abundant availability and cost-effectiveness of corn as a raw material. Corn sugars serve as an optimal substrate for the fermentation process, ensuring high yields and consistent product quality. This segment is particularly favored in the food and beverage industry, where non-GMO and organic corn sources further enhance product appeal. Its stable supply chain and sustainability are key drivers for growth.

End-User Insights

The food industry remains the largest consumer of xanthan gum, leveraging its properties as a stabilizer, thickener, and emulsifier. It plays a vital role in improving the texture, shelf life, and quality of dairy products, dressings, sauces, and gluten-free foods. With rising demand for clean-label and allergen-free products, xanthan gum's natural origin and multifunctionality make it highly desirable, ensuring robust growth prospects within the global food sector.

List of Key and Emerging Players in Xanthan Gum Market

- CP Kelco

- Cargill Incorporated

- ADM (Archer Daniels Midland Company)

- Deosen Biochemical Ltd.

- Jungbunzlauer Suisse AG

- Fufeng Group Company Limited

- Meihua Holdings Group Co., Ltd.

- Ingredion Incorporated

- Zoranoc Oilfield Chemical

- Hebei Xinhe Biochemical Co., Ltd.

to learn more about this report Download Market Share

Recent Developments

- September 2024 – Jungbunzlauer announced that they have committed around $200 million to expand their existing facility in Port Colborne, Ontario, with a new xanthan gum production line. The current 50,000-square-foot plant, operational since 2002, manufactures biodegradable ingredients sourced from corn. It also produces items such as citric acid and specialty salts through natural fermentation processes, according to the company.

Analyst Opinion

As per our analyst, the global xanthan gum market is poised for steady growth driven by rising demand for clean-label food ingredients, the expansion of the processed food industry, and surging applications across oil & gas, pharmaceuticals, and personal care sectors. The shift toward gluten-free and vegan diets is further fueling product adoption.

However, the market faces challenges like raw material price volatility and the availability of substitutes like guar gum, which could limit potential gains. Regulatory compliance across different regions also presents operational hurdles for manufacturers.

Despite these challenges, continuous innovations in production technologies and the surging demand from emerging economies are expected to create significant opportunities. Strategic collaborations, product diversification, and sustainability initiatives will be crucial for players aiming to strengthen their market position.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 700.89 Million |

| Market Size in 2025 | USD 736.84 Million |

| Market Size in 2033 | USD 1099.49 Million |

| CAGR | 5.13% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Form, By Function, By Source, By End-User Industry |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Xanthan Gum Market Segments

By Form

- Dry Powder

- Liquid

By Function

- Thickening Agent

- Stabilizing Agent

- Emulsifying Agent

- Suspending Agent

- Others

By Source

- Corn-based

- Wheat-based

- Soy-based

- Dairy-based

- Others

By End-User Industry

- Food Industry

- Oil & Gas Industry

- Pharmaceutical Industry

- Cosmetic & Personal Care Industry

- Chemical Industry

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.