CBD Pouches Market Size, Share & Trends Analysis Report By Content (Up to 10 mg, 10 mg - 20 mg, Others), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

CBD Pouches Market Overview

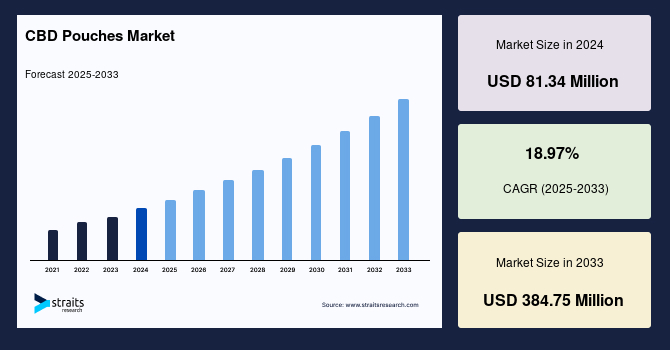

The global CBD pouches market size was valued at USD 81.34 million in 2024 and is estimated to grow from USD 96.42 million in 2025 to reach USD 384.75 million by 2033, growing at a CAGR of 18.97% during the forecast period (2025–2033). The market is driven by rising awareness of CBD’s health benefits, increasing consumer preference for discreet and smokeless consumption, growing demand for flavored and convenient formats, and supportive regulatory developments enhancing product safety and market adoption.

Key Market Trends & Insights

- North America held the largest market share, over 55% of the global CBD pouches industry.

- Based on Content, the 10 mg-20 mg segment held the highest market share of over 50%.

- Based on Type, the unflavored CBD pouches segment is expected to witness the fastest CAGR of 16.89%.

- Based on the Distribution Channel, the online segment is expected to witness the fastest CAGR of 20.36%.

Market Size & Forecast

- 2024 Market Size: USD 34 million

- 2033 Projected Market Size: USD 384.75 million

- CAGR (2025-2033): 18.97%

- North America: Largest market in 2024

- Asia-Pacific: Fastest-growing region

CBD pouches are small, pre-portioned sachets containing cannabidiol (CBD) derived from hemp, designed for oral use. They are smokeless, discreet, and convenient, making them an alternative to oils or edibles. Users place them between the gum and cheek for gradual absorption. Applications include stress relief, promoting relaxation, supporting sleep, and managing mild discomfort or inflammation. CBD pouches are increasingly popular among wellness-focused consumers seeking portable, easy-to-use, and precise-dose CBD products without the need for smoking or vaping.

The market is fueled by increasing consumer preference for natural and plant-based wellness products, alongside innovations in delivery methods that improve CBD bioavailability. Opportunities exist in product differentiation through functional pouches targeting sleep, energy, or focus. Companies can also explore partnerships with health and wellness brands and leverage marketing strategies emphasizing convenience and discretion. Moreover, regulatory clarity in key markets enables expansion, while ongoing R&D of new hemp-derived cannabinoids creates avenues for unique, high-value product offerings.

Market Trend

Growing Availability of Flavored CBD Pouches

A key trend shaping the global CBD pouches market is the growing availability of flavored options, designed to enhance consumer experience and widen market appeal. Brands are increasingly experimenting with flavors such as mint, citrus, berry, and exotic blends to attract both new and existing users seeking variety and satisfaction.

- According to Straits Research, flavored CBD pouches are emerging as a strong differentiator, helping brands stand out in a competitive landscape. This trend not only caters to evolving consumer tastes but also positions CBD pouches as a lifestyle-oriented product, driving their adoption among younger and health-conscious demographics.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 81.34 Million |

| Estimated 2025 Value | USD 96.42 Million |

| Projected 2033 Value | USD 384.75 Million |

| CAGR (2025-2033) | 18.97% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Cannadips, Jake's Mint Chew, Vibe CBD+CBG, FlowBlend, com |

to learn more about this report Download Free Sample Report

Market Driver

Rising Awareness of CBD’s Health Benefits

The global CBD pouches market is witnessing robust growth, largely driven by rising awareness of CBD’s health benefits. Consumers are increasingly recognizing the potential of CBD to support wellness, including stress relief, improved sleep, and general relaxation. This heightened awareness has fueled demand for convenient and discreet consumption formats, such as pouches.

- For instance, in June 2025, the UK Food Standards Agency (FSA) updated guidance encouraging businesses to adhere to a provisional acceptable daily intake (ADI) of 10 mg/day of CBD, while maintaining strict THC limits. The UK is also advocating for higher dose allowances to provide greater flexibility for wellness-focused products.

This regulatory clarity is further boosting consumer confidence, expanding market adoption, and attracting new players into the CBD pouches segment.

Market Restraint

Unclear or Inconsistent Global Regulatory Frameworks

One of the major restraints in the global market for CBD pouches is the unclear and inconsistent regulatory framework across different regions. While some countries have embraced hemp-derived CBD products, others still maintain strict restrictions or lack clear guidelines, creating uncertainty for manufacturers and distributors. This inconsistency limits global trade, delays product launches, and discourages investment in large-scale production. Moreover, varying labeling and dosage requirements add complexity, making it difficult for companies to maintain compliance and consumer trust in diverse markets.

Market Opportunity

Expansion Into Mainstream Retail Channels and E-Commerce Platforms

The global CBD pouches industry is witnessing significant opportunities as brands expand into mainstream retail channels and e-commerce platforms. Consumers are increasingly seeking convenient, discreet, and smokeless ways to consume CBD, making pouches an attractive format for wellness-focused products.

- For instance, Juana Dips, a cannabis company founded in 2024, exemplifies this trend, having rapidly expanded its presence in the U.S. market. By early 2025, the company was engaged in licensing discussions with 13 other firms, reflecting strong demand for its innovative THC-infused oral pouches, which are reminiscent of popular nicotine products like Zyn.

This growth highlights the potential for both online and offline channels to drive adoption, attract new consumers, and solidify CBD pouches as a mainstream wellness option.

Regional Analysis

North America dominates the global CBD pouches market with a market share of over 55%, driven by high consumer awareness and widespread adoption of wellness products. Increasing demand for convenient, smoke-free CBD consumption options, combined with supportive regulatory frameworks, is fueling market growth. Established and emerging players are innovating with flavored and high-potency pouches, as well as targeting retail and online distribution channels. Moreover, continuous product diversification and strategic partnerships are further strengthening the region’s leadership in the global market, making it a hub for innovation and consumer adoption.

The United States CBD pouches market is dominant, with a strong focus on product innovation and expansion. Companies like This Works, Inc., and Cannadips are actively launching new flavors and nicotine-free CBD pouches to cater to evolving consumer preferences. Strategic partnerships with e-commerce platforms and wellness retailers enhance product accessibility, while investments in sustainable sourcing and high-potency formulations are gaining traction.

Canada’s CBD pouches industry is growing with increasing consumer demand for natural wellness alternatives. Companies such as Aurora Cannabis and Purekana are developing CBD pouches with varied flavor profiles, different potency levels, and innovative packaging to meet evolving preferences. Strategic collaborations with local retailers and online platforms help expand reach and accessibility. Moreover, research into sustainable hemp sourcing and organic formulations is enhancing product appeal.

Asia-Pacific Market Trends

Asia-Pacific is the fastest-growing region with a CAGR of 19.67%, fueled by rising health awareness, expanding urban population, and increased interest in alternative wellness products. Market growth is supported by emerging manufacturing hubs, favorable regulatory developments, and the adoption of modern distribution channels. Companies are introducing flavored and functional CBD pouches, focusing on both offline and online retail expansion. Innovative marketing strategies targeting young, health-conscious consumers are driving adoption. The region’s strong growth potential is attracting investments and partnerships, positioning Asia-Pacific as a key emerging market.

China’s CBD pouches market is growing, with companies like Dragon Herb and Medihemp introducing CBD pouches with enhanced flavors, potency variations, and convenient packaging formats. Emphasis on online retail platforms and cross-industry partnerships helps increase product accessibility. Research into hemp sourcing and high-quality extraction techniques is also advancing, supporting market credibility.

India’s market for CBD pouches is moderately growing, with companies such as Kanha CBD and HempAura launching innovative products tailored to local consumer preferences. Efforts include flavored and high-potency pouches, eco-friendly packaging, and targeted digital marketing strategies to reach urban wellness consumers. Moreover, collaborations with e-commerce platforms and wellness retailers are expanding market accessibility.

Europe Market Trends

Europe’s CBD pouches market is characterized by steady growth due to increasing consumer awareness of wellness and alternative consumption methods. Companies like Endoca and Nordic Oil are launching premium, flavored, and nicotine-free CBD pouches while strengthening online and retail distribution networks. Regulatory clarity and product standardization are supporting growth, while marketing strategies focus on health-conscious consumers. The growing R&D into organic sourcing and high-quality extraction techniques is further boosting product appeal, making Europe an important market.

Latin America Market Trends

Latin America’s CBD pouches industry is growing steadily as consumers increasingly adopt CBD wellness products. Companies such as CBD Life and Green Leaf Labs are introducing flavored and convenient pouch options, targeting urban populations through retail and e-commerce channels. Regulatory developments and awareness campaigns are improving market acceptance. Moreover, investments in quality extraction, sustainable sourcing, and marketing emphasizing wellness benefits are enhancing brand credibility.

Middle East and Africa Market Trends

The Middle East and Africa’s CBD pouches market is gradually expanding due to rising health awareness and interest in alternative wellness solutions. Companies like Pure Hemp Africa and Sana CBD are focusing on flavored, high-potency pouches, emphasizing quality and safety. Partnerships with online retailers and regional distributors enhance accessibility. Product innovation, including eco-friendly packaging and organic sourcing, is attracting health-conscious consumers. Moreover, regulatory clarity in select regions is enabling market growth, making the MEA an emerging market with significant potential.

Content Insights

The 10 mg–20 mg segment holds a market share of over 45%, reflecting strong consumer preference for moderate-strength options. This segment benefits from consistent demand among both new and experienced users seeking balanced effects. Market research indicates its stability has contributed to significant revenue generation, making it a key contributor to overall growth trends in regions with established CBD adoption.

The up to 10 mg segment is emerging as the fastest-growing segment, expanding at a CAGR of 19.26%. Driven by health-conscious consumers and first-time users preferring lower-dose options, this segment is rapidly gaining traction across North America and Europe. Its rising popularity is reflected in growing market share, as consumers increasingly seek mild, manageable doses for wellness and daily use.

Type Insights

The flavored segment dominates the market with over 80% share, thanks to its broad appeal and variety of taste profiles. Consumers are drawn to flavored options for enhanced experience and palatability, encouraging repeat purchases. This dominance is particularly strong in markets where lifestyle and flavor trends shape buying behavior, ensuring that flavored variants remain the primary revenue driver in the global CBD pouches industry.

The unflavored segment is the fastest-growing segment, recording a CAGR of 17.56% as preference shifts toward simplicity and discretion. Health-focused consumers, seeking a neutral taste or additive-free products, are driving this trend. The segment’s increasing adoption in mature markets is steadily expanding its share, positioning unflavored pouches as a strategic growth area for manufacturers targeting niche, wellness-conscious audiences.

Distribution Channel Insights

The offline segment holds dominance with over 55% market share, driven by consumer trust in in-store purchases and direct product access. Physical retail allows buyers to assess quality and consult knowledgeable staff, reinforcing loyalty. The segment continues to benefit from established networks in urban and semi-urban areas, ensuring consistent revenue streams and maintaining its position as the backbone of CBD pouch sales.

The online segment is the fastest-growing distribution channel, expanding at a CAGR of 20.35%. E-commerce platforms attract convenience-oriented and younger consumers, offering broader product variety and discreet purchasing options. Regions like North America lead in digital adoption, contributing to the segment’s increasing market share and signaling a shift toward tech-enabled, direct-to-consumer strategies.

Company Market Share

Companies are focusing on product innovation, distribution expansion, and regulatory compliance to capture growing consumer demand. They are developing a variety of CBD pouch formulations, including flavored options and varying dosages, to cater to diverse consumer preferences. These products are being distributed through both offline retail channels and e-commerce platforms to enhance accessibility. Moreover, companies are working to meet regulatory standards to ensure product safety and consumer trust.

Cannadips is a U.S.-based company founded in 2016 in Humboldt County, California. Established with a mission to provide a tobacco- and nicotine-free alternative to traditional smokeless products, Cannadips offers hemp-derived CBD pouches in various flavors. The company emphasizes quick absorption through its proprietary process, enhancing the bioavailability of CBD.

List of Key and Emerging Players in CBD Pouches Market

- Cannadips

- Jake's Mint Chew

- Vibe CBD+CBG

- FlowBlend

- com

- Metolius Hemp Company

- Canndid

- Chillbar

- Comp9

- V&YOU

- Nicopods ehf.

Recent Development

- January 2025 - Green Meadows, a Massachusetts-based cannabis company, partnered with Colorado’s Palisade Apothecary to introduce JuanaDips THC pouches to the Massachusetts market. These award-winning, nano-infused, smokeless cannabis pouches offer a discreet and fast-acting alternative to traditional smoking methods.

- January 2025 - Dark Horse Cannabis partnered with Cannadips to introduce smokeless cannabis pouches to the Arkansas market. This collaboration marks Cannadips' first launch outside California, bringing their innovative pouches to a new audience. The pouches utilize patented technology and a proprietary coconut fiber medium to deliver a discreet and fast-acting cannabis experience.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 81.34 Million |

| Market Size in 2025 | USD 96.42 Million |

| Market Size in 2033 | USD 384.75 Million |

| CAGR | 18.97% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Content, By Type, By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

CBD Pouches Market Segments

By Content

- Up to 10 mg

- 10 mg - 20 mg

- Others

By Type

- Flavored

- Unflavored

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Anantika Sharma

Research Practice Lead

Anantika Sharma is a research practice lead with 7+ years of experience in the food & beverage and consumer products sectors. She specializes in analyzing market trends, consumer behavior, and product innovation strategies. Anantika's leadership in research ensures actionable insights that enable brands to thrive in competitive markets. Her expertise bridges data analytics with strategic foresight, empowering stakeholders to make informed, growth-oriented decisions.