Pharmerging Market Size, Share & Trends Analysis Report By Product (Pharmaceutical, Branded Drugs, Generic Drugs, Other Healthcare Verticals), By Country Economy (Tier-1, Tier-2, Tier-3), By Indication (Cardiovascular Diseases, Lifestyle Diseases, Cancer & Autoimmune Diseases, Infectious Diseases, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Pharmerging Market Size

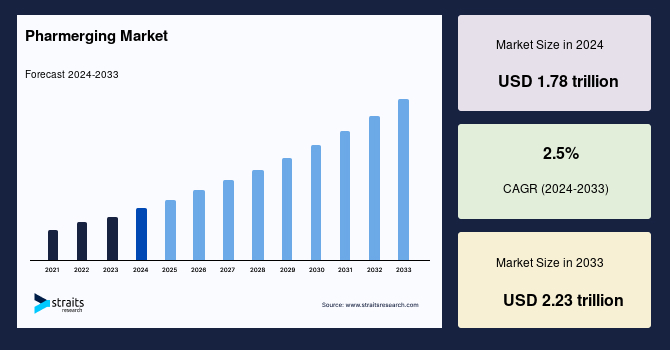

The global pharmerging market size was valued at USD 1.78 Trillion in 2024 and is expected to grow from USD 1.82 Trillion in 2025 to reach USD 2.22 Trillion in 2033, growing at a CAGR of 2.5% during the forecast period (2025–2033).

"Pharmerging" refers to the emerging pharmaceutical markets in developing countries, particularly those with rapidly growing economies and expanding healthcare infrastructure. These regions are becoming increasingly important to global pharmaceutical companies due to their rising demand for healthcare products, improving access to medicines, and expanding middle-class populations. Countries in the "pharmerging" category include China, India, Brazil, Russia, and other nations in Africa and Southeast Asia.

The market is experiencing robust growth, driven by increasing healthcare needs, broader pharmaceutical access, and rising government investments in emerging economies. As healthcare infrastructure improves and insurance coverage expands, the demand for pharmaceuticals continues to rise. Moreover, the growing prevalence of chronic diseases, such as cardiovascular conditions, diabetes, and cancer, further fuels the market's expansion.

These factors collectively create a dynamic environment for the pharmaceutical industry, offering significant opportunities in these rapidly developing regions.

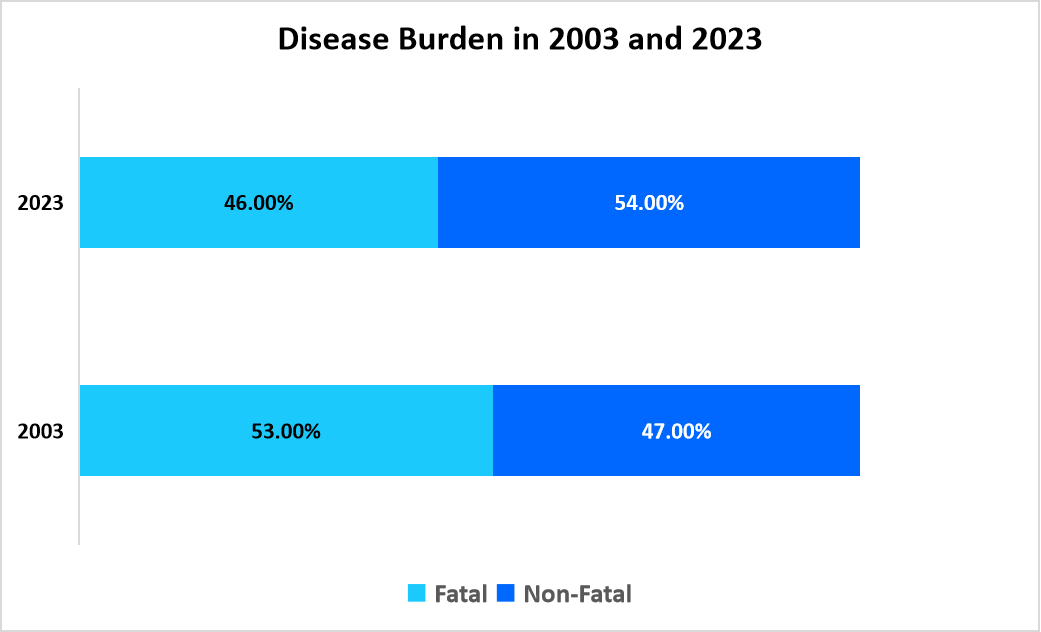

The graph below presents a comparison of the disease burden between 2003 and 2023

Source: Straits Research, Australian Institute of Health and Welfare

As per the above graph, the rising prevalence of both fatal and non-fatal diseases is driving the need for innovative and cost-effective treatments in the pharmerging market.

Pharmaceutical companies are responding by targeting these emerging markets through strategic collaborations, expanding manufacturing capacities, and implementing tailored drug pricing models. The growing adoption of biosimilars and generic drugs is further facilitating market penetration, providing affordable alternatives to high-cost treatments.

Moreover, the expansion of digital health technologies, such as telemedicine and e-pharmacies, is transforming drug distribution and improving accessibility for patients in underserved regions. As innovation and investment continue to flow into these emerging healthcare ecosystems, the global market remains a key focus for pharmaceutical companies seeking sustained growth and a competitive edge.

Market Trends

Expanding Role of Digital Therapeutics in Chronic Disease Management

Digital therapeutics (DTx) are transforming chronic disease management by utilizing technology to provide evidence-based, personalized interventions. These software applications and devices monitor health parameters, offer real-time feedback, and encourage behavioral changes, helping patients manage conditions like diabetes, hypertension, and cardiovascular diseases more effectively.

- For example, a study published in October 2024 in NCBI showed that a mobile health intervention for type 2 diabetes significantly improved glycemic control.

This integration of digital solutions not only enhances patient engagement but also offers scalable solutions to address the growing burden of chronic diseases, further accelerating market growth.

Rise of Localized Contract Manufacturing for Cost Efficiency

The rise of localized contract manufacturing for cost efficiency is reshaping the pharmaceutical industry, particularly in emerging markets. Countries like India are becoming significant hubs for contract manufacturing organizations (CMOs), offering cost-effective production and compliance with international quality standards.

- For instance, in February 2025, Indian contract drug manufacturers urged the government to remove regulatory hurdles and expedite raw material import clearances to capitalize on global firms seeking alternatives to Chinese suppliers.

This shift not only reduces production costs but also mitigates supply chain risks, boosting the competitiveness and resilience of the pharmaceutical market in these regions.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 1.78 trillion |

| Estimated 2025 Value | USD 1.82 trillion |

| Projected 2033 Value | USD 2.22 trillion |

| CAGR (2025-2033) | 2.5% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Sanofi, Pfizer Inc., AstraZeneca, GlaxoSmithKline, Hoffmann-La Roche Ltd. |

to learn more about this report Download Free Sample Report

Pharmerging Market Growth Factors

Rapid Expansion of Universal Healthcare Coverage

The rapid expansion of universal healthcare coverage in global market is significantly enhancing access to medical services and pharmaceuticals. Governments are implementing policies to extend healthcare services to underserved populations, thereby increasing the demand for medications.

- For instance, in April 2024, the World Bank Group announced a goal to help countries provide affordable healthcare to an additional 1.5 billion people by 2030, focusing on expanding services to remote areas and reducing financial barriers.

Such initiative exemplifies the global commitment to achieving universal health coverage, further driving the pharmaceutical market growth in emerging economies.

Increasing Public-Private Partnerships in Drug Development

Public-private partnerships (PPPs) are accelerating drug development and expanding healthcare access in global market. These collaborations enable resource-sharing, foster innovation, and enhance healthcare delivery.

- An example of this is AstraZeneca’s partnership with PEPFAR (2016-2021), which integrated hypertension services into existing HIV platforms to identify and reach individuals who needed HIV services. In March 2023, this partnership expanded to 10 additional African countries, strengthening healthcare infrastructure and improving pharmaceutical accessibility.

Such partnerships are pivotal in advancing drug discovery and development, particularly in regions with high healthcare needs.

Restraining Factor

Stringent and Evolving Regulatory Frameworks

Regulatory inconsistencies across pharmerging nations create barriers to pharmaceutical approvals, manufacturing, and distribution. Many countries frequently update regulations, including Good Manufacturing Practices (GMP) and bioequivalence requirements, leading to delays and increased compliance costs for manufacturers. The lack of regulatory harmonization across regions such as Asia-Pacific, Latin America, and Africa further complicates market entry for global pharmaceutical companies. For instance, China's reforms in the National Medical Products Administration (NMPA) guidelines have increased clinical trial requirements, making it more challenging for foreign drugmakers to launch products quickly.

Market Opportunity

Growing Market for Preventive Vaccines and Immunization Programs

The global pharmerging market for preventive vaccines and immunization programs in pharmerging countries is enhancing public health outcomes and creating significant growth opportunities. Governments and global health organizations are prioritizing vaccine introduction and distribution to combat infectious diseases.

- For example, the World Health Organization reported in July 2024 that 84% of infants worldwide received three doses of the diphtheria-tetanus-pertussis (DTP3) vaccine in 2023, marking a substantial achievement in immunization efforts. The introduction of new vaccines, including those for malaria and COVID-19, is expected to further reduce mortality rates and improve health standards in these regions.

The growing demand for preventive vaccines provides a lucrative opportunity for manufacturers to introduce new products, thereby driving market growth.

Regional Insights

North America holds a leading position in the global pharmerging market due to its strong pharmaceutical R&D ecosystem, high adoption of biologics and biosimilars, and advanced regulatory pathways that accelerate drug approvals. The region benefits from extensive government funding for healthcare initiatives, a well-established biopharmaceutical manufacturing infrastructure, and a robust network of CROs supporting clinical trials.

Moreover, increasing collaborations between pharmaceutical giants and emerging biotech firms drive innovation, while favorable reimbursement policies and expanding patient assistance programs enhance market accessibility, solidifying North America's dominance in the pharmerging landscape.

Asia Pacific Pharmerging Market Trends

Asia-Pacific is expected to register the fastest CAGR due to rapid healthcare infrastructure development, increasing local pharmaceutical production, and strong government support for generic and biosimilar adoption. The region benefits from cost-effective manufacturing hubs, rising investments in R&D, and an expanding patient pool with high demand for affordable treatments. Moreover, regulatory reforms in countries like China and India are streamlining drug approvals while growing public and private healthcare expenditures further fuel market expansion, making Asia-Pacific the fastest-growing region in the market.

China’s pharmerging market is heavily influenced by its Centralized Procurement policy, which has expanded nationwide since its 2018 pilot. Managed by the National Healthcare Security Administration, this policy ensures lower drug prices and greater accessibility by conducting volume-based national drug procurement. By December 2024, the tenth procurement round achieved an average price reduction of over 70%, with some drugs seeing cuts of up to 90%. This policy reduces patient costs, minimizes commercial bribery, and streamlines market efficiency.

India's pharmaceutical industry has seen impressive growth, with exports rising by 125%, from ₹90,415 crore in 2013-14 to ₹2,04,110 crore in 2022-23. The country ranks as the third-largest drug producer by volume, supplying to approximately 200 countries, and produces 60% of the world’s vaccines. India has also become a hub for generic drug manufacturing, bolstered by government incentives like the Production Linked Incentive (PLI) scheme, which saw investments of ₹21,861 crore by March 2023. This strong foundation positions India as a key player.

Indonesia’s pharmerging market is driven by the expansion of Jaminan Kesehatan Nasional (JKN), the world’s largest single-payer health insurance program, which was expected to cover over 90% of the population by December 2023. This initiative has significantly reduced out-of-pocket expenses, increasing access to essential medicines and generic drugs. The government is also promoting local pharmaceutical manufacturing to reduce reliance on imports. With its expanding healthcare infrastructure and growing drug production capabilities, Indonesia is becoming a key hub for pharmaceutical growth in Southeast Asia.

Europe Pharmerging Market Trends

Russia’s pharmerging market is driven by the government’s focus on import substitution, reducing reliance on foreign pharmaceuticals. The Pharma 2030 program encourages domestic production, with over 60% of the country’s pharmaceutical demand met locally by 2023. Moreover, the "Produkty na polku" ("Available on Shelves") initiative, launched in late 2023, aims to develop local equivalents of patented drugs, ensuring continuous availability during supply chain disruptions. These efforts bolster Russia’s self-reliance in drug production.

Latam Pharmerging Market Trends

Mexico’s market for pharmerging is bolstered by its strong manufacturing base, strategic location, and participation in international trade agreements like USMCA. The country ranks second-largest in Latin America’s pharmaceutical industry, with over 500 manufacturing plants ensuring cost-effective production. Government initiatives such as COFEPRIS regulatory alignment with global standards facilitate faster drug approvals and exports. Moreover, Mexico’s growing healthcare coverage and demand for generics drive market expansion, making it a critical hub.

Product Insights

The pharmaceuticals segment leads the global market, driven by the increasing demand for generic drugs, rising chronic disease prevalence, and expanding access to essential medicines through government initiatives. The growing acceptance and approval of biosimilars and specialty drugs further bolsters this segment by offering cost-effective alternatives to branded drugs.

- As of January 2022, the U.S. FDA approved 33 biosimilars, with 21 commercially available, highlighting the market’s expansion in emerging economies. This trend reinforces the dominance of the pharmaceuticals segment in pharmerging markets.

Country Economy Insights

The Tier-1 segment holds the largest share, benefiting from higher healthcare spending, advanced pharmaceutical manufacturing capabilities, and robust regulatory frameworks. Countries like China, India, and Brazil are key growth drivers, supported by their strong domestic production, increasing healthcare investments, and expanding universal healthcare coverage. These economies are capitalizing on their large populations and improving infrastructure to propel pharmaceutical market expansion, positioning Tier-1 nations as dominant players in the global pharmerging landscape.

Indication Insights

The infectious diseases segment remains the dominant revenue generator in the market due to high prevalence rates and widespread government-led immunization programs. Diseases such as tuberculosis, malaria, and hepatitis continue to burden low- and middle-income countries, creating a growing demand for vaccines, antibiotics, and antiviral drugs.

- In December 2024, the WHO expanded its malaria vaccine rollout to 17 African countries, further boosting the need for preventive treatments. This reinforces the infectious diseases segment as the key market driver in emerging economies.

Company Market Share

Key players in the industry are focusing on adopting a variety of strategic business approaches to strengthen their position in the market. These strategies include forming strategic collaborations with other pharmaceutical companies, healthcare providers, and research institutions to enhance product development and distribution capabilities. Product approvals, especially for innovative therapies and generics, are also a key focus, as they allow companies to expand their portfolios and cater to unmet medical needs.

Biocon: An Emerging Player in the Global Pharmerging Market

Biocon, headquartered in Bengaluru, India, is a prominent biopharmaceutical company specializing in the development and manufacturing of affordable biologics, biosimilars, and generic formulations. With a strong focus on innovation and cutting-edge research, Biocon has established itself as a leader in the global biosimilars market, particularly in oncology, immunology, and diabetes care.

Recent Developments by Biocon:

- In December 2024, Biocon Limited and its European partner, Zentiva, received decentralized procedure approval in the European Union for their complex formulation of Liraglutide. This approval pertains to the generic versions of Victoza, used for treating Type-2 Diabetes, and Saxenda, utilized for weight management.

List of Key and Emerging Players in Pharmerging Market

- Sanofi

- Pfizer Inc.

- AstraZeneca

- GlaxoSmithKline

- Hoffmann-La Roche Ltd.

- GE Healthcare

- Eli Lilly and Company

- Medtronic

- Abbott

- Johnson and Johnson

- Biocon

- Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Takeda Pharmaceutical Company Limited.

to learn more about this report Download Market Share

Recent Developments

- January 2025 – GSK announced an agreement to acquire IDRx, Inc., a biopharmaceutical company focused on precision medicine for cancer treatment. The deal, valued at $1 billion upfront, with potential milestone payments of up to $150 million, aims to strengthen GSK’s oncology portfolio.

- March 2024 – AstraZeneca acquired Fusion Pharmaceuticals, a clinical-stage company specializing in next-generation radio conjugates for cancer treatment, to expand its oncology portfolio and expertise in actinium-based radio conjugates.

Analyst Opinion

As per our analysts, the global pharmerging market is experiencing robust and dynamic growth, fueled by several key factors, including expanding healthcare access, rising chronic disease prevalence, and progressive governmental initiatives. The widespread adoption of biosimilars, digital health solutions, and localized contract manufacturing is significantly reshaping the competitive landscape and offering novel avenues for market penetration. Despite these advancements, the market faces challenges such as regulatory inconsistencies, complex market entry barriers, and political instability in some regions.

Moreover, the evolving regulatory frameworks across these countries can delay product approvals and increase compliance costs, affecting the speed to market for new pharmaceutical innovations. However, pharmaceutical companies are addressing these hurdles through strategic collaborations, enhancing R&D investments, and streamlining operations to mitigate risks and improve market efficiency.

With the expansion of digital therapeutics, increased R&D funding, and the rapid growth of high-demand therapeutic areas, the market presents substantial opportunities for pharmaceutical companies seeking to capitalize on cost-effective drug development and gain a competitive edge. As the sector continues to evolve, companies that can navigate the regulatory complexities and leverage emerging trends will be well-positioned for long-term success.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 1.78 trillion |

| Market Size in 2025 | USD 1.82 trillion |

| Market Size in 2033 | USD 2.22 trillion |

| CAGR | 2.5% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Product, By Country Economy, By Indication |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Pharmerging Market Segments

By Product

- Pharmaceutical

- Branded Drugs

- Generic Drugs

- Other Healthcare Verticals

By Country Economy

- Tier-1

- Tier-2

- Tier-3

By Indication

- Cardiovascular Diseases

- Lifestyle Diseases

- Cancer & Autoimmune Diseases

- Infectious Diseases

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Mitiksha Koul

Research Associate

Mitiksha Koul is a Research Associate with 2 years of experience in market research. She focuses on analyzing industry trends, competitive landscapes, and growth opportunities to support strategic decision-making. Mitiksha’s strong analytical skills and research expertise enable her to deliver actionable insights that help businesses adapt to evolving market dynamics and achieve sustainable growth.