Vehicle Roadside Assistance Market Size, Share & Trends Analysis Report By Service Type (Towing Support, Tire Replacement, Emergency Fuel Refill, Vehicle Lockout, Battery Assistance, Other services), By Vehicle Category (Passenger Vehicles, Commercial Fleets), By Service Provider (Motor Insurers, Automobile Manufacturers, Automotive Clubs & Membership Programs, Independent Warranty Firms) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Vehicle Roadside Assistance Market Overview

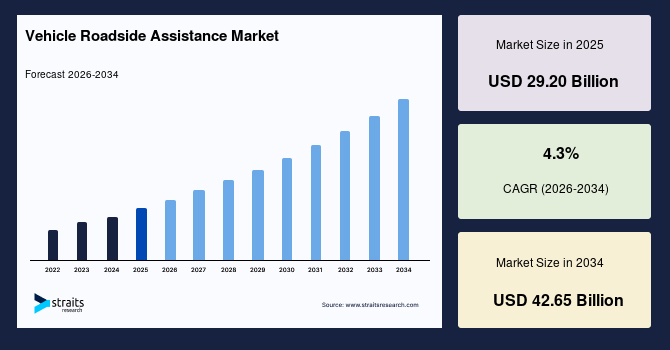

The global vehicle roadside assistance market size is estimated at USD 29.20 billion in 2025 and is projected to reach USD 42.65 billion by 2034, growing at a CAGR of 4.3% during the forecast period. The major drivers of the vehicle roadside assistance market are government regulation and safety norms, including EU directives that support emergency response and roadside assistance. Limited awareness and take-up in emerging regions continue to be a concern. Regular efforts to enhance infrastructure and harmonize services are fueling market development and consumer confidence.

Key Market Trends & Insights

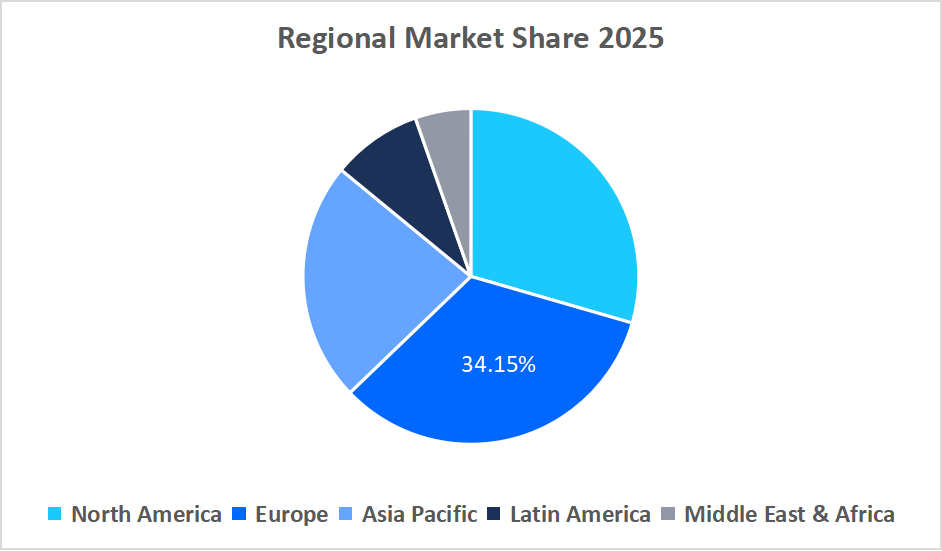

- Europe held a dominant share of the vehicle roadside assistance market, accounting for a 34.15% share in 2025.

- The Asia-Pacific region is projected to grow at the fastest pace, with a CAGR of 7.45% from 2026 to 2034.

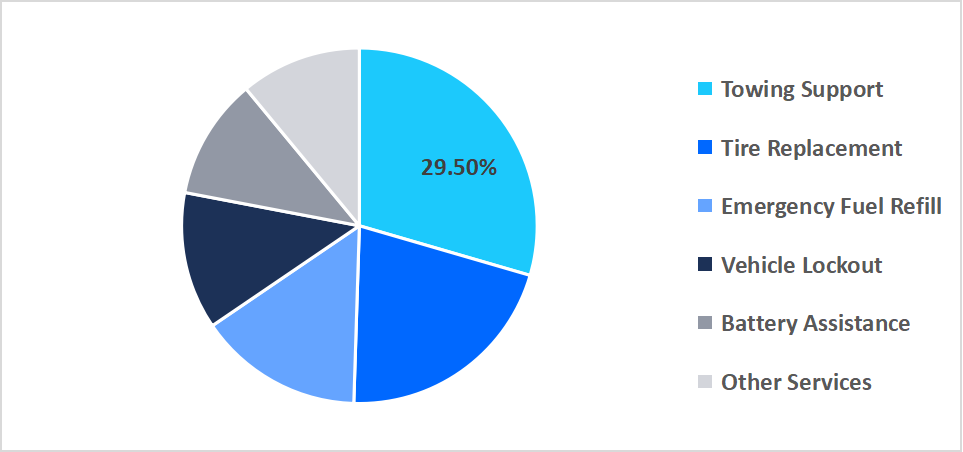

- Based on service type, the Towing Support segment held the highest market share of 29.5% in 2025.

- On the basis of service type, the Battery Assistance segment was expected to register the fastest CAGR growth of 6.90% from 2026-2034.

- Based on the provider, the Automobile Manufacturers segment dominated the market in 2025.

- Based on vehicle category, the Commercial Fleets segment was expected to register the fastest CAGR of 7.2 % during the forecast period.

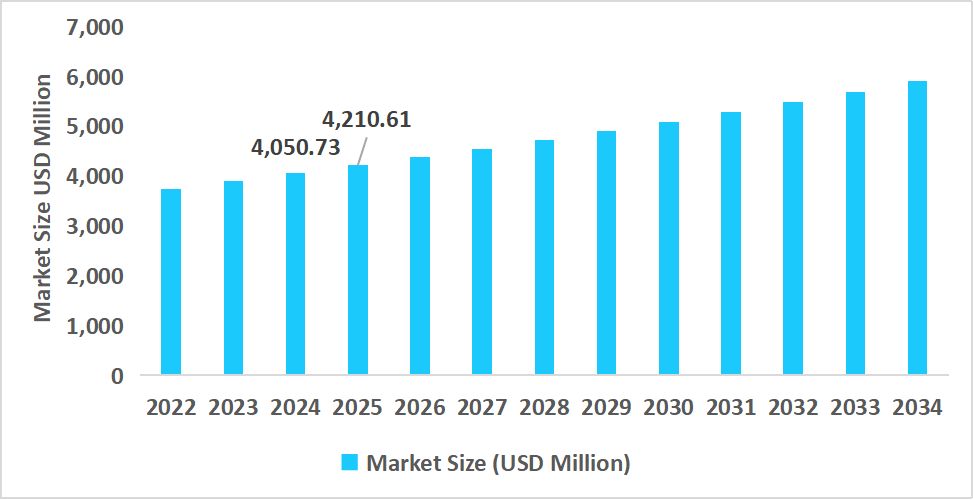

- Germany dominates the European vehicle roadside assistance market, valued at USD 4.05 billion in 2024 and projected to reach USD 4.21 billion in 2025.

Table: Germany Vehicle Roadside Assistance Market Size (USD Million)

Source: Straits Research

Market Size & Forecast

- 2025 Market Size: USD 29.20 billion

- 2034 Projected Market Size: USD 42.65 billion

- CAGR (2026-2034): 4.3%

- Dominating Region: Europe

- Fastest-Growing Region: Asia-Pacific

The global vehicle roadside assistance market is expanding due to the increasing demand for fast and trustworthy car support services. Growing awareness of breakdown management and road safety standards is propelling service uptake. Embedding connected vehicle technologies and telematics is enhancing response effectiveness for passenger and commercial vehicles. Joint service provider-OEM-insurer partnerships and AI-powered dispatch solutions are further increasing market expansion.

Latest Market Trends

Move from Isolated Help to Connected Mobility Solutions

The roadside assistance market for vehicles is moving from stand-alone, service-specific contact to end-to-end mobility ecosystems that combine emergency services with other forms of transportation. Drivers have historically experienced issues like incomplete availability of services, varying response times, and a lack of integration with other mobility services. Today, major players are bundling services like roadside assistance, navigation, and real-time traffic updates, providing a greater overall user experience. Change is indicative of a significant shift in how roadside assistance is viewed and used, towards an entirely more comprehensive way of thinking about mobility.

EV Roadside Assistance Service Expansion

Perhaps the most notable movement in roadside assistance has been the growth in services dedicated to electric vehicles (EVs). With increased use of EVs, conventional models of roadside assistance have shifted to addressing the special requirements of EV owners.

Automotive Association of the Northern Territory (AANT) launches a mobile EV charging van to help reduce range anxiety for EV owners. The service is a battery top-up for EV users who cannot make it to a charging station as part of the current roadside assistance cover for AANT members, free of charge. This effort reflects the company's dedication to changing with the increasing EV market and improving the roadside assistance experience for both electric vehicles and other types of vehicles.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 29.20 Billion |

| Estimated 2026 Value | USD 30.46 Billion |

| Projected 2034 Value | USD 42.65 Billion |

| CAGR (2026-2034) | 4.3% |

| Dominant Region | Europe |

| Fastest Growing Region | Asia-Pacific |

| Key Market Players | AA PLC, Agero, Allstate Insurance, American Automobile Association (AAA), ARC |

to learn more about this report Download Free Sample Report

Vehicle Roadside Assistance Market Drivers

Evolution of Public Sector Roadside Assistance Programmes

The public sector programmes are at the forefront of designing roadside assistance programmes, especially in areas with high traffic density and accidents. The programs are aimed at improving road safety, reducing response times, and decongesting emergency services. India's Ministry of Road Transport and Highways introduced the Highway Accident Relief and Safety (HARS) program on priority national highways to provide instant relief to stranded motorists, dispose of minor accidents, and enhance highway security.

The program received a first-phase budget of USD 2 million, which reflects considerable government investment in roadside public support facilities. This increase in public sector participation is pushing the growth of the vehicle roadside assistance market via enhanced service availability and response efficiency.

Market Restraint

Limited Availability of Services in Rural and Distant Locations

One of the major challenges in the auto roadside assistance industry is the poor service availability in rural and distant locations. Urban regions enjoy large-scale roadside assistance networks, whereas rural locations experience delays and gaps in services because of logistical problems, lesser vehicle concentrations, and fewer service operators.

Texas Department of Transportation (TxDOT) initiated the Highway Emergency Response Operator (HERO) program in Midland and Ector counties to meet these needs. The program, functioning from 6 a.m. to 6 p.m. every day, employs 10 trucks and 3 tow vehicles, offering free roadside services including minor repair of vehicles, tire replacement, and removal of debris. Interestingly, in its first two days of operation, the HERO team had handled 71 calls and aided 121 incidents, a testament to the need for such services in previously underserved communities. The program has funding from a $5 million investment by TxDOT, Midland County, and the Permian Strategic Partnership, with Midland County pitching in $500,000 each on January 17 and October 1, 2025.This program highlights the imperative to plan for expansion and infrastructure growth to facilitate uniform roadside assistance everywhere.

Market Opportunity

Expansion of Insurance-Linked Roadside Assistance Programs

One of the biggest opportunities in the vehicle roadside assistance market involves collaboration between insurance providers and service providers to increase coverage and response time. Combining roadside assistance with insurance policies directly, drivers receive more immediate, trustworthy assistance while insurers can increase customer satisfaction and loyalty.This program showcases the way insurance-linked programs present a strategic opportunity for growth through enhanced accessibility and reliability of roadside assistance, and enhanced customer retention for insurers.

Regional Analysis

Europe dominated the vehicle roadside assistance market in 2025 with a share of 34.15%. The region's leadership is due to well-developed automotive infrastructure, dense vehicles, and mature public and private roadside assistance programs. Increased consumer knowledge about vehicle breakdown services and the bundling of assistance packages by automobile manufacturers further intensified market penetration.

Germany leads the market development of Europe, with the vehicle roadside assistance market of the country being worth USD 4.21 billion in 2025. It has high usage among top automobile manufacturers like Volkswagen, BMW, and Mercedes-Benz, with a well-established insurance-linked support environment providing extensive coverage and reliability across the board to firmly position Germany as the leading regional player.

North America Market Insights

North America is a high-value market for auto roadside assistance as a result of extensive car ownership, customer desire for full-service packages, and voluntary manufacturer-sponsored programs. The U.S. and Canada are experiencing greater adoption of telematics-based assistance services in cars, which improves response times and service reliability.

Manufacturer-led efforts are also accelerating market takeup. For instance, top U.S. vehicle manufacturers are offering roadside assistance as part of premium warranty and subscription plans, responding quickly to motorists in distress. Insurance companies also encourage adoption by offering premium discounts for vehicles with factory-installed roadside assistance services.

Asia-Pacific Market Insights

The Asia-Pacific is expected to be the highest-growing region at a CAGR of 7.45% between 2026 and 2034, based on increasing vehicle ownership, growth in commercial fleets, and increasing urban traffic congestion problems. India and Australia are introducing public and private support initiatives to enhance road safety and lower breakdown-related delays, while Japan and South Korea are using advanced telematics and connected vehicle solutions.

India is a growing roadside assistance market with rising penetration in the commercial vehicle and premium vehicle segments. Government initiatives for safety on highways, along with the integration of manufacturer-supported assistance services, are fueling possibilities for high growth in the marketplace in the region.

Latin America Market Insights

Latin America is experiencing continuous growth through economic growth and increased interest in vehicle protection and assistance services. Mexico and Brazil are first movers, with adoption mainly in cities and among high-end vehicle segments. The fact that international automakers have standardized assistance programs across all platforms globally is driving market penetration.

Brazil’s growth potential is particularly tied to infrastructure readiness. Currently, the limited availability of organized assistance services in rural areas points to opportunities for expansion as emergency response networks and service providers scale operations.

Middle East & Africa Market Insights

Middle East & Africa region represents an emerging market with growth being focused in the Gulf Cooperation Council (GCC) countries because of high car ownership and demand for premium vehicles with embedded support services. UAE and Saudi Arabia are spearheading adoption through investments in highway safety initiatives and enhancing emergency response infrastructure.

In the UAE, smart mobility programs supported by the government and high luxury vehicle penetration are promoting early takeup of roadside assistance services. Coordination among local authorities, automakers, and insurance companies provides quick response capabilities, making the UAE a regional leader in MEA's vehicle roadside assistance market.

Regional Market share (%) in 2025

Source: Straits Research

Service Type Insights

The Towing Support segment led the market with a revenue share of 29.5% in 2025. Growth is fueled by its integral function in removing disabled cars from roads, reducing traffic congestion, and maintaining driver safety. Towing is favored by car owners since it assures safe recovery for both minor faults and serious accidents, thus overall road safety and efficiency of emergency response.

The Battery Assistance segment is expected to experience the highest growth, clocking an estimated CAGR of approximately 5.1% over the forecast period. The surge in on-road vehicle numbers and the growing uptake of battery-based automotive technologies fuel quick growth by triggering increased demand for on-road battery assistance services on time.

By service type Market Share (%), 2025

Source: Straits Research

Vehicle Type Insights

The Commercial Fleets segment is anticipated to achieve the highest CAGR of 7.2% over the forecast period. This is due to the increasing demand among transportation, logistics, and delivery businesses that have professional roadside assistance as a means to save time, adhere to schedules, and effectively manage operating expenses. The integration of roadside assistance with fleet operations provides faster response times and fewer interruptions than ad-hoc solutions.

Passenger Vehicles segment accounted for the highest market share of 62.8% in 2025 due to the large number of privately owned vehicles and increasing dependence on reliable roadside assistance for daily commutation. Owners of vehicles prefer organized support services for prompt recovery in case of breakdowns, boosting convenience and road safety.

Service Provider Insights

The Automobile Manufacturers segment will expand at the highest rate of 6.8% during the forecast period. This is because roadside assistance is increasingly being taken up as part of vehicle buying bundles and extended warranty programs. Brand reputation and customer loyalty favor OEM-sponsored services, providing more stable and availability-based assistance, leading to higher take-up across both passenger vehicles and commercial fleets.

Competitive Landscape

The global Vehicle Roadside Assistance Market is relatively fragmented, with a combination of established automotive service providers, insurance firms, and niche roadside assistance players. A limited number of top players attain a high market share through extensive services offered, packaged deals, and collaborations with automakers and insurers. In contrast, some regional and local players address specific markets with customized roadside assistance offerings.

Major players in the market are AA PLC, Agero, Allstate Insurance, among others. These organizations compete to reinforce their market positions by undertaking activities like service enhancement, strategic partnerships, and the integration of connected vehicle and telematics-based solutions to improve response times and service reliability.

Key Emerging Player: Roadzen Technologies

Roadzen Technologies is an India-based emerging company that delivers AI-powered roadside assistance platforms for insurers and OEMs. The firm specializes in predictive dispatch algorithms and real-time diagnostics tailored for electric and connected vehicles.

- In July 2025, Roadzen announced a strategic partnership with one of the world’s top two-wheeler manufacturers to launch connected roadside assistance for electric vehicles across India. The OEM partner serves over 100 million vehicles globally, including more than 60 million two-wheelers in India.

By embedding intelligent support into the EV experience, Roadzen Technologies is redefining roadside assistance for the electric mobility era.

List of Key and Emerging Players in Vehicle Roadside Assistance Market

- AA PLC

- Agero

- Allstate Insurance

- American Automobile Association (AAA)

- ARC

- GEICO

- Liberty Mutual Insurance

- MAPFRE-ASISTENCIA

- National General Motor Club

- Nissan Motor

- Good Sam

- OnStar

- Better World Club

- Erie Insurance

- Travelers

- Nationwide

- Verizon Connect

- TLC Assist

- ELAA International\

- Bosch Service Solutions

Strategic Initiatives

- May 2025: GEICO, a leading insurance company, expanded its roadside assistance offerings by integrating on-demand services through a mobile app. This move aims to provide customers with quicker response times and more transparent pricing, enhancing the overall customer experience in roadside assistance.

- April 2025: The National Roads and Motorists' Association (NRMA) in Australia reported a 17% year-on-year increase in Roadside Assistance memberships and a 34% above-budget performance in its NRMA Rewards program.

- March 2025: Michelin's mobility services division bought the startup "FixaFlat Digital" to improve its roadside offerings. The purchase combines FixaFlat's digital platform, relying on an app and network of traveling technicians to fix tires on the spot, greatly increasing Michelin's direct-to-consumer digital service capacity.

- February 2024: Bosch said it is launching its "Service Connect" system, leveraging in-vehicle sensors and analytics that anticipate likely vehicle breakdowns, including batteries, before a driver gets stranded. The system can schedule a service visit automatically or send roadside support in advance.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 29.20 Billion |

| Market Size in 2026 | USD 30.46 Billion |

| Market Size in 2034 | USD 42.65 Billion |

| CAGR | 4.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Service Type, By Vehicle Category, By Service Provider |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Vehicle Roadside Assistance Market Segments

By Service Type

- Towing Support

- Tire Replacement

- Emergency Fuel Refill

- Vehicle Lockout

- Battery Assistance

- Other services

By Vehicle Category

- Passenger Vehicles

- Commercial Fleets

By Service Provider

- Motor Insurers

- Automobile Manufacturers

- Automotive Clubs & Membership Programs

- Independent Warranty Firms

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.