Biosimilar Monoclonal Antibodies Market Size, Share & Trends Analysis Report By Type (Adalimumab, Bevacizumab, Infliximab, Rituximab, Trastuzumab, Others), By Indication (Oncology, Autoimmune diseases, Others), By Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Others) and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2025-2033

Biosimilar Monoclonal Antibodies Market Size

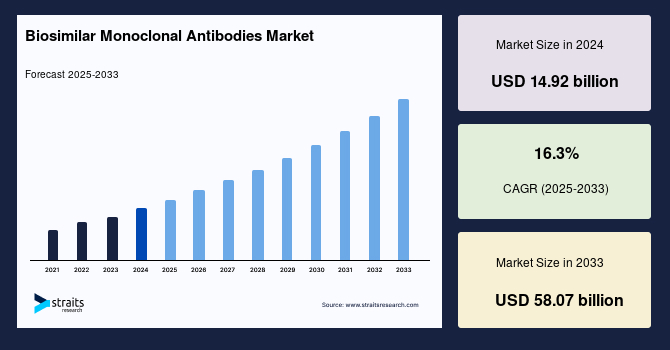

The global biosimilar monoclonal antibodies market size was valued at USD 14.92 Billion in 2024 and is projected to grow from USD 17.35 Billion in 2025 to reach USD 58.07 Billion by 2033, exhibiting a CAGR of 16.3% during the forecast period (2025–2033).

Biosimilar monoclonal antibodies (mAbs) are biologic drugs designed to be highly similar to already approved reference monoclonal antibodies, with no clinically meaningful differences in safety, purity, or effectiveness. Produced using living cells, these antibodies are crucial in treating conditions such as cancer, autoimmune diseases, and inflammatory disorders. Rigorous testing ensures biosimilars match the efficacy of original biologics, offering a cost-effective alternative that enhances patient access to essential treatments.

The global market is experiencing rapid growth, driven by the rising demand for affordable biologic therapies, the increasing prevalence of chronic diseases, and expanding regulatory approvals. As healthcare systems worldwide seek to reduce the financial burden of high-cost biologics, biosimilars provide a viable solution, improving treatment accessibility in key therapeutic areas such as oncology, immunology, and ophthalmology.

Greater acceptance among physicians and patients supported by real-world evidence and robust post-marketing surveillance is further accelerating adoption. Moreover, advancements in bioprocessing techniques and analytical methods are further propelling market growth, enhancing the efficiency and scalability of biosimilar production. Meanwhile, government initiatives promoting biosimilar adoption and the ongoing expiration of patents for reference biologics are unlocking new opportunities.

Market Trends

Rising Patent Expirations of Biologic Drugs

The expansion of the global biosimilar monoclonal antibodies market is largely driven by the expiration of patents on blockbuster biologics, opening the door for cost-effective biosimilar alternatives. Major drugs such as Humira (adalimumab), Herceptin (trastuzumab), and Remicade (infliximab) have lost exclusivity, enabling the entry of biosimilars that offer comparable efficacy at significantly lower prices.

- For instance, in January 2023, AbbVie's Humira (adalimumab)-one of the world's top-selling biologics-lost its U.S. patent exclusivity, leading to the introduction of multiple biosimilars. This has intensified market competition, driving substantial price reductions and enhancing patient access to affordable treatment options.

As more biologics face patent cliffs, biosimilars are expected to play a crucial role in expanding treatment accessibility, improving affordability, and enhancing overall healthcare outcomes across diverse medical settings.

Growing Adoption in Oncology & Autoimmune Diseases

Biosimilar monoclonal antibodies are increasingly being adopted in oncology and autoimmune disease treatment due to their cost-effectiveness and therapeutic equivalence to reference biologics. Key biosimilars such as Rituximab, Bevacizumab, and Trastuzumab are widely used for cancers like lymphoma and breast cancer, while Infliximab and Adalimumab biosimilars are becoming standard treatments for autoimmune conditions such as rheumatoid arthritis and Crohn's disease.

- For example, in September 2024, a National Library of Medicine study conducted at an Australian cancer center found that switching from Rituximab to its biosimilar Riximyo in Non-Hodgkin's Lymphoma patients resulted in no significant differences in safety, discontinuation rates, or mortality. These findings confirm Riximyo as a safe and effective alternative, further supporting the growing confidence in biosimilars.

This trend is enhancing treatment accessibility, reducing healthcare costs, and driving global market growth.

Market Summary

| Market Metric | Details & Data (2024-2033) |

|---|---|

| 2024 Market Valuation | USD 14.92 Billion |

| Estimated 2025 Value | USD 17.35 Billion |

| Projected 2033 Value | USD 58.07 Billion |

| CAGR (2025-2033) | 16.3% |

| Dominant Region | North America |

| Fastest Growing Region | Asia Pacific |

| Key Market Players | Roche Holding AG, Novartis AG, Pfizer Inc., Samsung Bioepis, Amgen Inc. |

to learn more about this report Download Free Sample Report

Biosimilar Monoclonal Antibodies Market Growth Factors

Expanding Biosimilar Approvals & Reimbursement Policies

Regulatory agencies such as the FDA (U.S.), EMA (Europe), and PMDA (Japan) are streamlining approval pathways for biosimilar monoclonal antibodies, facilitating faster market entry. At the same time, governments and insurers are strengthening reimbursement policies to encourage wider patient access and cost savings.

In the U.S., the Biosimilar User Fee Act (BsUFA) and interchangeability designations promote adoption, while tender-based procurement in Europe increases competition and affordability.

- For example, in January 2023, the U.S. Medicare program implemented higher reimbursement incentives for biosimilars under the Inflation Reduction Act, offering an 8% add-on payment over reference biologics to encourage provider adoption.

Such initiatives are significantly enhancing the uptake of biosimilars, ensuring greater affordability and broader patient access to life-saving treatments.

Increasing Physician & Patient Acceptance

Rising awareness and trust in biosimilar monoclonal antibodies among healthcare providers and patients are driving market adoption. Real-world evidence, post-marketing surveillance, and targeted educational initiatives have effectively addressed concerns regarding efficacy and safety. As a result, physicians are more confident in prescribing biosimilars, recognizing their therapeutic equivalence to reference biologics, while patients benefit from lower costs and greater accessibility to essential treatments.

- For instance, in 2023, a study published in the American Journal of Managed Care revealed that over 80% of rheumatologists were comfortable prescribing Infliximab and Adalimumab biosimilars for rheumatoid arthritis. This widespread acceptance has led to significant cost reductions and improved patient access to biologic therapies.

With growing confidence among stakeholders, biosimilars are gaining momentum as a cost-effective alternative to expensive biologics, fueling greater adoption, affordability, and market expansion worldwide.

Market Restraining Factors

High Development & Manufacturing Costs

The development and production of biosimilar monoclonal antibodies are highly complex, requiring advanced bioprocessing technologies, extensive clinical trials, and rigorous regulatory approvals. Unlike small-molecule generics, biosimilars must demonstrate structural similarity, efficacy, and immunogenicity equivalence to reference biologics, necessitating significant investment in R&D, analytical characterization, and pharmacovigilance.

Moreover, specialized manufacturing facilities, stringent quality controls, and long development timelines contribute to high costs, limiting the ability to offer substantial price reductions. Regulatory compliance requirements, including comparative clinical studies and post-marketing surveillance, further increase expenses.

These challenges can delay market entry, restrict competition, and reduce profitability, making it difficult for smaller players to compete, thereby slowing biosimilar adoption.

Market Opportunity

Partnerships & Collaborations for Market Expansion

Strategic collaborations between biopharmaceutical companies, contract manufacturing organizations (CMOs), and healthcare providers are playing a crucial role in expanding the global biosimilar monoclonal antibodies market. These partnerships facilitate cost-sharing in R&D, streamline regulatory approvals, and enhance distribution networks, helping companies overcome financial and technical barriers.

Moreover, joint ventures between global and regional players enable market penetration in emerging economies, where biosimilars can provide cheap alternatives to expensive biologics.

- For instance, in 2022, Biocon Biologics and Viatris completed a strategic deal, expanding their biosimilar portfolio with Trastuzumab, Bevacizumab, and Insulin Glargine. This collaboration strengthened their global market presence, particularly in the U.S. and Europe, improving patient access to affordable biologic therapies.

Such alliances create significant growth opportunities by accelerating biosimilar adoption, optimizing production efficiency, and expanding geographic reach.

Regional Insights

North America leads the global biosimilar monoclonal antibodies market, supported by a favorable regulatory environment, substantial healthcare expenditure, and rapid adoption of biosimilars. The FDA’s Biologics Price Competition and Innovation Act (BPCIA) has simplified the approval process, facilitating quicker market entry. Robust reimbursement policies, government incentives, and insurer backing have further encouraged healthcare providers to adopt biosimilars more widely.

Moreover, the presence of major industry players like Amgen Inc., Pfizer Inc., and Mylan N.V. bolsters market growth. The increasing demand for affordable biologics, combined with growing acceptance among healthcare providers, continues to drive biosimilar uptake in oncology, immunology, and inflammatory diseases throughout the region.

U.s. Biosimilar Monoclonal Antibodies Market Trends

The U.S. dominates the market, driven by high R&D investments, strong regulatory support, and the launch of innovative biosimilars. The FDA’s streamlined approval pathways facilitate rapid market entry. In May 2024, Biocon Biologics received FDA approval for its biosimilar Aflibercept (Yesafili), marking its expansion into the U.S. ophthalmology market. This milestone strengthens Biocon’s portfolio, enhances affordability, and improves patient access.

Asia-Pacific is poised for the fastest CAGR growth, driven by expanding biosimilar manufacturing capabilities, increasing regulatory approvals, and rising healthcare investments. Countries such as China, India, Japan, and South Korea are leading biosimilar production, supported by government initiatives, local biopharmaceutical innovations, and cost-driven healthcare reforms. Moreover, strategic collaborations between global and regional biopharma companies are enhancing biosimilar accessibility, making the region a major hub for biosimilar development and commercialization.

Singapore’s biosimilar market is rapidly expanding, driven by value-based healthcare policies and government initiatives. For instance, in September 2024, Singapore’s Agency for Care Effectiveness (ACE) implemented value-driven strategies, increasing biosimilar adoption to 95% within a year for infliximab, adalimumab, trastuzumab, rituximab, and bevacizumab. This initiative resulted in over 80% price reductions and projected $136 million in savings over five years, enhancing access to affordable biologics.

India’s biosimilar monoclonal antibodies industry is witnessing rapid growth, driven by high disease burden and increasing biosimilar approvals. In May 2023, Alkem Oncology launched Cetuxa, a biosimilar of Cetuximab, for head and neck cancer. Approved by the Drugs Controller General of India (DCGI), this biosimilar was developed by Enzene Biosciences Limited. The launch reinforces India’s focus on affordability, accessibility, and local manufacturing, making biosimilars more accessible to critically ill patients.

Japan’s market for biosimilar monoclonal antibodies is growing due to favorable regulatory policies and increasing commercialization efforts. In January 2025, Biocon Biologics Ltd (BBL) announced that Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) approved Ustekinumab BS subcutaneous injection [YD], a biosimilar to Stelara (Ustekinumab). This biosimilar, developed by Biocon and commercialized by Yoshindo Inc., expands affordable immunology treatment options, reinforcing Japan’s commitment to cost-effective biologic therapies.

Countries Insights

- Germany- Germany is a key player in the European biosimilar monoclonal antibodies market, driven by advanced healthcare infrastructure, strong regulatory approvals, and new biosimilar launches. In January 2024, Sandoz launched Tyruko (natalizumab), the first biosimilar for relapsing-remitting multiple sclerosis (RRMS), developed by Polpharma Biologics. This launch enhances patient access to affordable MS treatments, reinforcing Germany’s position as a leader in biosimilar adoption.

- UK - The UK biosimilar monoclonal antibodies industry is expanding due to new product launches and regulatory support for affordability. In March 2024, Dr. Reddy’s Laboratories introduced Versavo, a bevacizumab biosimilar, strengthening its oncology portfolio. This aligns with the UK’s cost-containment strategies and National Health Service biosimilar adoption initiatives, ensuring wider patient access to affordable cancer treatments while boosting market penetration for key biosimilar players.

Type Insights

The Adalimumab segment holds the largest share, driven by its widespread use in treating autoimmune diseases such as rheumatoid arthritis, psoriasis, and Crohn’s disease. The loss of patent exclusivity for Humira has enabled multiple biosimilar entries, increasing competition and lowering treatment costs. Moreover, regulatory support, interchangeability designations, and favorable reimbursement policies have accelerated adoption across major healthcare markets, ensuring broader patient access and fueling market growth.

Indication Insights

The oncology segment leads the global market due to the high global cancer burden and rising demand for cost-effective treatments. Biosimilars of bevacizumab, trastuzumab, and rituximab play a crucial role in therapies for breast cancer, lymphoma, and colorectal cancer. Moreover, increasing regulatory approvals by the FDA, EMA, and PMDA have enhanced biosimilar penetration, significantly reducing treatment costs while maintaining efficacy. As healthcare systems push for affordable cancer care, the adoption of oncology biosimilars continues to rise.

Distribution Channel Insights

Hospital pharmacies dominate the market, serving as primary distribution centers for oncology and autoimmune disease treatments. These pharmacies ensure controlled access, physician supervision, and insurance coverage, facilitating safe and efficient patient care. Moreover, government and insurer-driven reimbursement initiatives encourage hospitals to prioritize biosimilars, driving wider adoption. With growing hospital reliance on biosimilars for cost-effective biologic treatments, hospital pharmacies continue to play a pivotal role in expanding market access and affordability.

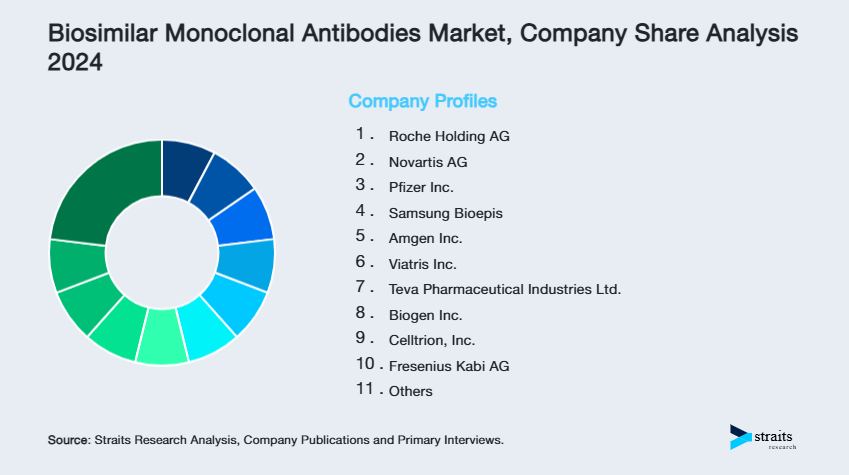

Company Market Share

Key players in the biosimilar monoclonal antibodies industry are focused on adopting key business strategies, such as strategic collaborations, regulatory approvals, acquisitions, and new product launches, to gain a competitive edge. Companies are investing heavily in R&D, expanding manufacturing capabilities, and strengthening global distribution networks.

Samsung Bioepis: An Emerging Player in the Global Biosimilar Monoclonal Antibodies Market

Samsung Bioepis is a leading biosimilar developer specializing in oncology, immunology, and ophthalmology. The company has launched FDA and EMA-approved monoclonal antibody biosimilars, including trastuzumab, bevacizumab, and adalimumab, enhancing global access to cost-effective biologic treatments.

Recent Developments at Samsung Bioepis Include:

- In January 2025, Samsung Bioepis Co., Ltd. and Teva Pharmaceutical Industries Ltd. announced a license, development, and commercialization agreement for EPYSQLI (eculizumab-aagh), a biosimilar to Soliris (eculizumab) in the United States.

List of Key and Emerging Players in Biosimilar Monoclonal Antibodies Market

- Roche Holding AG

- Novartis AG

- Pfizer Inc.

- Samsung Bioepis

- Amgen Inc.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Biogen Inc.

- Celltrion, Inc.

- Fresenius Kabi AG

- Sandoz AG

- Boehringer Ingelheim International GmbH

- Merck KGaA

- Amneal Pharmaceuticals, Inc.

- Biocon Limited

to learn more about this report Download Market Share

Recent Developments

- July 2024 – Amneal Pharmaceuticals, Inc. announced the addition of omalizumab, a biosimilar referencing XOLAIR, to its biosimilar pipeline. XOLAIR is widely used for treating allergic asthma and chronic idiopathic urticaria. This expansion reinforces Amneal’s commitment to developing cost-effective biologic alternatives, increasing patient access to advanced allergy and asthma treatments.

Analyst Opinion

As per our analyst, the global biosimilar monoclonal antibodies market is poised for substantial growth, fueled by increasing regulatory approvals, expanding patient access to cost-effective biologics, and rising adoption among healthcare providers. Key advancements in manufacturing technologies, coupled with real-world evidence supporting biosimilar efficacy and safety, are accelerating market penetration.

Despite these positive trends, the global market faces several challenges. High development and manufacturing costs remain a significant hurdle, as complex production processes and regulatory requirements require considerable investment. Moreover, the market is experiencing resistance from some healthcare providers and patients who are still wary of switching from reference biologics.

However, despite these challenges, the Asia-Pacific region presents a particularly promising opportunity for growth. Governments in countries such as China, India, and South Korea are implementing strong initiatives to promote biosimilars and reduce healthcare costs. As regulatory approval processes streamline and biosimilar adoption rises in these markets, they are expected to contribute significantly to the market's expansion.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2024 | USD 14.92 Billion |

| Market Size in 2025 | USD 17.35 Billion |

| Market Size in 2033 | USD 58.07 Billion |

| CAGR | 16.3% (2025-2033) |

| Base Year for Estimation | 2024 |

| Historical Data | 2021-2023 |

| Forecast Period | 2025-2033 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Type , By Indication , By Distribution Channel |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Biosimilar Monoclonal Antibodies Market Segments

By Type

- Adalimumab

- Bevacizumab

- Infliximab

- Rituximab

- Trastuzumab

- Others

By Indication

- Oncology

- Autoimmune diseases

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Dhanashri Bhapakar

Senior Research Associate

Dhanashri Bhapakar is a Senior Research Associate with 3+ years of experience in the Biotechnology sector. She focuses on tracking innovation trends, R&D breakthroughs, and market opportunities within biopharmaceuticals and life sciences. Dhanashri’s deep industry knowledge enables her to provide precise, data-backed insights that help companies innovate and compete effectively in global biotech markets.