Genetic Testing Market Size, Share & Trends Analysis Report By Technique (Polymerase chain reaction (PCR), DNA Sequencing, Cytogenetics, Microarrays, Others) By Application (Oncology, Cardiovascular Disease Diagnosis, Neurological Disorders, Genetic Disorders, Others, By End User (Hospitals & Clinics Diagnostic, Laboratories, Others), and By Region (North America, Europe, APAC, Middle East and Africa, LATAM) Forecasts, 2026-2034

Genetic Testing Market Overview

The global genetic testing market size is estimated at USD 14.49 billion in 2025 and is anticipated to grow from USD 17.41 billion in 2026 till USD 77.64 billion in 2034, growing at a CAGR of 20.55% from 2026 to 2034. Factors contributing to this growth include the rising integration of at-home and digital genetic testing kits, which are improving accessibility, empowering consumers with direct health insights, and expanding adoption beyond clinical settings into everyday preventive care.

Key Market Insights

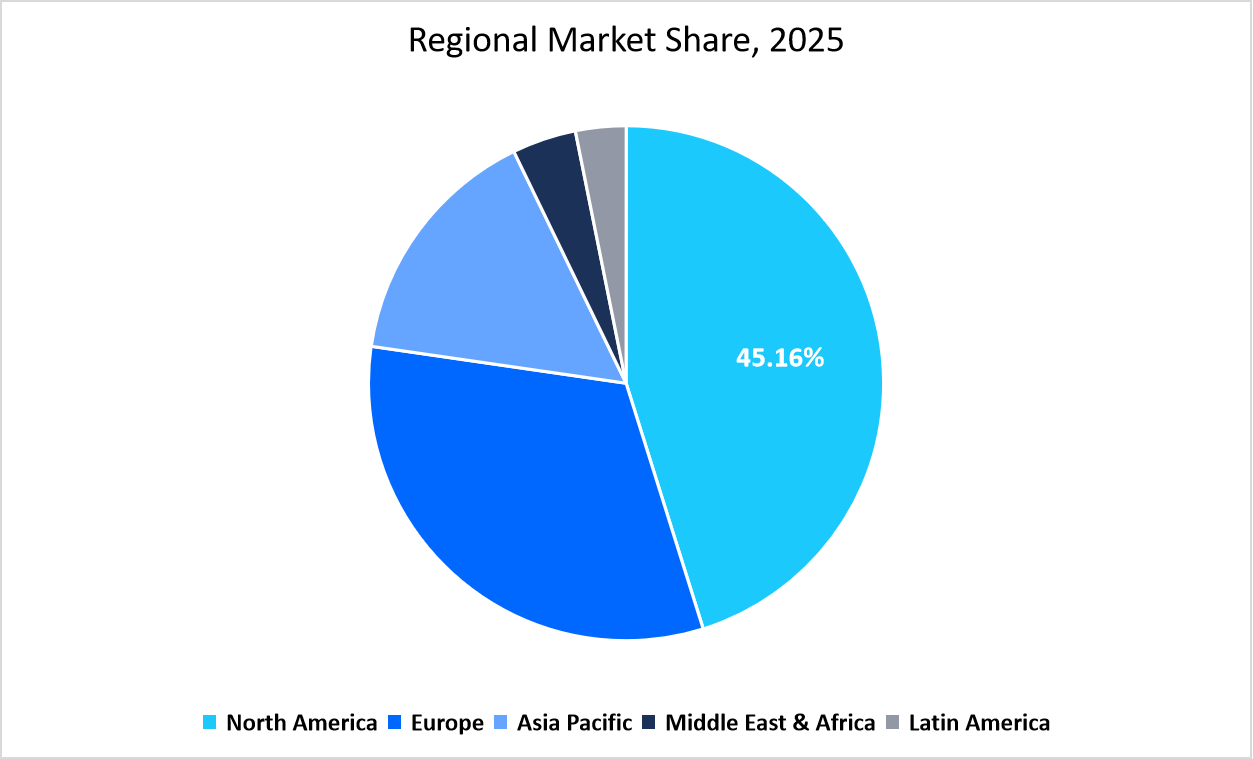

- North America held a dominant share of the global genetic testing industry, accounting for 45.16% of the revenue share in 2025.

- The Asia-Pacific region is projected to grow at the fastest pace, registering a CAGR of 23.54% during the forecast period of 2026 to 2034.

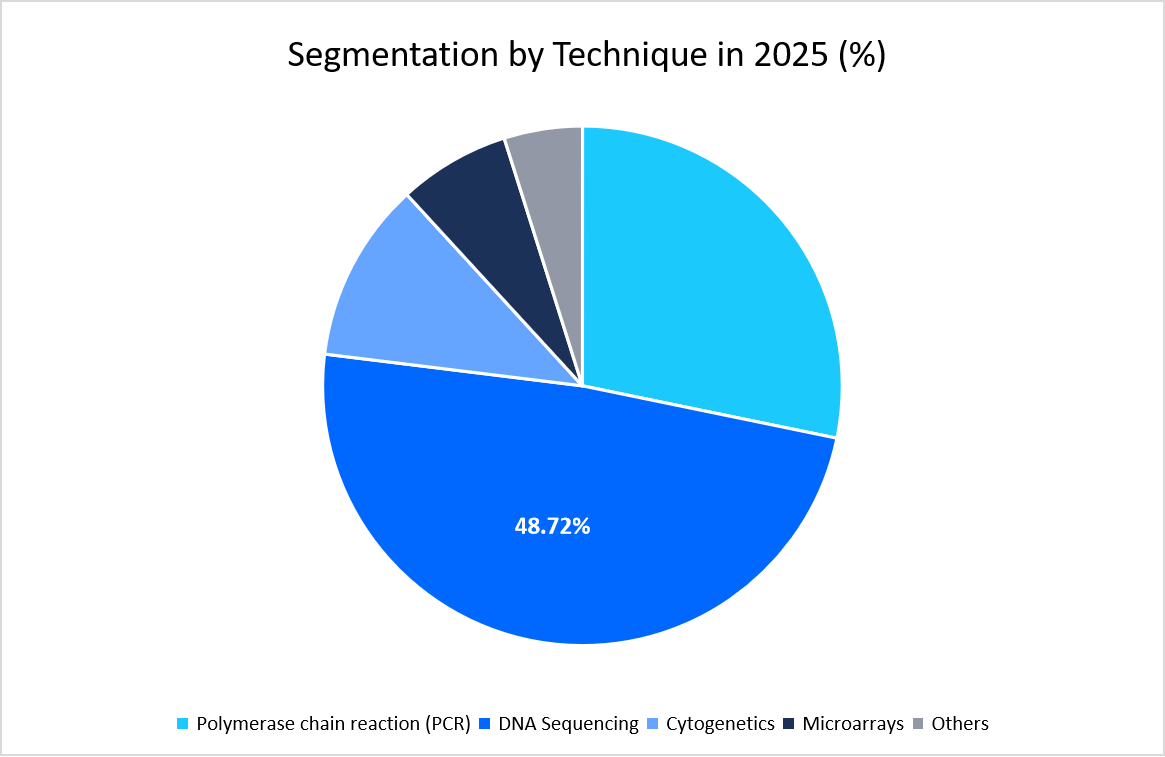

- Based on technique, the DNA sequencing segment held the highest market share of 48.72% in 2025.

- Based on the application, the genetic disorders category is expected to register the fastest CAGR of 22.78% from 2026 to 2034.

- Based on end user, the hospitals & clinics segment dominated the market in 2025.

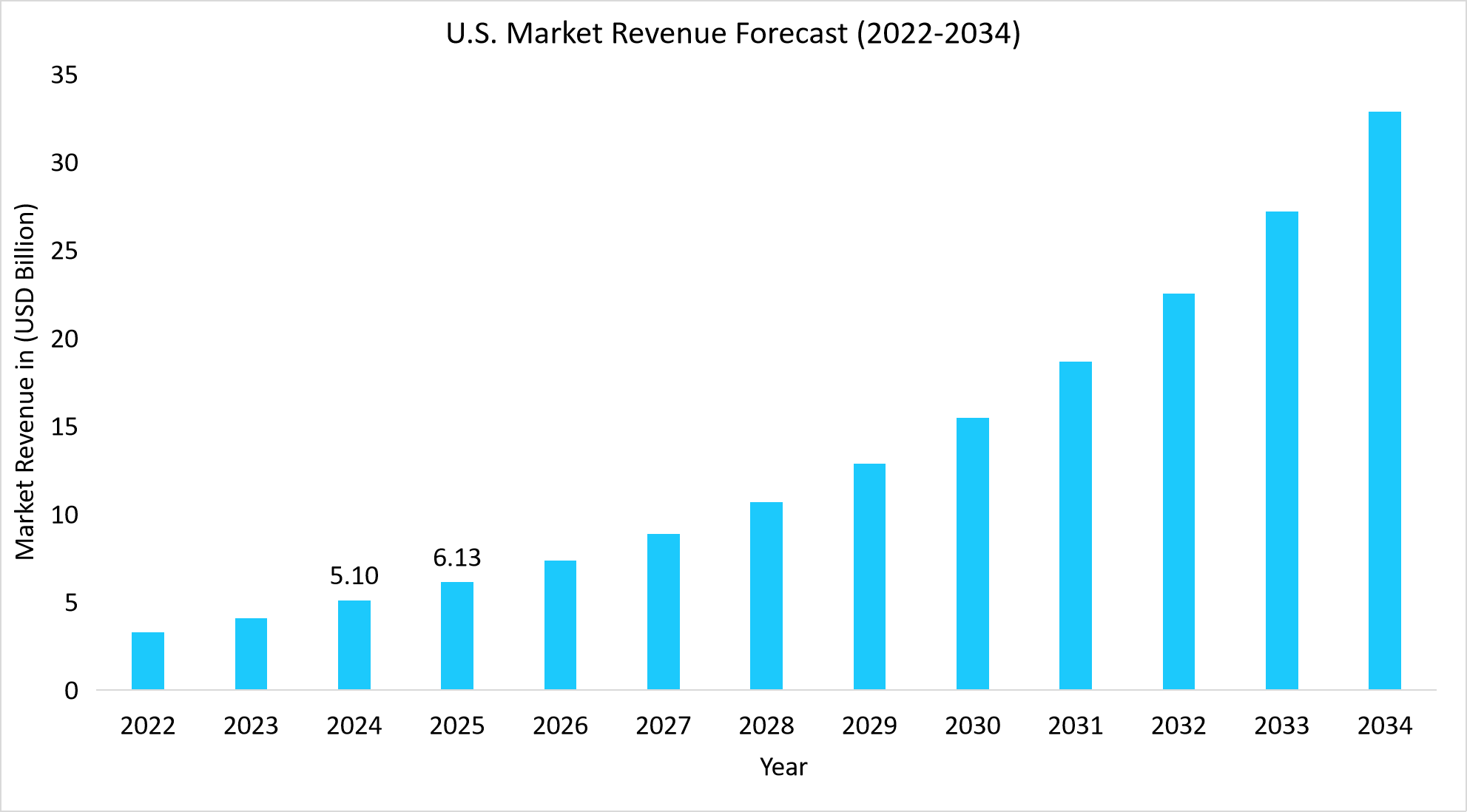

- The U.S. dominates the global genetic testing market, valued at USD 5.10 billion in 2024 and reaching USD 6.13 billion in 2025.

Market Size and Forecast

- 2025 Market Size: USD 14.49 billion

- 2034 Projected Market Size: USD 77.64 billion

- CAGR (2025 to 2034): 20.55%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

Source: Straits Research Analysis

The market is evolving as genetic testing moves beyond its traditional role of diagnosis to become a gateway to advanced therapies. The approval of gene therapies for conditions such as sickle cell disease and spinal muscular atrophy highlights how genetic testing is essential in identifying patients who can benefit from these breakthrough treatments. Alongside this, pharmacogenomics testing is becoming more common in oncology, cardiology, and neurology, enabling physicians to tailor drug choices for greater safety and effectiveness. At the same time, investments in biobanks and national genome mapping programs are enriching global reference databases, improving both the accuracy and clinical relevance of test results. Regionally, North America is advancing through federal genomics programs, while Asia Pacific is accelerating growth with local manufacturing and population-scale studies. Collectively, these developments are embedding genetic testing into mainstream preventive and personalized medicine.

Market Trends

Oncology Guidelines Shift Toward ctDNA for MRD

Cancer follow-up is moving from traditional methods to molecular monitoring with circulating tumor DNA (ctDNA). In the past, minimal residual disease (MRD) in conditions like diffuse large B-cell lymphoma (DLBCL) was tracked mainly through imaging and pathology, which often detected relapse late. The National Comprehensive Cancer Network’s 2023 updates include ctDNA assays for MRD assessment in DLBCL, reflecting a major shift in oncology standards. Clinical evidence supports this change as studies show how ctDNA can identify relapse up to 3 months earlier than PET and CT scans in aggressive lymphomas. This transition from imaging-based surveillance to molecular assays is expanding the role of genetic testing, making it a central tool in oncology care and fueling overall market growth.

From Cost Barriers to Reimbursement-Driven Adoption

One of the biggest barriers to genetic testing has always been cost. This is now changing as Medicare and CMS have introduced clear reimbursement frameworks.

- For example, in March 2024, CMS finalized coverage under National Coverage Determinations (NCDs) for Next Generation Sequencing (NGS) in patients with inherited cancers and solid tumors.

In addition, the MolDx program issued updated Local Coverage Determinations (LCDs) for pharmacogenomic (PGx) testing in 2024, creating reliable billing pathways for labs and hospitals. The shift from uncertain, out-of-pocket costs to structured reimbursement support has transformed testing from a selective option into a routine part of patient care, thereby boosting the growth of the genetic testing market.

Market Summary

| Market Metric | Details & Data (2025-2034) |

|---|---|

| 2025 Market Valuation | USD 14.49 Billion |

| Estimated 2026 Value | USD 17.41 Billion |

| Projected 2034 Value | USD 77.64 Billion |

| CAGR (2026-2034) | 20.55% |

| Dominant Region | North America |

| Fastest Growing Region | Europe |

| Key Market Players | Illumina, Inc., Thermo Fisher Scientific Inc., Hoffmann-La Roche Ltd, Myriad Genetics, Inc., Quest Diagnostics Incorporated |

to learn more about this report Download Free Sample Report

Market Drivers

High Adoption of Universal cfDNA Screening Tests across all Pregnancies

Prenatal care is moving toward making cell-free DNA (cfDNA), also known as NIPT, a standard option for all pregnant women. Earlier, it was mostly suggested for older mothers or those with higher risk, but in its updated guidelines, the American College of Obstetricians and Gynecologists (ACOG) and the Society for Maternal Fetal Medicine (SMFM) now recommend that every pregnant woman should be offered cfDNA screening. This shift is supported by strong clinical evidence, as studies show false positive rates as low as 0.06% and very high accuracy for Down syndrome detection.

- By 2024, U.S. health systems reported over 2 million cfDNA tests performed annually.

This rapid clinical uptake not only reshapes prenatal care but is also driving the broader genetic testing industry, as it expands test adoption across all pregnancy categories.

Market Restraint

Data Privacy Concerns Slowing Genetic Test Uptake

A growing challenge for the genetic testing market is patient hesitation over how their genetic data is used and stored. Unlike routine lab tests, DNA data is permanent and can reveal sensitive health or family information.

- In the U.S., a 2024 survey by the American Journal of Human Genetics found that nearly 40% of respondents were worried about potential misuse of their genetic information, including by insurers or employers.

Moreover, high-profile data breaches, such as the 2023 security incident at 23andMe affecting millions of profiles, have further increased these fears. This ongoing concern is slowing adoption despite clinical benefits.

Market Opportunities

Expansion into Global Markets through Strategic Partnerships

A significant opportunity in the market lies in expanding services through strategic partnerships and global collaborations, enabling companies to enhance test capabilities and reach a broader patient population.

- For example, in June 2025, Galatea Bio partnered with Fabric Genomics and Broad Clinical Labs to enhance genetic testing by integrating rare pathogenic variant analysis and polygenic risk scoring (PRS).

Such collaboration aimed to assess genetic susceptibility to common diseases, providing a more comprehensive approach to genetic testing. By leveraging these partnerships, Galatea Bio expanded its reach and capabilities in the global genetic testing market.

Regional Insights

The North America region dominated the market with a revenue share of 45.16% in 2025. High shares are due to its strong regulatory framework and early adoption of digital health integration. Electronic health record systems in the region are increasingly embedding genetic test results, improving care coordination between laboratories and physicians. The presence of advanced biobanks and large-scale population genomics projects also supports research and clinical adoption across hospitals and universities.

Source: Straits Research Analysis

The U.S. is driving regional growth through population-scale genomic initiatives and direct investments in precision medicine. The NIH’s All of Us program, which has already returned genomic results to over 100,000 participants, is expanding nationwide in 2025. This program is pushing genetic testing into preventive healthcare and strengthening its role in personalized treatment planning.

Asia Pacific Market Trends

The Asia Pacific region is the fastest-growing region, with a CAGR of 23.54% during the forecast timeframe, driven by government-backed precision medicine programs and local manufacturing of testing technologies. Countries like China, Japan, and South Korea are investing heavily in genomics infrastructure to improve affordability and accessibility. Rising demand for early detection of hereditary cancers and infectious disease genomics further supports adoption. In addition, regional initiatives are promoting population level genome mapping, creating strong momentum for integrating genetic testing into mainstream healthcare.

India is emerging as a key growth hub in the Asia Pacific, supported by its growing biotechnology ecosystem and rising awareness of preventive healthcare. The Indian Council of Medical Research (ICMR) and private diagnostic chains are expanding genetic testing for rare diseases and oncology. In 2024, India also announced a National Rare Disease Policy update, which includes provisions for genetic diagnostics, enabling patients to access subsidized tests. Increasing partnerships between global sequencing companies and Indian labs are further boosting adoption, making India one of the fastest-growing markets in the region.

Technique Insights

The DNA sequencing segment dominated the market in 2025 with a revenue share of 48.72%. primarily due to its expanding role in oncology diagnostics. Clinical guidelines now increasingly recommend sequencing-based panels for detecting tumor mutations, which directly guide targeted therapies. This strong link between sequencing and cancer treatment has firmly positioned it as the leading technique.

Source: Straits Research Analysis

Application Insights

The genetic disorders segment is anticipated to grow at a CAGR of 22.78% during 2026–2034. High growth is attributed to the rise in carrier and prenatal screening, expanding worldwide. Families increasingly seek early answers about inherited conditions, while doctors rely on genetic testing to guide lifelong management. This growing role in preventive care makes testing for genetic disorders a key growth area.

End-User Insights

The hospitals & clinics segment dominated the market in 2025, supported by their role as primary access points for integrated genetic counselling and testing services. Unlike standalone labs, hospitals provide immediate clinical interpretation and treatment planning, making them the preferred choice for patients seeking comprehensive diagnosis and care.

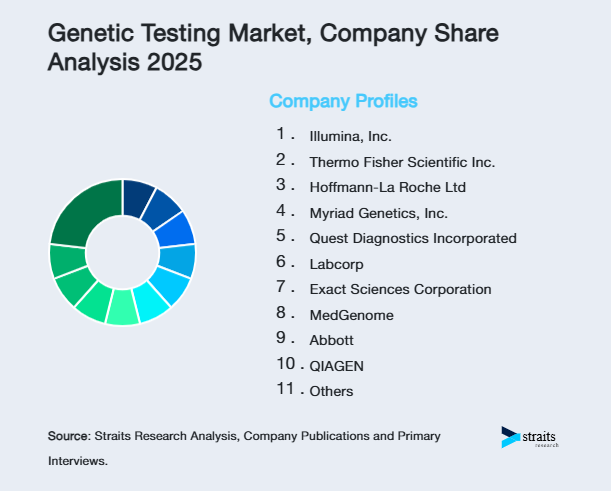

Competitive Landscape

The global genetic testing market is highly fragmented in nature due to the presence of numerous small and medium-sized players alongside established multinational companies, each offering diverse testing services across diagnostics, ancestry, and predictive health.

The industry participants are inclined towards adopting key business strategies, such as strategic collaborations, product approvals, acquisitions, and product launches, to gain a strong foothold in the market.

MedGenome: An Emerging Market Player

MedGenome is a Bengaluru-based genomics-driven diagnostics and research services company, providing advanced genetic testing and personalized medicine solutions.

- In July 2024, MedGenome acquired a stake in GenX Diagnostics, a leading diagnostic lab chain in Odisha. This acquisition expands MedGenome’s presence in East India, particularly in Tier 2 and Tier 3 cities, combining its genomic capabilities with GenX’s established regional network. The partnership aims to provide clinicians with actionable genetic insights, enabling more targeted treatments and improved patient outcomes.

List of Key and Emerging Players in Genetic Testing Market

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Hoffmann-La Roche Ltd

- Myriad Genetics, Inc.

- Quest Diagnostics Incorporated

- Labcorp

- Exact Sciences Corporation

- MedGenome

- Abbott

- QIAGEN

- BREDA Genetics

- Mapmygenome

- Igenomix

- tellmeGen

- 24Genetics

to learn more about this report Download Market Share

Recent Developments

- June 2025: Myriad Genetics, Inc., a leader in molecular diagnostics and precision medicine, has introduced early access to its FirstGene Multiple Prenatal Screen, advancing the field of genetic testing.

- May 2025: Gene Solutions, a leader in prenatal and oncology genetic testing, has partnered with NEWCL Biomedical Laboratory, Taiwan’s pioneering LDT-certified clinical laboratory, to establish an advanced Next-Generation Sequencing (NGS) facility in Taiwan.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 14.49 Billion |

| Market Size in 2026 | USD 17.41 Billion |

| Market Size in 2034 | USD 77.64 Billion |

| CAGR | 20.55% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends |

| Segments Covered | By Technique, By Application, By End User |

| Geographies Covered | North America, Europe, APAC, Middle East and Africa, LATAM |

| Countries Covered | US, Canada, UK, Germany, France, Spain, Italy, Russia, Nordic, Benelux, China, Korea, Japan, India, Australia, Taiwan, South East Asia, UAE, Turkey, Saudi Arabia, South Africa, Egypt, Nigeria, Brazil, Mexico, Argentina, Chile, Colombia |

to learn more about this report Download Free Sample Report

Genetic Testing Market Segments

By Technique

- Polymerase chain reaction (PCR)

- DNA Sequencing

- Cytogenetics

- Microarrays

- Others

By Application

- Oncology

- Cardiovascular Disease Diagnosis

- Neurological Disorders

- Genetic Disorders

- Others

By End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

By Region

- North America

- Europe

- APAC

- Middle East and Africa

- LATAM

Frequently Asked Questions (FAQs)

Debashree Bora

Healthcare Lead

Debashree Bora is a Healthcare Lead with over 7 years of industry experience, specializing in Healthcare IT. She provides comprehensive market insights on digital health, electronic medical records, telehealth, and healthcare analytics. Debashree’s research supports organizations in adopting technology-driven healthcare solutions, improving patient care, and achieving operational efficiency in a rapidly transforming healthcare ecosystem.